Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analysis - What is CAGR? CAGR stands for the Compound Annual Growth Rate. It is the measure of an investment's annual growth rate over time,

Analysis What is CAGR?

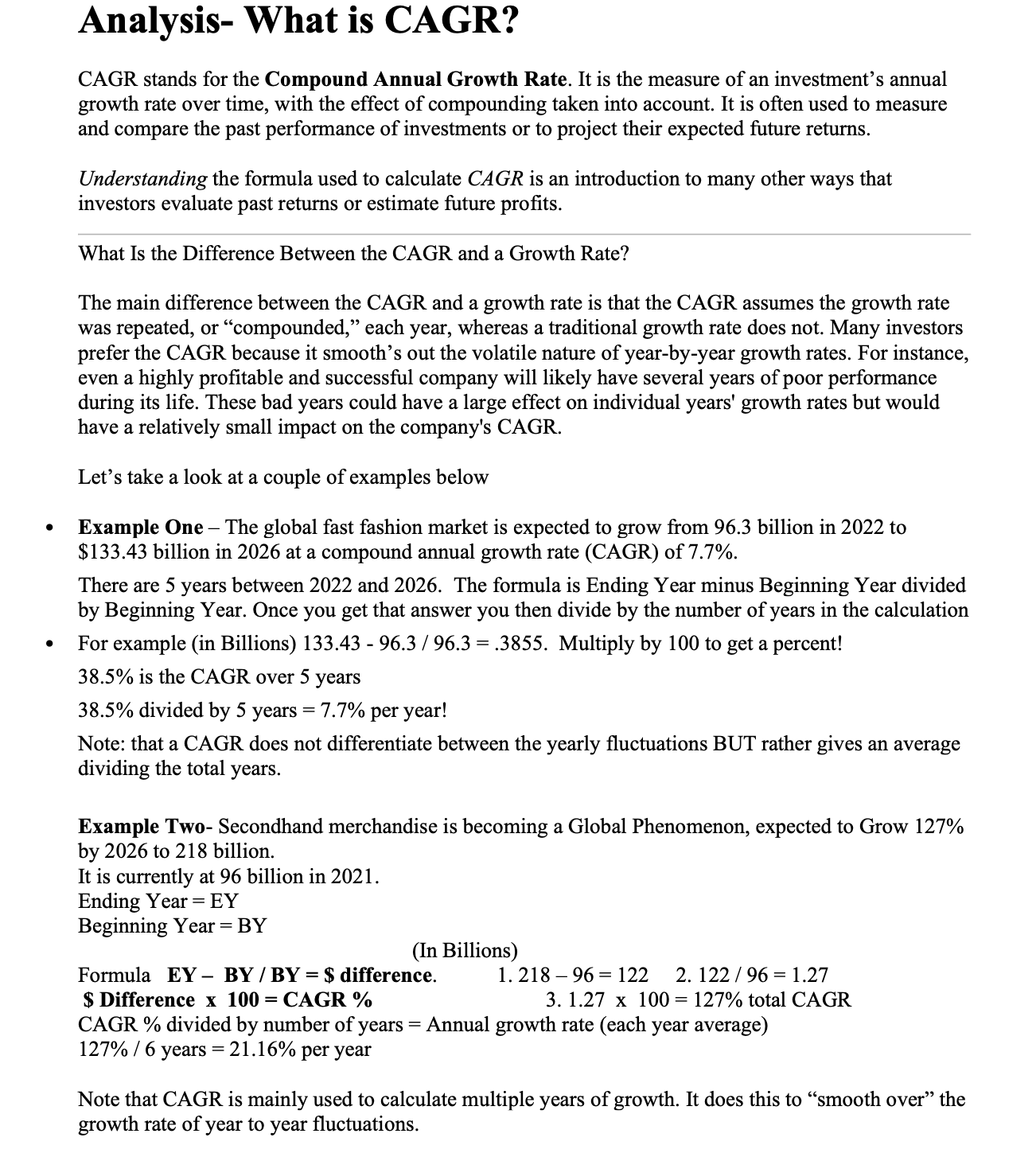

CAGR stands for the Compound Annual Growth Rate. It is the measure of an investment's annual

growth rate over time, with the effect of compounding taken into account. It is often used to measure

and compare the past performance of investments or to project their expected future returns.

Understanding the formula used to calculate CAGR is an introduction to many other ways that

investors evaluate past returns or estimate future profits.

What Is the Difference Between the CAGR and a Growth Rate?

The main difference between the CAGR and a growth rate is that the CAGR assumes the growth rate

was repeated, or "compounded," each year, whereas a traditional growth rate does not. Many investors

prefer the CAGR because it smooth's out the volatile nature of yearbyyear growth rates. For instance,

even a highly profitable and successful company will likely have several years of poor performance

during its life. These bad years could have a large effect on individual years' growth rates but would

have a relatively small impact on the company's CAGR.

Let's take a look at a couple of examples below

Example One The global fast fashion market is expected to grow from billion in to

$ billion in at a compound annual growth rate CAGR of

There are years between and The formula is Ending Year minus Beginning Year divided

by Beginning Year. Once you get that answer you then divide by the number of years in the calculation

For example in Billions Multiply by to get a percent!

is the CAGR over years

divided by years per year!

Note: that a CAGR does not differentiate between the yearly fluctuations BUT rather gives an average

dividing the total years.

Example Two Secondhand merchandise is becoming a Global Phenomenon, expected to Grow

by to billion.

It is currently at billion in

Ending Year EY

Beginning Year

In Billions

Formula $ difference.

$ Difference x CAGR

total CAGR

CAGR divided by number of years Annual growth rate each year average

years per year

Note that CAGR is mainly used to calculate multiple years of growth. It does this to "smooth over" the

growth rate of year to year fluctuations.Financial Goal Setting & CAGR. Creating the Statement of Strategy and Substantiation Complete a financial CAGR see page in your Manual Select a public company.

Report their most recent Revenue from the Income Statement.

Use the expected growth of in five years time.

What is the CAGR per year for that company?

Show all math in your work.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started