Answered step by step

Verified Expert Solution

Question

1 Approved Answer

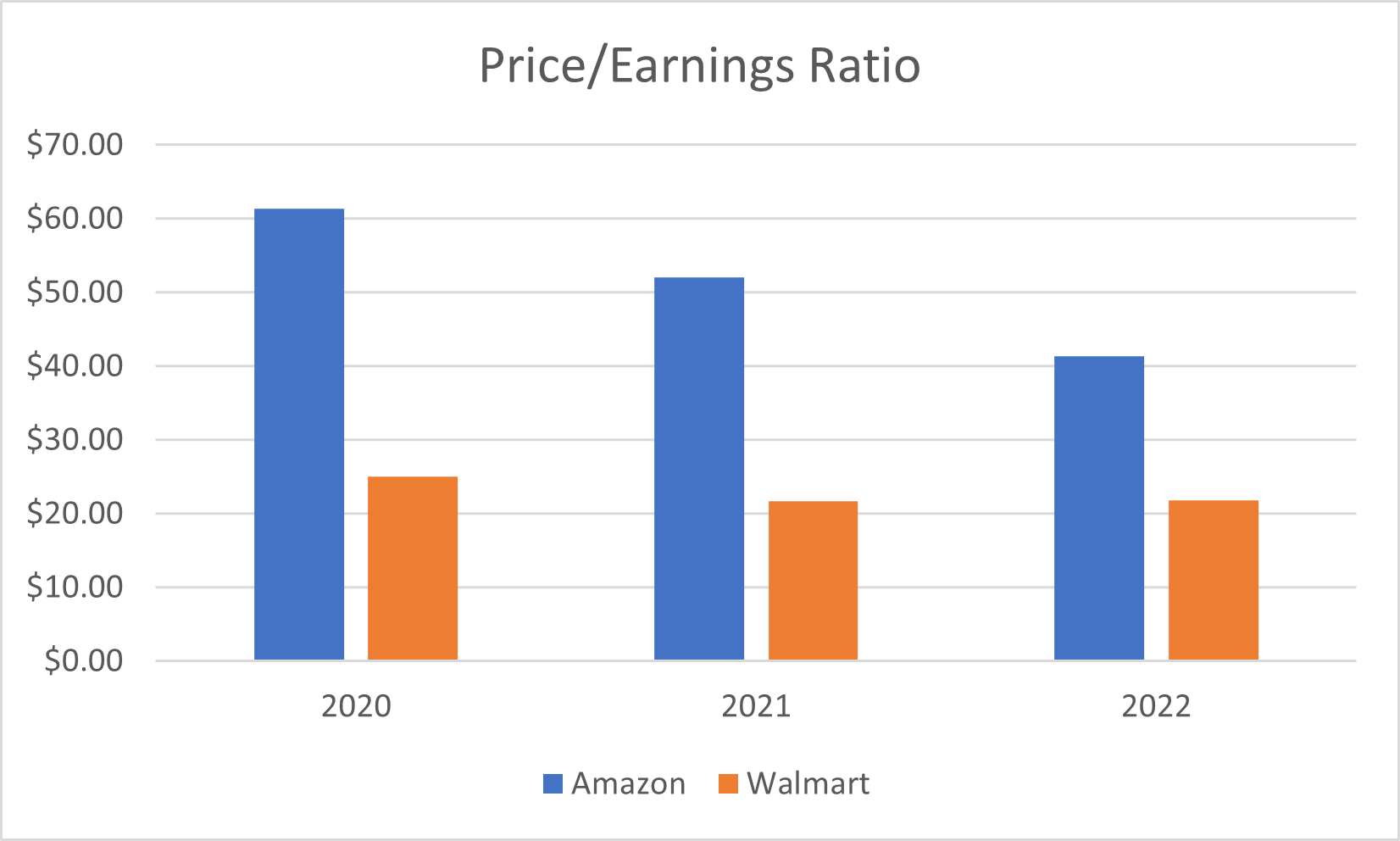

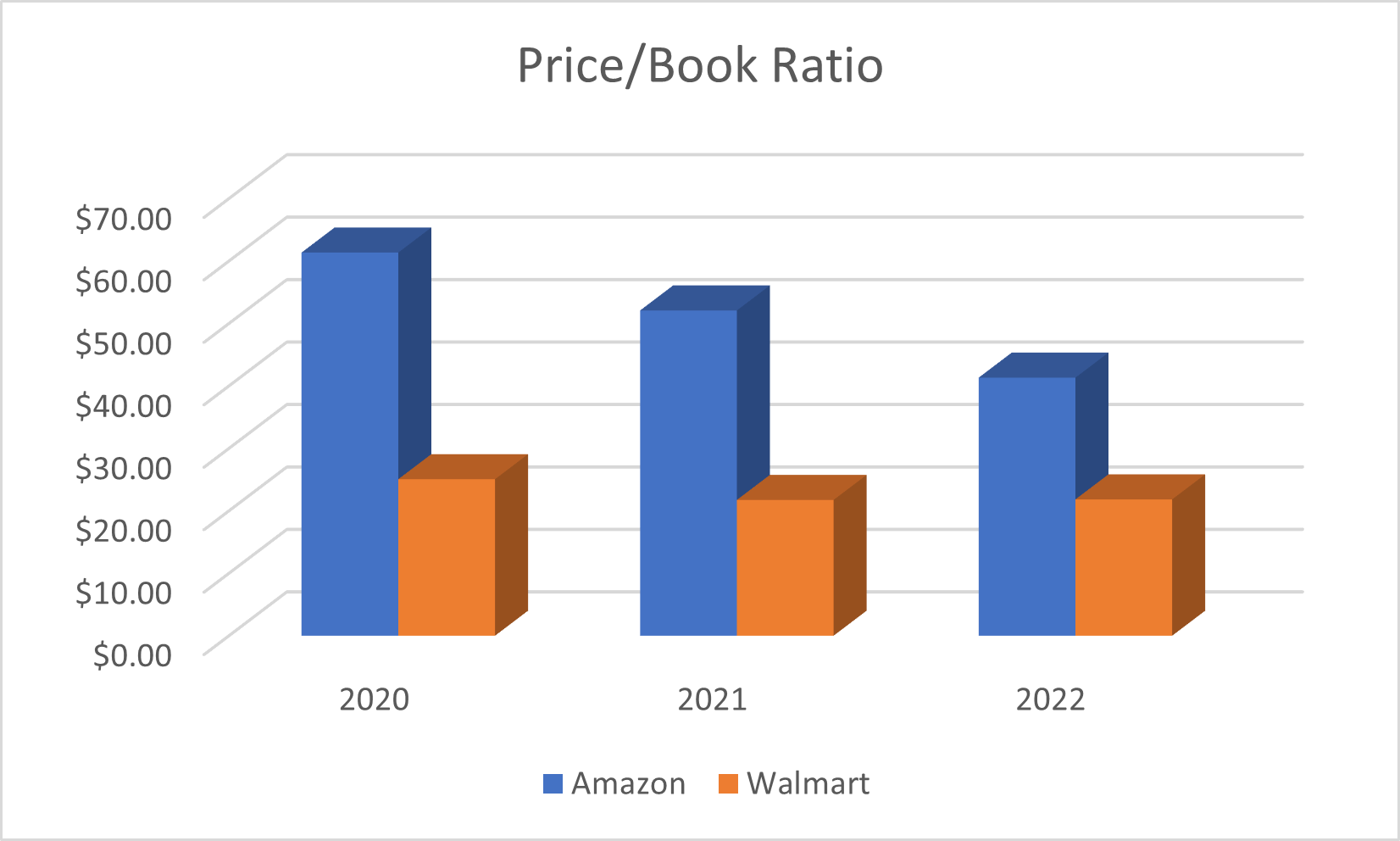

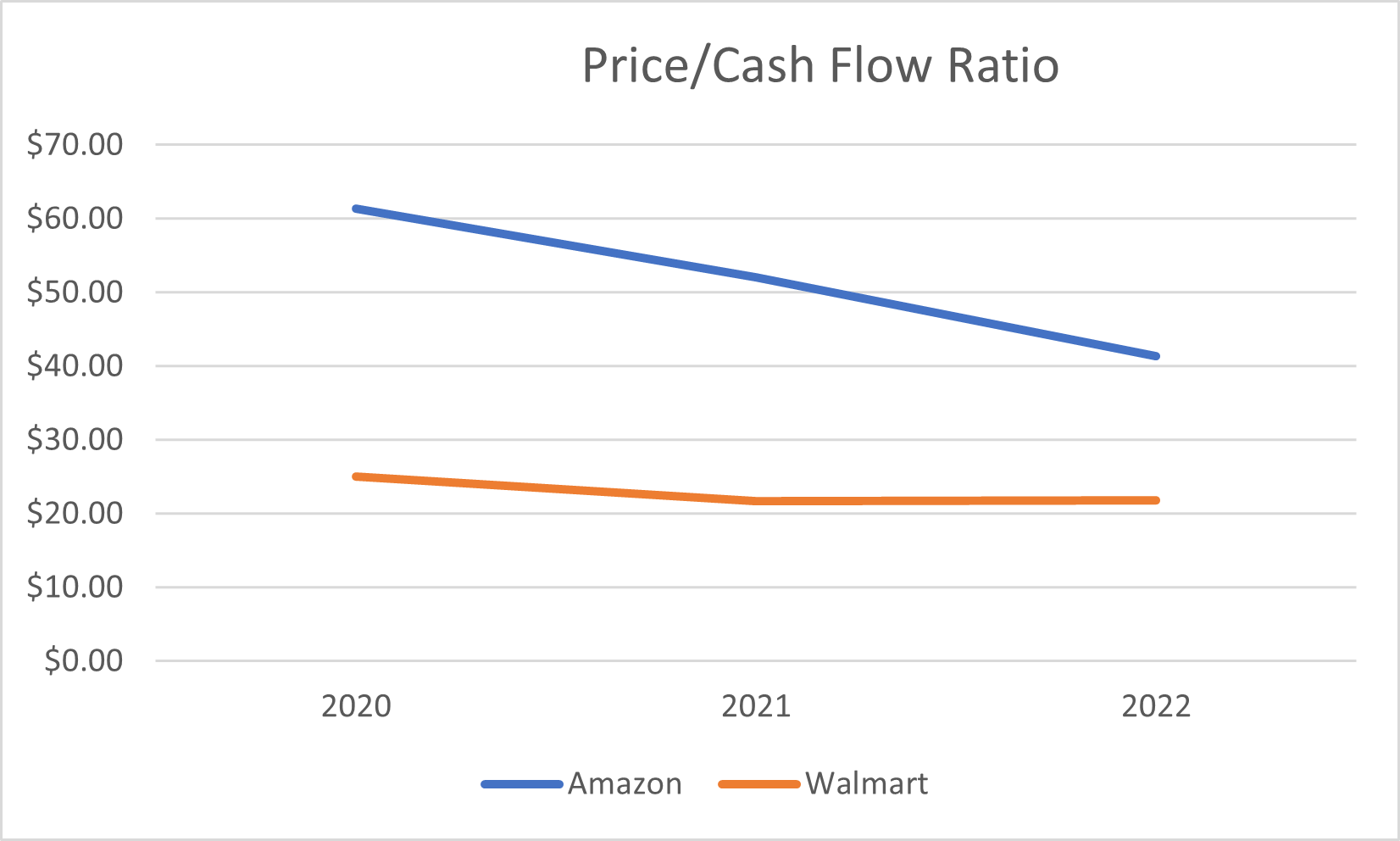

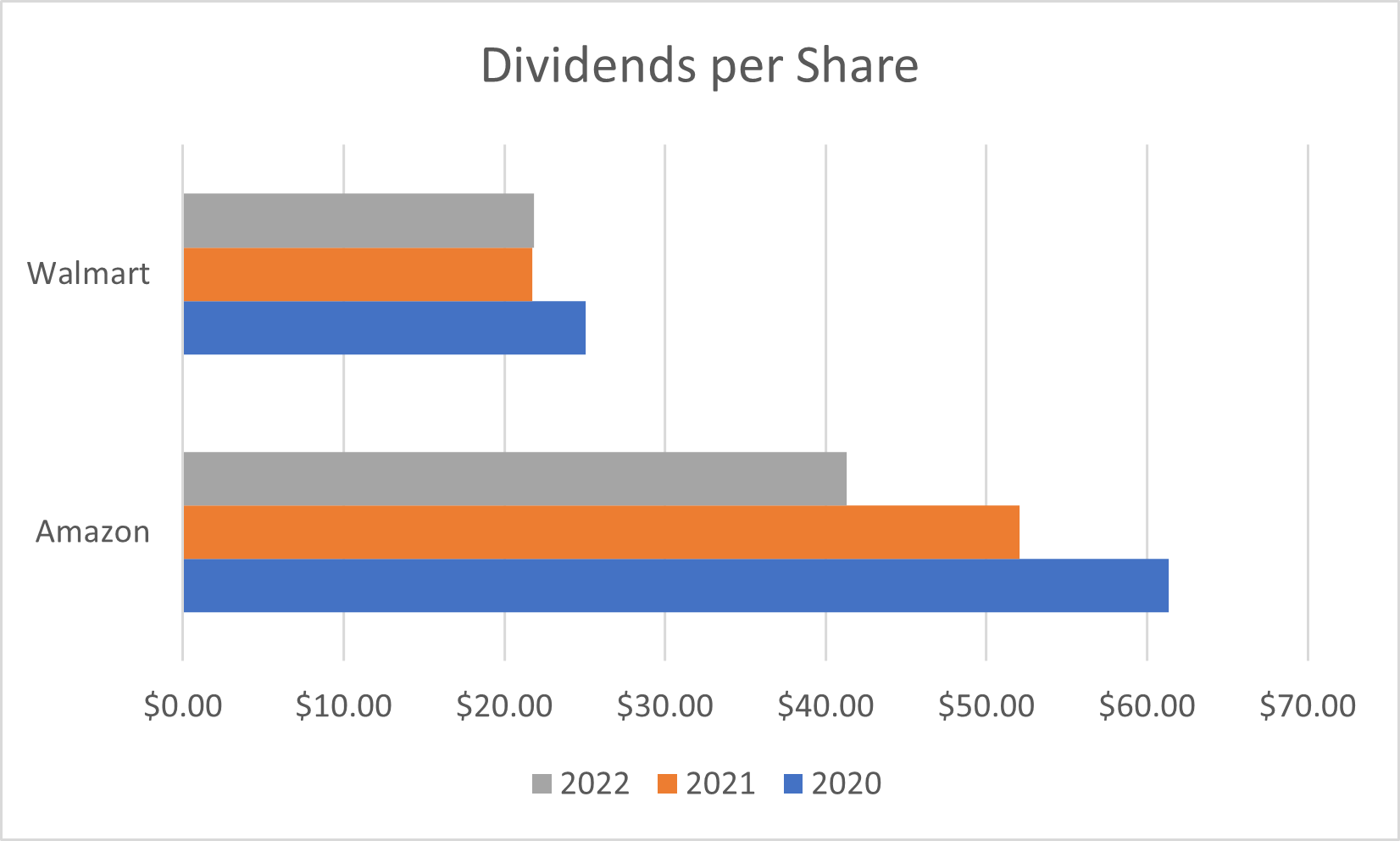

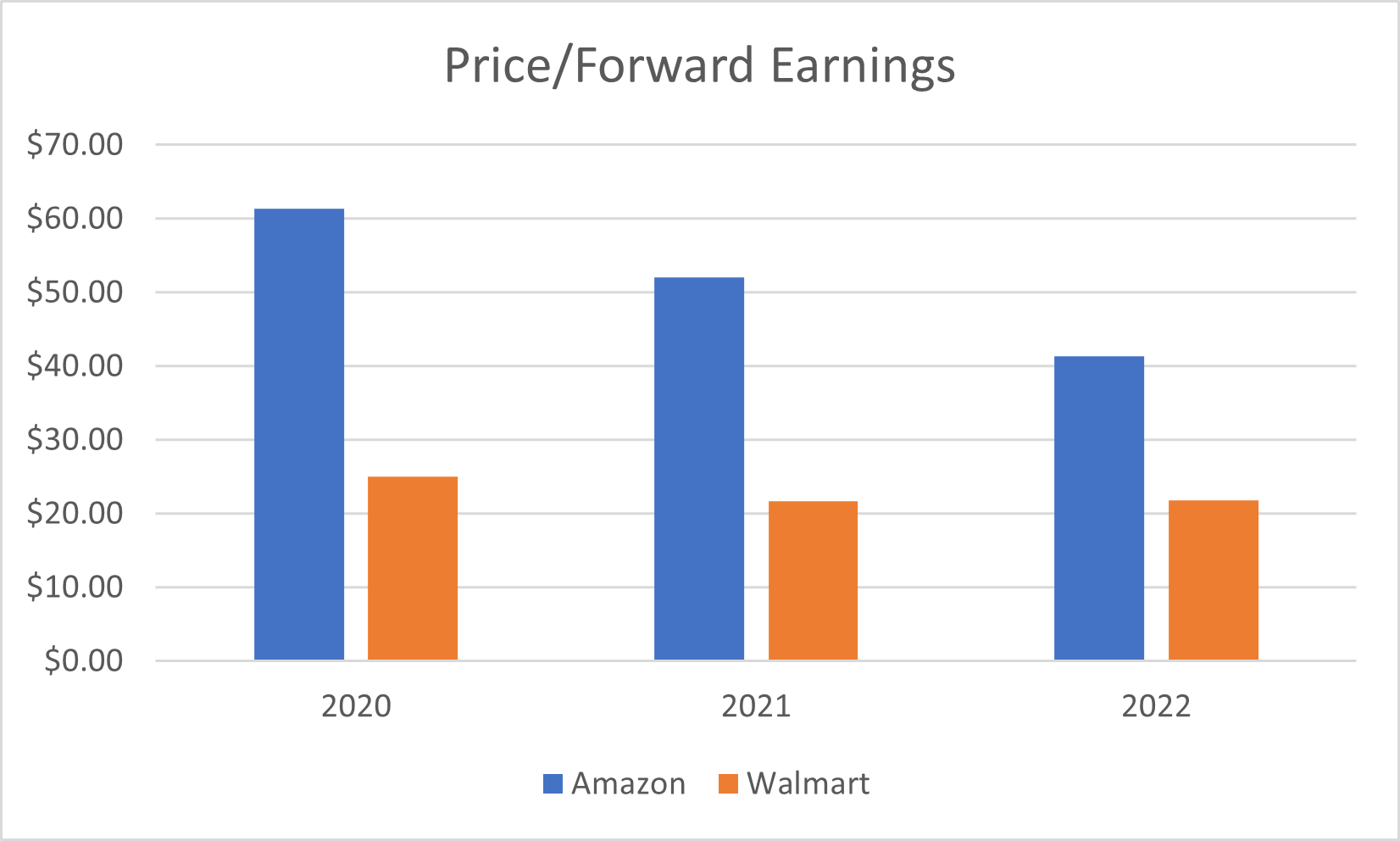

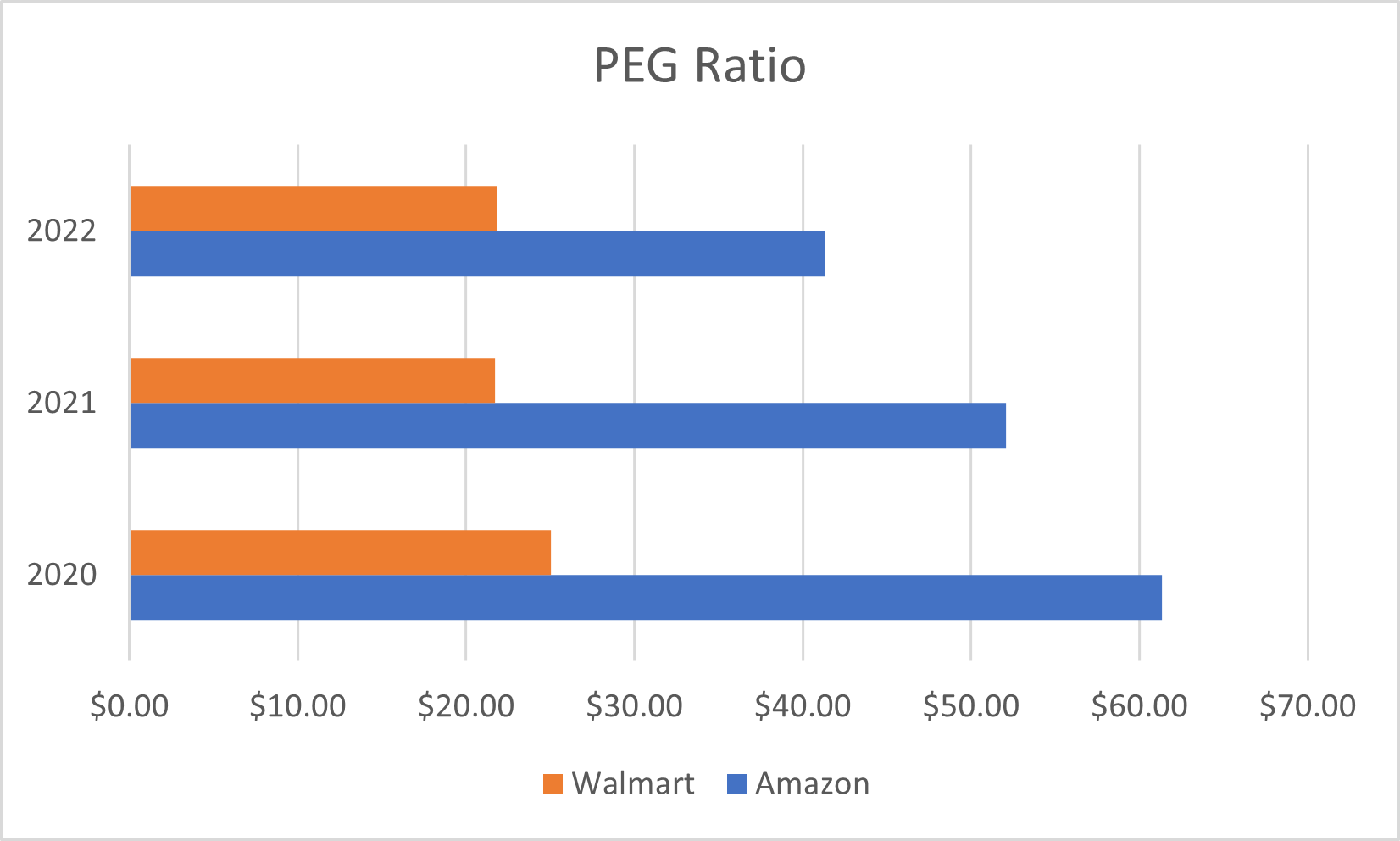

Analysis of Market ratio Results for Amazon and be sure to compare results against the industry or main competitor Walmart Inc. Need to answer Are

Analysis of Market ratio Results for Amazon and be sure to compare results against the industry or main competitor Walmart Inc. Need to answer Are the Common Stockholders receiving an adequate return on their investment? Is it reasonable to buy the stock?

Dividends per Share Walmart Amazon $0.00$10.00$20.00$30.00$40.00$50.00$60.00$70.00 202220212020 Price/Book Ratio $70.00$60.00$50.00$40.00$30.00$20.00$10.00$0.00 2020 2021 2022 Amazon Walmart - Price/Cash Flow Ratio Price/Earnings Ratio Dividends per Share Walmart Amazon $0.00$10.00$20.00$30.00$40.00$50.00$60.00$70.00 202220212020 Price/Book Ratio $70.00$60.00$50.00$40.00$30.00$20.00$10.00$0.00 2020 2021 2022 Amazon Walmart - Price/Cash Flow Ratio Price/Earnings Ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started