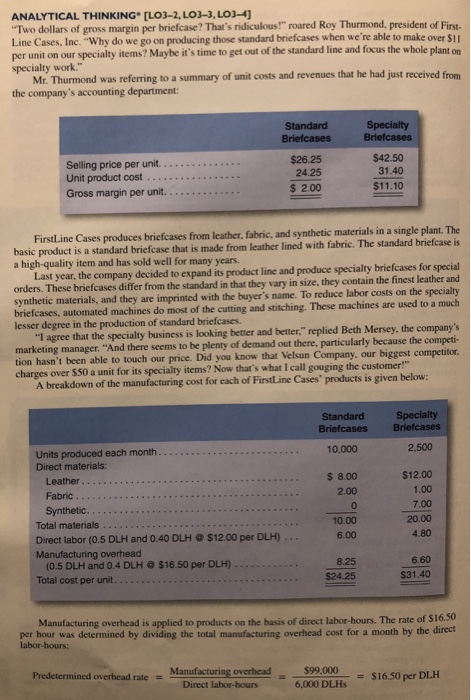

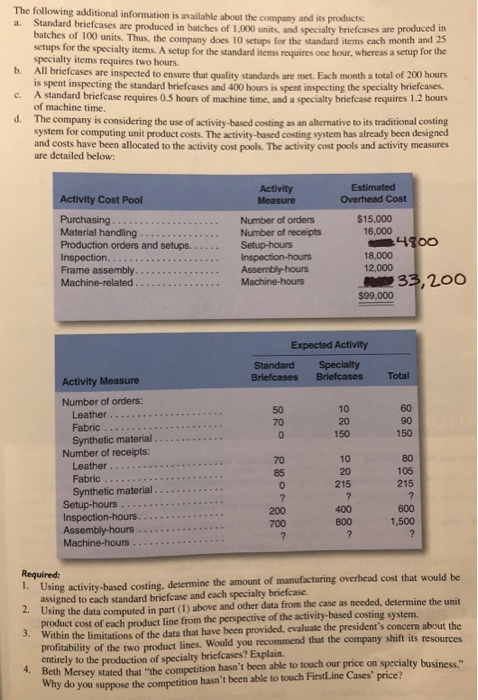

ANALYTICAL THINKING [LO3-2, LO3-3, LO3-4 Two dollars of gross margin per briefcase? That's ridiculous" roared Roy Thurmond, president of First- Line Cases, Inc. "Why do we go on producing those standard briefcases when we're able to make over S11 per unit on our specialty items? Maybe it's time to get out of the standard line and focus the whole plant on specialty work. Mr. Thurmond was referring to a summary of unit costs and revenues that he had just received from the company's accounting department: Standard Briefcases $26.25 24.25 $ 2.00 Briefcases $42.50 31.40 $11.10 Selling price per unit. Unit product cost FirstLine Cases produces briefcases from leather, fabric, and synthetic materials in a single plant The basic product is a standard briefcase that is made from leather lined with fabri The standard briefcase is Last year the company decided to e pand is product line and produce specilty briefcases for special hese briefcases differ from the standard in that they vary in size, they contain the finest leather and synthetic materials, and they are imprinted with the buyer's name. To reduce labor costs on the specialty iefcases, automated machines do most of the cutting and stitching. These machines are used to a much n of standard briefcases. lesser degree in marketing manager. "And there seems to be plenty charges over $50 a unit for its specialty items? Now that's what I call gouging the customer" "I agree that the specialty business is looking better and better," replied Beth Mersey, the company's of demand out there, particularly because the competi tion hasn't been able to touch our price. Did you know that Velsun Company, our biggest competitor A breakdown of the manufacturing cost for each of FirstLine Cases' products is given below: Standard Specialty Briefcases Briefcases Units produced each month Direct materials: 10,000 2,500 S 8.00 2.00 $12.00 Leather Fabric Synthetic 7.00 20.00 4.80 Total materials. 10.00 Direct labor (0.5 DLH and 0.40 DLH $12.00 per DLH) (0.5 DLH and 0.4 DLH$16.50 per DLH) Total cost per unit 8.25 $24.25 6.60 $31.40 Manufacturing overhead is applied to products on the basis of direct labor-hours. The rate of $16.50 per hour was determined by dividing the total manufacturing overhead cost for a month by the direct labor-hours: Manufacturing overhead Direct labor-hours $99,000 6,000 DLHs Predctermined overhead rate a- $16.50 per DLH The following additional information is available about the company and its products a. Standard briefcases are produced in batches of 1,000 units, and specialty briefcases are produced in batches of 100 units. Thus, the company does 10 setups for the standard items cach month and 25 setups for the specialty items. A sctup for the standard items requires one hour, whereas a setup for the specialty items requires two hours. briefcases are inspected to ensure that quality standards are met. Each month a total of 200 hours is spent inspecting the standard briefcases and 400 hours is spent inspecting the specialty briefcases. c. A standard briefcase requires 0.5 hours of machine time, and a specialty briefcase requires 1.2 hours of machine time. d. The company is considering the use of activity-based costing as an alternative to its traditional costing system for computing unit product costs. The activity-based costing system has already been designed and costs have been allocated to the activity cost pools. The activity cost pools and activity measures are detailed below: Activity Cost Pool Overhead Cost Number of orders Number of receipts $15,000 16,000 Material handling Production orders and setups. 18,000 12,000 Frame assembly. 33,200 $99,000 Expected Activity Standard Specialty Total Activity Measure Number of orders: 60 90 150 10 50 70 Fabric Synthetic material Leather 150 Number of receipts: 85 0 10 20 215 105 215 Synthetic material. Setup-hours. 200 700 400 800 600 1,500 Machine-hours Using activity-based costing, determine the amount of manufacturing overhead cost that would be assigned to each standard briefease and each specialty briefcase. Using the data computed in part (1) above and other data from the case as needed, determine the unit product cost of each product line from the perspective of the activity-based costing system. Within the limitations of the data that have been provided, evaluate the president's concern about the profitability of the two product lines. Would you recommend that the company shift its resources entirely to the production of specialty briefcases? Explain. . 3. 4. Beth ersey stated that "the competition hasa't been able to touch our price on specialty business" Why do you suppose the competition hasn't been able to touch FirstLine Cases' price