Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyze: After the corporation's formation, what is the fundamental accounting equation for Toy's Chest Corporation? Issuing stock at par for cash and noncash assets. ()

Analyze: After the corporation's formation, what is the fundamental accounting equation for Toy's Chest Corporation?

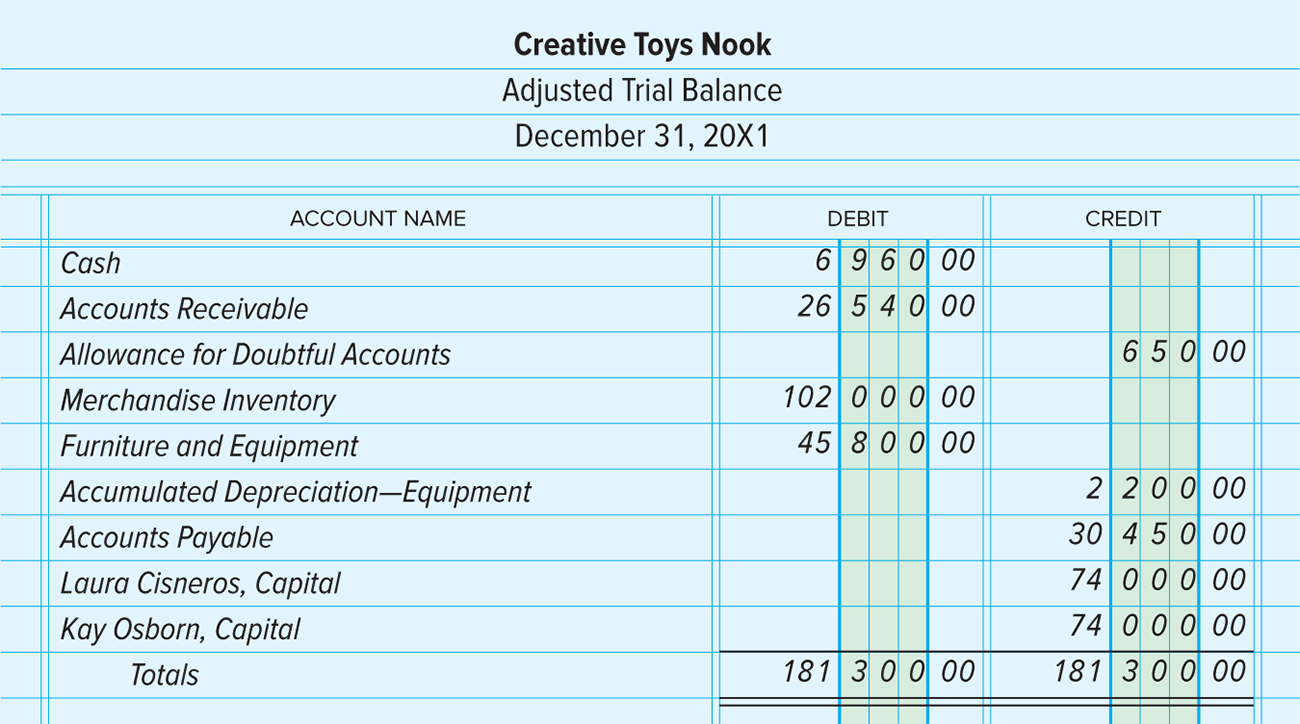

Issuing stock at par for cash and noncash assets. () Objective 206 Laura Cisneros and Kay Osborn are equal partners in Creative Toys Nook. Cisneros and Osborn have decided to form Toy Chest Corporation to take over the operation of Creative Toys Nook on December 31,20X1. The corporation is authorized to issue 8,000 shares of no-par-value common stock with a stated value of $25 per share and 2,000 shares of $50 par-value, 12 percent preferred stock that is noncumulative and nonparticipating. Certain assets are revalued so that the accounts will reflect current values. Cisneros and Osborn will each receive 250 shares of Toy Chest Corporation preferred stock at par value ( $50 ) and sufficient no-par-value shares of common stock at stated value ( $25 ) to cover the partners' adjusted net investment in the partnership. The trial balance shown below was prepared after the firm's accounting records were closed at the end of its fiscal year on December 31,20X1, and the assets were revalued as agreed on. Page 739 INSTRUCTIONS 1. In the corporation's general journal, record a memorandum entry describing its formation on December 31,20X1. 2. Make general journal entries as of December 31 to show the takeover of the assets and liabilities of the partnership and the issuance of stock in payment to Laura Cisneros and Kay Osborn. Use the same account names that the partnership used for assets and liabilities. Also use the following new account titles: Common Stock and Preferred Stock. Creative Toys Nook Adjusted Trial Balance December 31, 20X1 Issuing stock at par for cash and noncash assets. () Objective 206 Laura Cisneros and Kay Osborn are equal partners in Creative Toys Nook. Cisneros and Osborn have decided to form Toy Chest Corporation to take over the operation of Creative Toys Nook on December 31,20X1. The corporation is authorized to issue 8,000 shares of no-par-value common stock with a stated value of $25 per share and 2,000 shares of $50 par-value, 12 percent preferred stock that is noncumulative and nonparticipating. Certain assets are revalued so that the accounts will reflect current values. Cisneros and Osborn will each receive 250 shares of Toy Chest Corporation preferred stock at par value ( $50 ) and sufficient no-par-value shares of common stock at stated value ( $25 ) to cover the partners' adjusted net investment in the partnership. The trial balance shown below was prepared after the firm's accounting records were closed at the end of its fiscal year on December 31,20X1, and the assets were revalued as agreed on. Page 739 INSTRUCTIONS 1. In the corporation's general journal, record a memorandum entry describing its formation on December 31,20X1. 2. Make general journal entries as of December 31 to show the takeover of the assets and liabilities of the partnership and the issuance of stock in payment to Laura Cisneros and Kay Osborn. Use the same account names that the partnership used for assets and liabilities. Also use the following new account titles: Common Stock and Preferred Stock. Creative Toys Nook Adjusted Trial Balance December 31, 20X1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started