Answered step by step

Verified Expert Solution

Question

1 Approved Answer

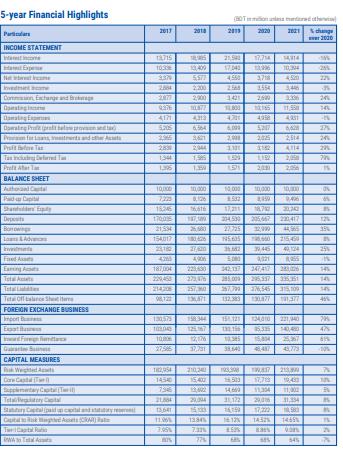

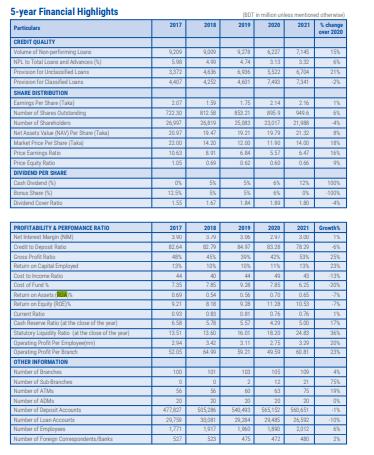

Analysis of the Financial Health of this bank through Ratio analysis, Trend analysis, and Common Size Analysis Recommendation based on the outcome of the analysis

Analysis of the Financial Health of this bank through Ratio analysis, Trend analysis, and Common Size Analysis

Recommendation based on the outcome of the analysis

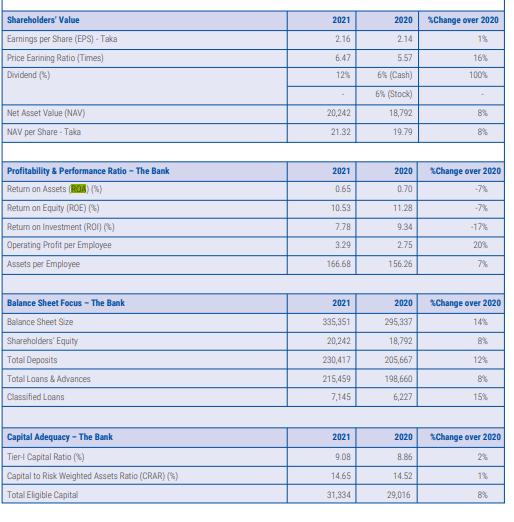

Shareholders' Value 2021 2020 Change over 2020 Earnings per Share (EPS) - Taka 2.16 214 1% Price Earining Ratio (Times) 6.47 5.57 16% Dividend (*) 12% 6% (Cash) 100% 6% (Stock) Net Asset Value (NAV) NAV per Share Taka 20,242 18,792 8% 21.32 19.79 8% Profitability & Performance Ratio - The Bank Return on Assets (ROA) (%) Return on Equity (ROE) (%) Return on Investment (ROI) (%) Operating Profit per Employee Assets per Employee 2021 2020 *Change over 2020 0.65 0.70 -7% 10.53 11.28 -7% 7.78 9.34 -17% 3.29 2.75 20% 166.68 156.26 7% Balance Sheet Focus - The Bank 2021 2020 Change over 2020 Balance Sheet Size 335,351 295,337 14% Shareholders Equity 20,242 18,792 8% Total Deposits Total Loans & Advances 230,417 205,667 12% 215,459 198,660 8% Classified Loans 7,145 6,227 15% Capital Adequacy-The Bank 2021 2020 Change over 2020 Tier- Capital Ratio (%) 9.08 8.86 2% Capital to Risk Weighted Assets Ratio (CRAR) (%) 14.65 14.52 1% Total Eligible Capital 31,334 29,016 8%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started