Answered step by step

Verified Expert Solution

Question

1 Approved Answer

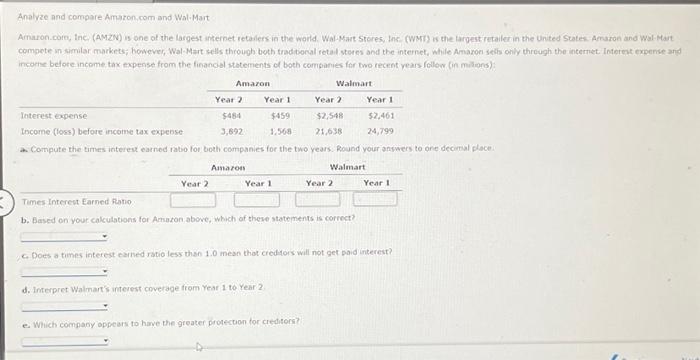

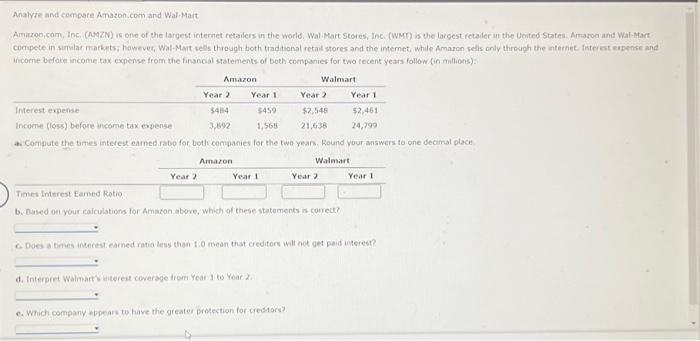

Analyze and compare Amazon.com and Wal-Mart Amazon.com, Inc. (AMZN) is one of the largest internet retailers in the world. Wal-Mart Stores, Inc. (WMT) is the

Analyze and compare Amazon.com and Wal-Mart Amazon.com, Inc. (AMZN) is one of the largest internet retailers in the world. Wal-Mart Stores, Inc. (WMT) is the largest retailer in the United States. Amazon and Wal-Mart compete in similar markets; however, Wal-Mart sells through both traditional retail stores and the internet, while Amazon sells only through the internet. Interest expense and income before income tax expense from the financial statements of both companies for two recent years follow (in millions): Amazon Year 2 Year 1 $459 Interest expense Income (loss) before income tax expense 1,568 a Compute the times interest earned ratio for both companies for the two years. Round your answers to one decimal place. Walmart Year 2 $484 3,892 Amazon Year 1 Walmart d. Interpret Walmart's interest coverage from Year 1 to Year 2. Year 2 e. Which company appears to have the greater protection for creditors? $2,548 21,638 Year 2 Times Interest Earned Ratio b. Based on your calculations for Amazon above, which of these statements is correct? Year 1 $2,461 24,799 c. Does a times interest earned ratio less than 1.0 mean that creditors will not get paid interest? Year 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started