Answered step by step

Verified Expert Solution

Question

1 Approved Answer

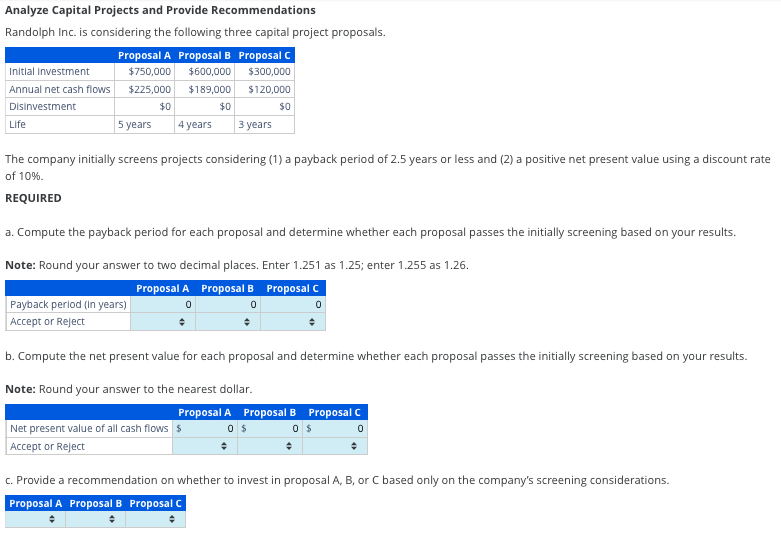

Analyze Capital Projects and Provide Recommendations Randolph Inc. is considering the following three capital project proposals. The company initially screens projects considering (1) a payback

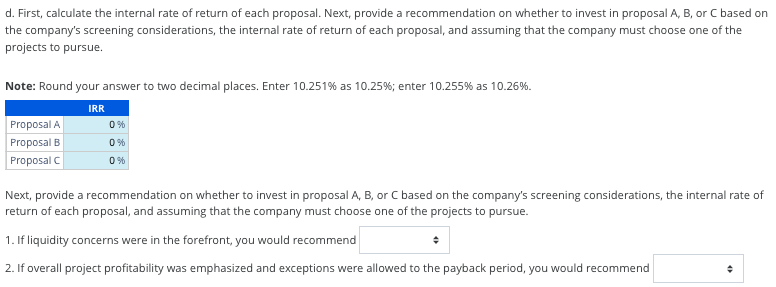

Analyze Capital Projects and Provide Recommendations Randolph Inc. is considering the following three capital project proposals. The company initially screens projects considering (1) a payback period of 2.5 years or less and (2) a positive net present value using a discount rate of 10%. REQUIRED a. Compute the payback period for each proposal and determine whether each proposal passes the initially screening based on your results. Note: Round your answer to two decimal places. Enter 1.251 as 1.25; enter 1.255 as 1.26. b. Compute the net present value for each proposal and determine whether each proposal passes the initially screening based on your results. Note: Round your answer to the nearest dollar. d. First, calculate the internal rate of return of each proposal. Next, provide a recommendation on whether to invest in proposal A, B, or C based on the company's screening considerations, the internal rate of return of each proposal, and assuming that the company must choose one of the projects to pursue. Note: Round your answer to two decimal places. Enter 10.251% as 10.25%; enter 10.255% as 10.26%. Next, provide a recommendation on whether to invest in proposal A, B, or C based on the company's screening considerations, the internal rate of return of each proposal, and assuming that the company must choose one of the projects to pursue. 1. If liquidity concerns were in the forefront, you would recommend 2. If overall project profitability was emphasized and exceptions were allowed to the payback period, you would recommend

Analyze Capital Projects and Provide Recommendations Randolph Inc. is considering the following three capital project proposals. The company initially screens projects considering (1) a payback period of 2.5 years or less and (2) a positive net present value using a discount rate of 10%. REQUIRED a. Compute the payback period for each proposal and determine whether each proposal passes the initially screening based on your results. Note: Round your answer to two decimal places. Enter 1.251 as 1.25; enter 1.255 as 1.26. b. Compute the net present value for each proposal and determine whether each proposal passes the initially screening based on your results. Note: Round your answer to the nearest dollar. d. First, calculate the internal rate of return of each proposal. Next, provide a recommendation on whether to invest in proposal A, B, or C based on the company's screening considerations, the internal rate of return of each proposal, and assuming that the company must choose one of the projects to pursue. Note: Round your answer to two decimal places. Enter 10.251% as 10.25%; enter 10.255% as 10.26%. Next, provide a recommendation on whether to invest in proposal A, B, or C based on the company's screening considerations, the internal rate of return of each proposal, and assuming that the company must choose one of the projects to pursue. 1. If liquidity concerns were in the forefront, you would recommend 2. If overall project profitability was emphasized and exceptions were allowed to the payback period, you would recommend Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started