Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyze and report held-to-maturity investments purchased at a premium) Insurance companies and pension plans hold large quantities of bond investments. Variety Insurance Corp. purchased

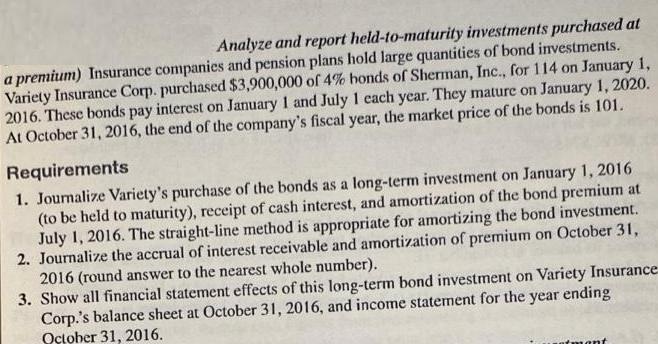

Analyze and report held-to-maturity investments purchased at a premium) Insurance companies and pension plans hold large quantities of bond investments. Variety Insurance Corp. purchased $3,900,000 of 4% honds of Sherman, Inc., for 114 on January 1, 2016. These bonds pay interest on January 1 and July 1 each year. They mature on January 1, 2020. At October 31, 2016, the end of the company's fiscal year, the market price of the bonds is 101. Requirements 1. Journalize Variety's purchase of the bonds as a long-term investment on January 1, 2016 (to be held to maturity), receipt of cash interest, and amortization of the bond premium at July 1, 2016. The straight-line method is appropriate for amortizing the bond investment. 2. Journalize the accrual of interest receivable and amortization of premium on October 31, 2016 (round answer to the nearest whole number). 3. Show all financial statement effects of this long-term bond investment on Variety Insurance Corp.'s balance sheet at October 31, 2016, and income statement for the year ending October 31, 2016. atmant

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Date Account Titles and Explanation Debit Credit Jan 1 2016 Held to maturity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started