Question

Analyze manufacturing overhead SOS produces clothes and uses a job costing system. The company allocates manufacturing overhead based on the direct labor hours for each

Analyze manufacturing overhead

SOS produces clothes and uses a job costing system. The company allocates manufacturing overhead based on the direct labor hours for each job in the plant.

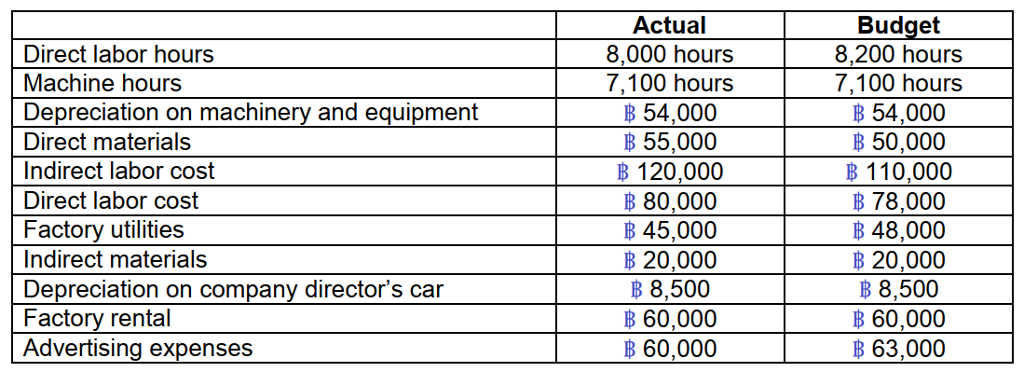

SOS reports the following cost data for the past year:

Requirements 1. Compute the predetermined manufacturing overhead rate for SOS. 2. Calculate the allocated manufacturing overhead for the past year. 3. Compute the underallocated and overallocated manufacturing overhead. How will this be adjusted? 4. How will the budgeted cost data and predetermined manufacturing overhead information be useful to the company manager?

Direct labor hours Machine hours Depreciation on machinery and equipment Direct materials Indirect labor cost Direct labor cost Factory utilities Indirect materials Depreciation on company director's car Factory rental Advertising expenses Actual 8,000 hours 7,100 hours B 54,000 B 55,000 120,000 B 80,000 B 45,000 B 20,000 B 8,500 B 60,000 B 60,000 Budget 8,200 hours 7,100 hours B 54,000 B 50,000 B 110,000 B 78,000 B 48,000 B 20,000 B 8,500 60,000 63,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started