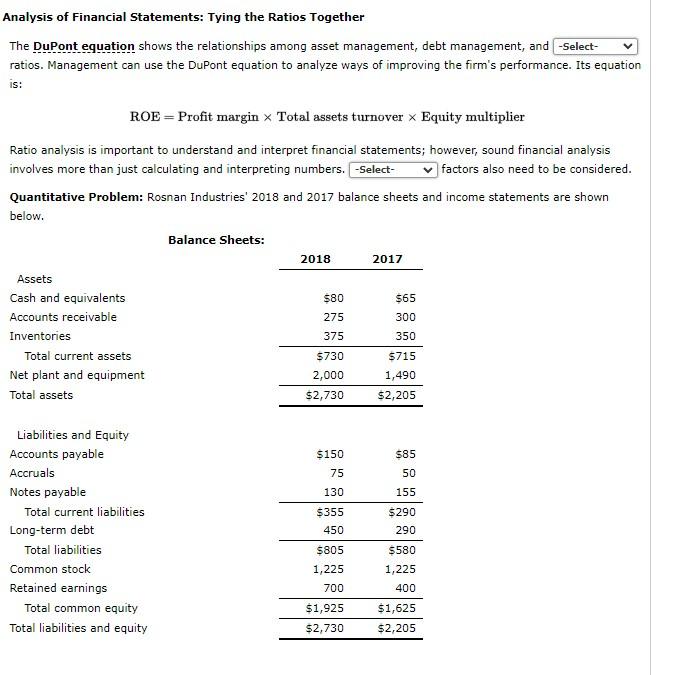

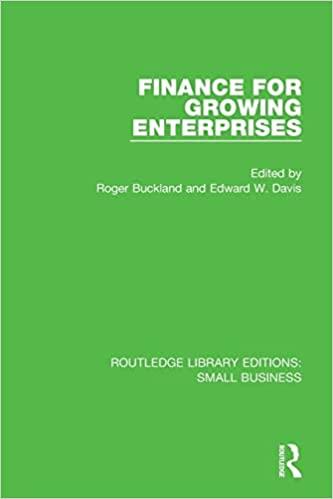

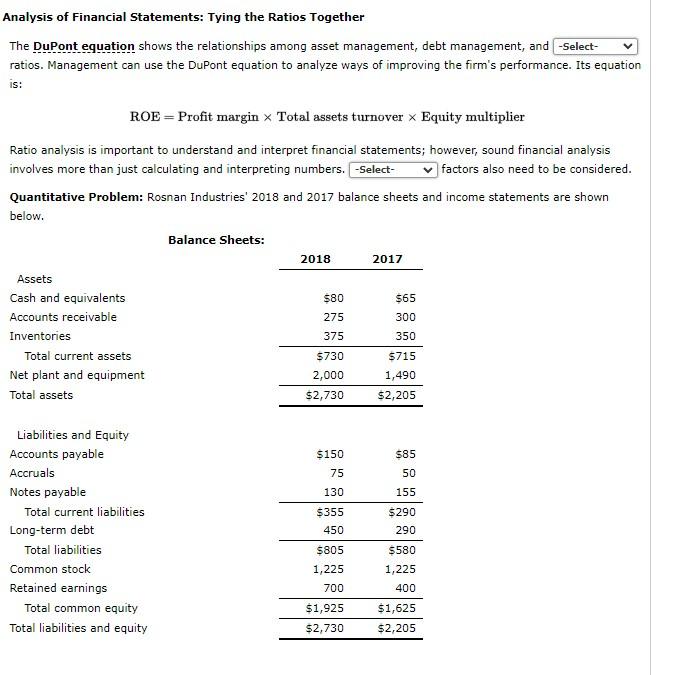

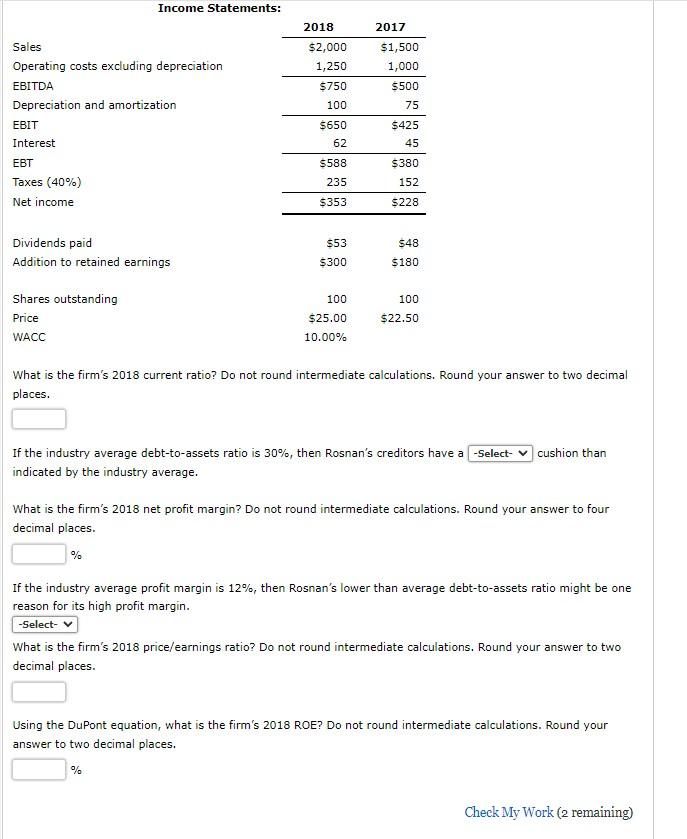

Analysis of Financial Statements: Tying the Ratios Together The DuPont equation shows the relationships among asset management, debt management, and -Select- ratios. Management can use the DuPont equation to analyze ways of improving the firm's performance. Its equation is: ROE=Profit margin x Total assets turnover Equity multiplier Ratio analysis is important to understand and interpret financial statements; however, sound financial analysis involves more than just calculating and interpreting numbers. -Select- factors also need to be considered. Quantitative Problem: Rosnan Industries' 2018 and 2017 balance sheets and income statements are shown below. Balance Sheets: 2018 2017 565 580 275 300 Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets 375 350 $730 $715 1,490 2,000 $2,730 $2,205 $150 $85 75 50 130 Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity 5355 450 155 $290 290 $580 1,225 5805 1,225 700 $1,925 $2,730 400 $1,625 $2,205 Income Statements: 2018 $2,000 1,250 2017 $1,500 1,000 $750 $500 Sales Operating costs excluding depreciation EBITDA Depreciation and amortization EBIT Interest 100 75 $650 62 $425 45 $588 $380 EBT Taxes (40%) Net income 235 152 $353 $228 Dividends paid Addition to retained earnings $53 5300 $48 $180 Shares outstanding Price WACC 100 $25.00 10.00% 100 $22.50 What is the firm's 2018 current ratio? Do not round intermediate calculations. Round your answer to two decimal places. If the industry average debt-to-assets ratio is 30%, then Rosnan's creditors have a -Select- cushion than indicated by the industry average. What is the firm's 2018 net profit margin? Do not round intermediate calculations. Round your answer to four decimal places. % If the industry average profit margin is 12%, then Rosnan's lower than average debt-to-assets ratio might be one reason for its high profit margin. -Select- What is the firm's 2018 price/earnings ratio? Do not round intermediate calculations. Round your answer to two decimal places. Using the DuPont equation, what is the firm's 2018 ROE? Do not round intermediate calculations. Round your answer to two decimal places. % Check My Work (2 remaining)