Answered step by step

Verified Expert Solution

Question

1 Approved Answer

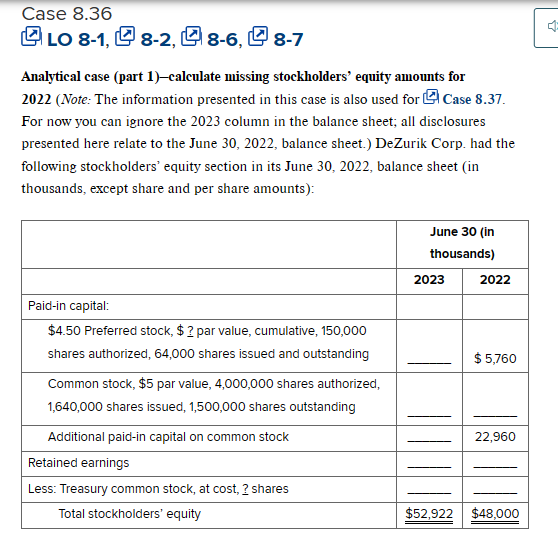

Analytical case (part 1)-calculate missing stockholders' equity amounts for 2022 (Note: The information presented in this case is also used for 3 Case 8.37. For

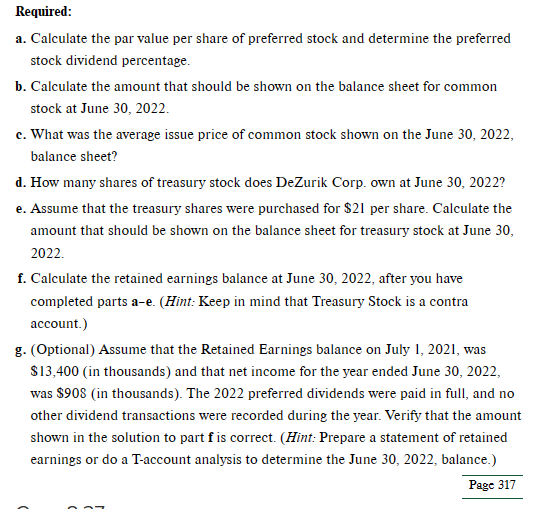

Analytical case (part 1)-calculate missing stockholders' equity amounts for 2022 (Note: The information presented in this case is also used for 3 Case 8.37. For now you can ignore the 2023 column in the balance sheet; all disclosures presented here relate to the June 30,2022, balance sheet.) DeZurik Corp. had the following stockholders' equity section in its June 30,2022 , balance sheet (in thousands, except share and per share amounts): c. What was the average issue price of common stock shown on the June 30,2022 , balance sheet? d. How many shares of treasury stock does DeZurik Corp. own at June 30, 2022? e. Assume that the treasury shares were purchased for $21 per share. Calculate the amount that should be shown on the balance sheet for treasury stock at June 30 , 2022. f. Calculate the retained earnings balance at June 30,2022, after you have completed parts a-e. (Hint: Keep in mind that Treasury Stock is a contra account.) g. (Optional) Assume that the Retained Earnings balance on July 1, 2021, was $13,400 (in thousands) and that net income for the year ended June 30, 2022, was $908 (in thousands). The 2022 preferred dividends were paid in full, and no other dividend transactions were recorded during the year. Verify that the amount shown in the solution to part f is correct. (Hint: Prepare a statement of retained earnings or do a T-account analysis to determine the June 30, 2022, balance.)

Analytical case (part 1)-calculate missing stockholders' equity amounts for 2022 (Note: The information presented in this case is also used for 3 Case 8.37. For now you can ignore the 2023 column in the balance sheet; all disclosures presented here relate to the June 30,2022, balance sheet.) DeZurik Corp. had the following stockholders' equity section in its June 30,2022 , balance sheet (in thousands, except share and per share amounts): c. What was the average issue price of common stock shown on the June 30,2022 , balance sheet? d. How many shares of treasury stock does DeZurik Corp. own at June 30, 2022? e. Assume that the treasury shares were purchased for $21 per share. Calculate the amount that should be shown on the balance sheet for treasury stock at June 30 , 2022. f. Calculate the retained earnings balance at June 30,2022, after you have completed parts a-e. (Hint: Keep in mind that Treasury Stock is a contra account.) g. (Optional) Assume that the Retained Earnings balance on July 1, 2021, was $13,400 (in thousands) and that net income for the year ended June 30, 2022, was $908 (in thousands). The 2022 preferred dividends were paid in full, and no other dividend transactions were recorded during the year. Verify that the amount shown in the solution to part f is correct. (Hint: Prepare a statement of retained earnings or do a T-account analysis to determine the June 30, 2022, balance.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started