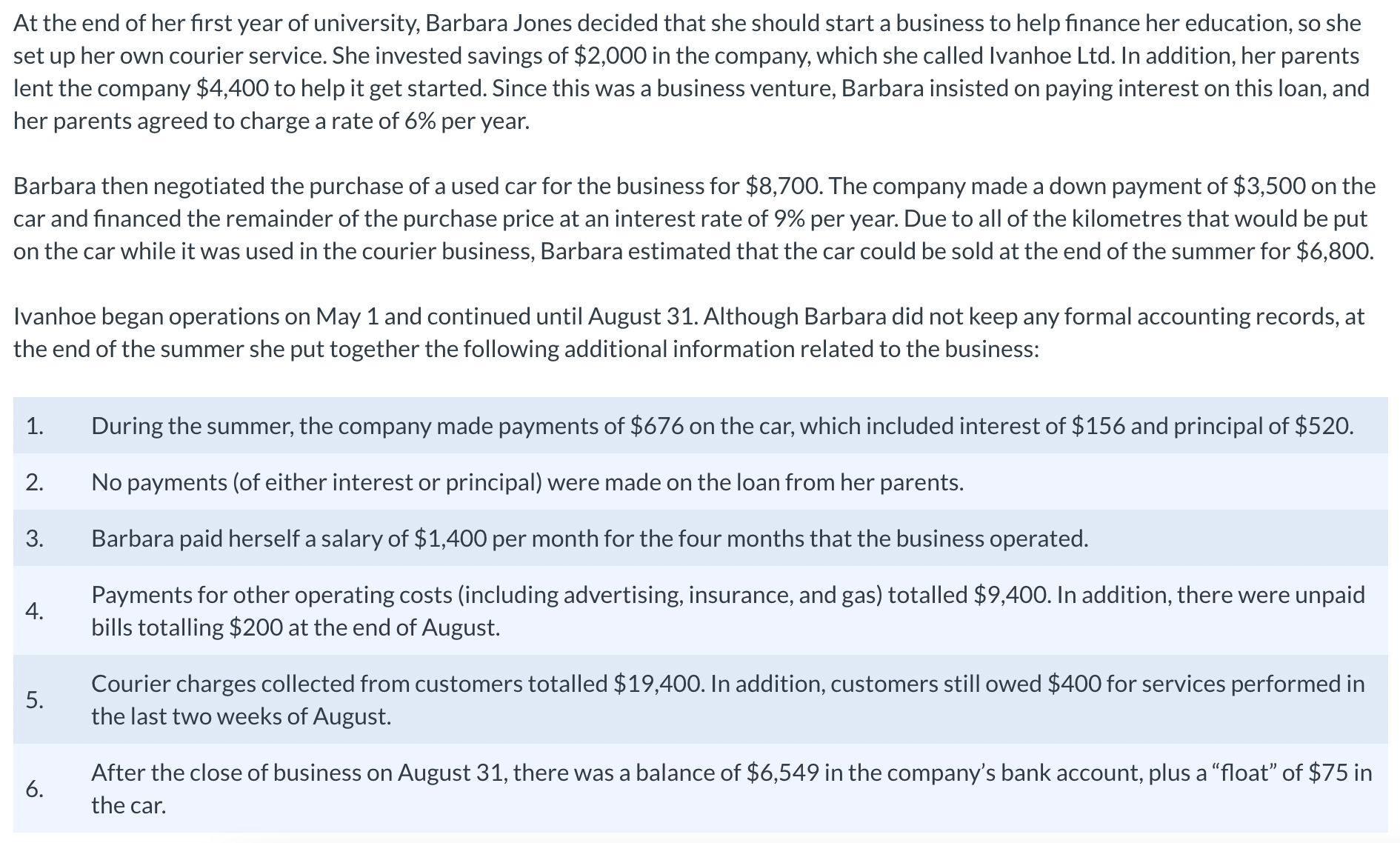

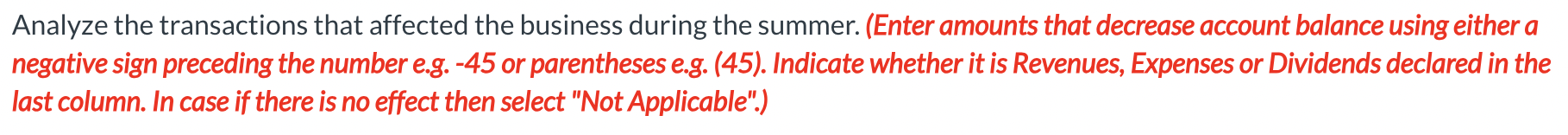

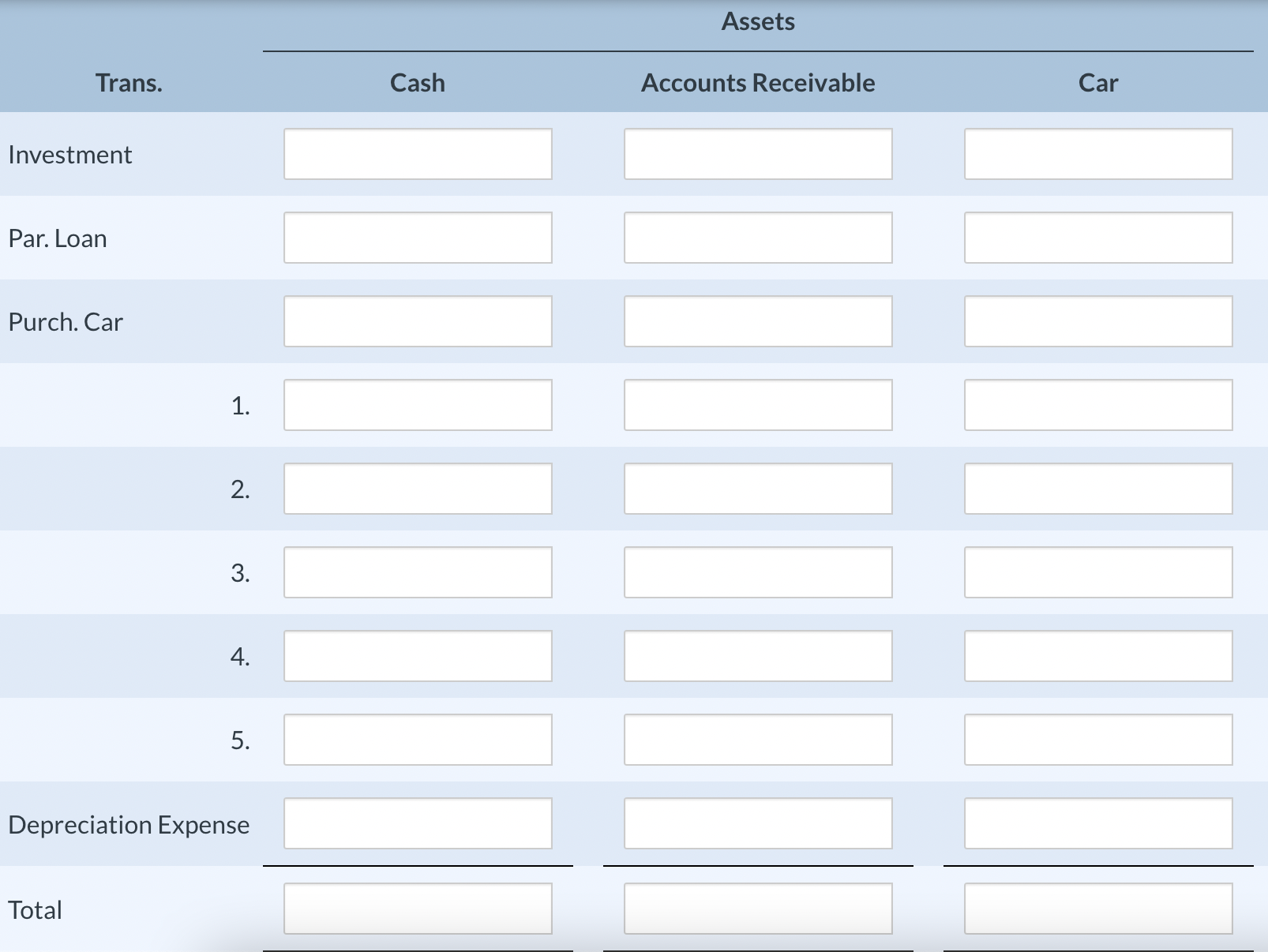

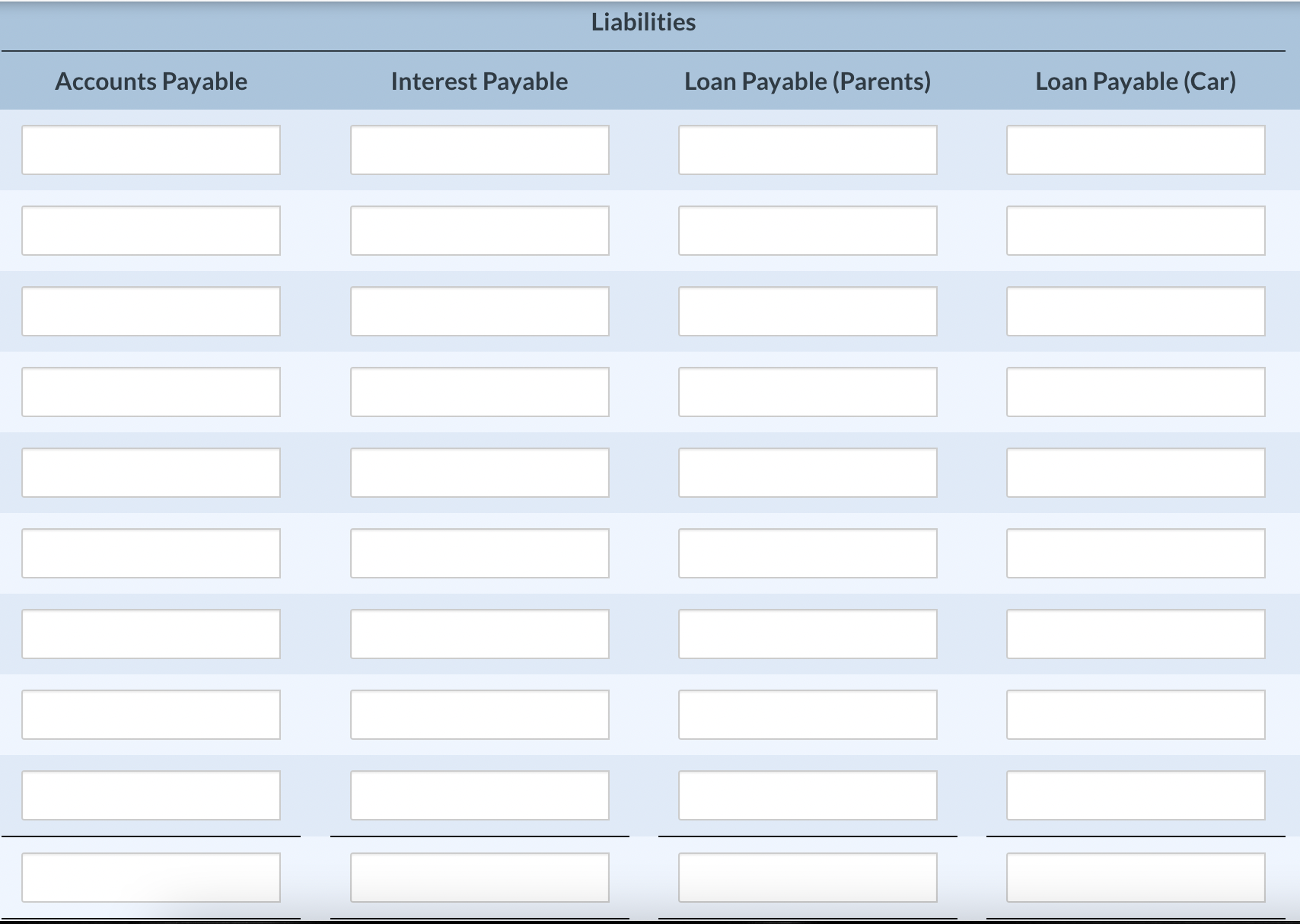

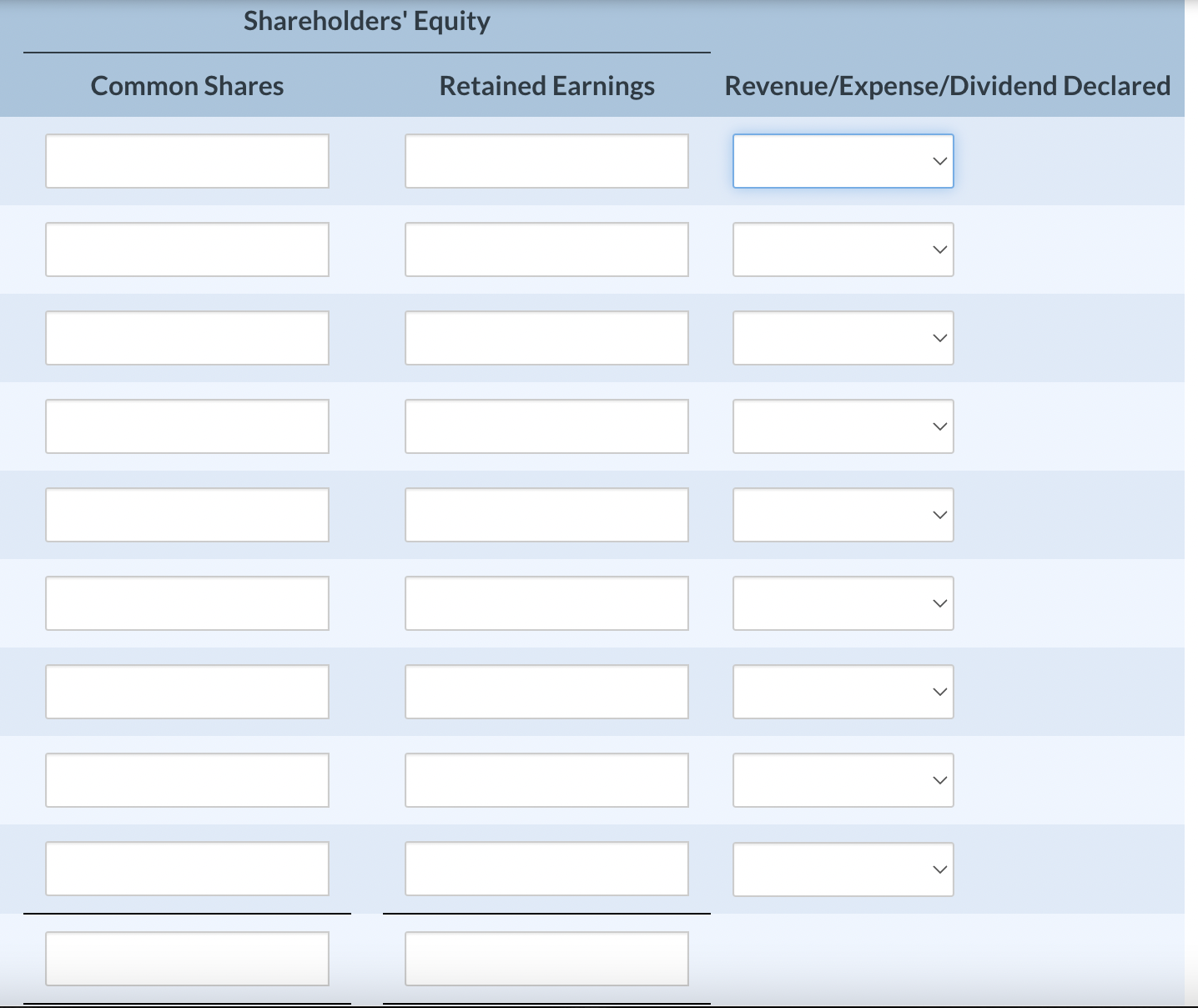

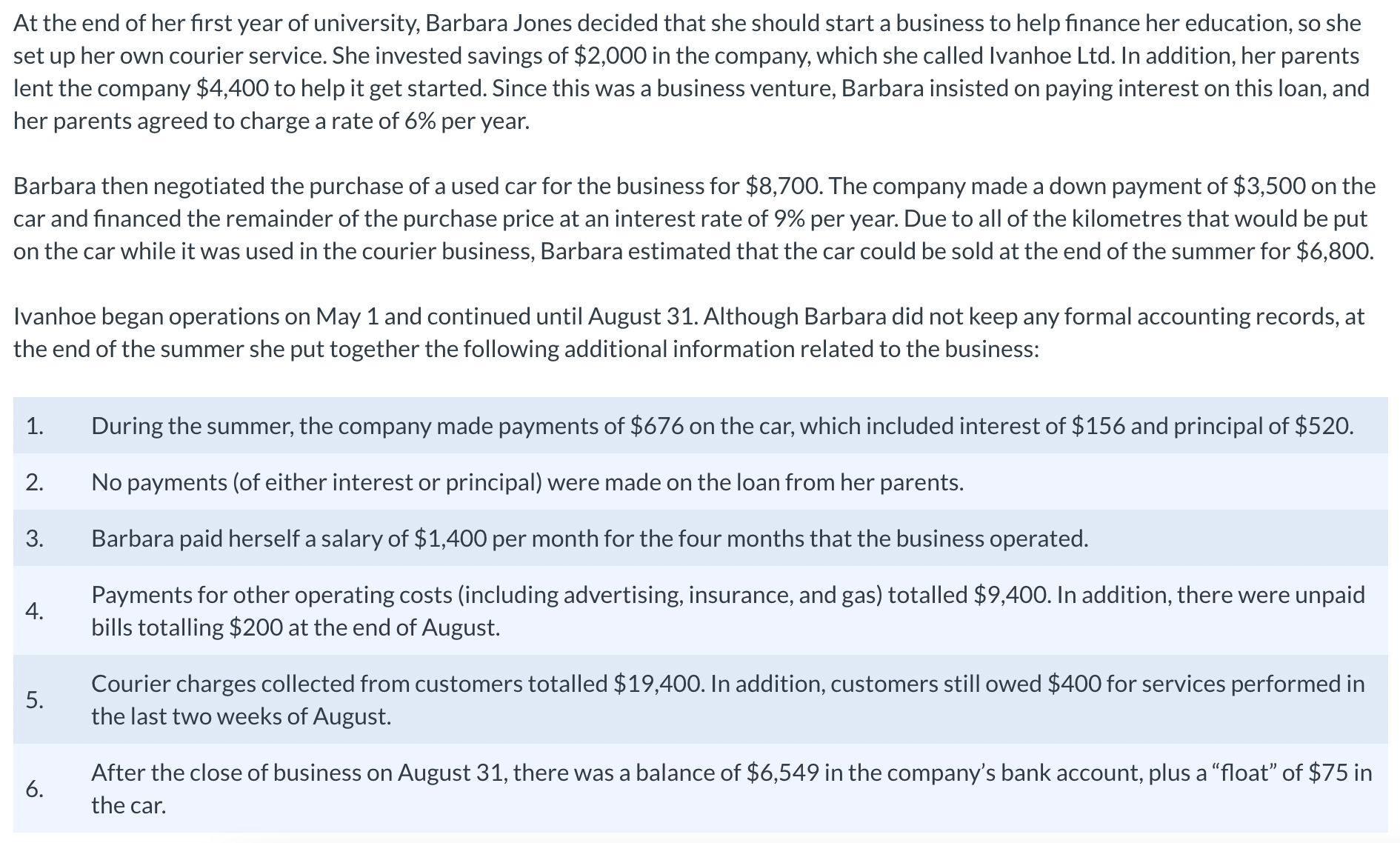

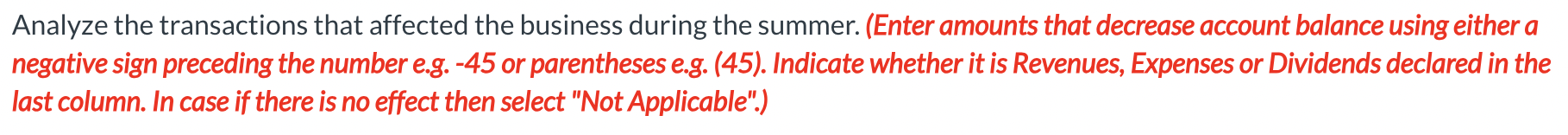

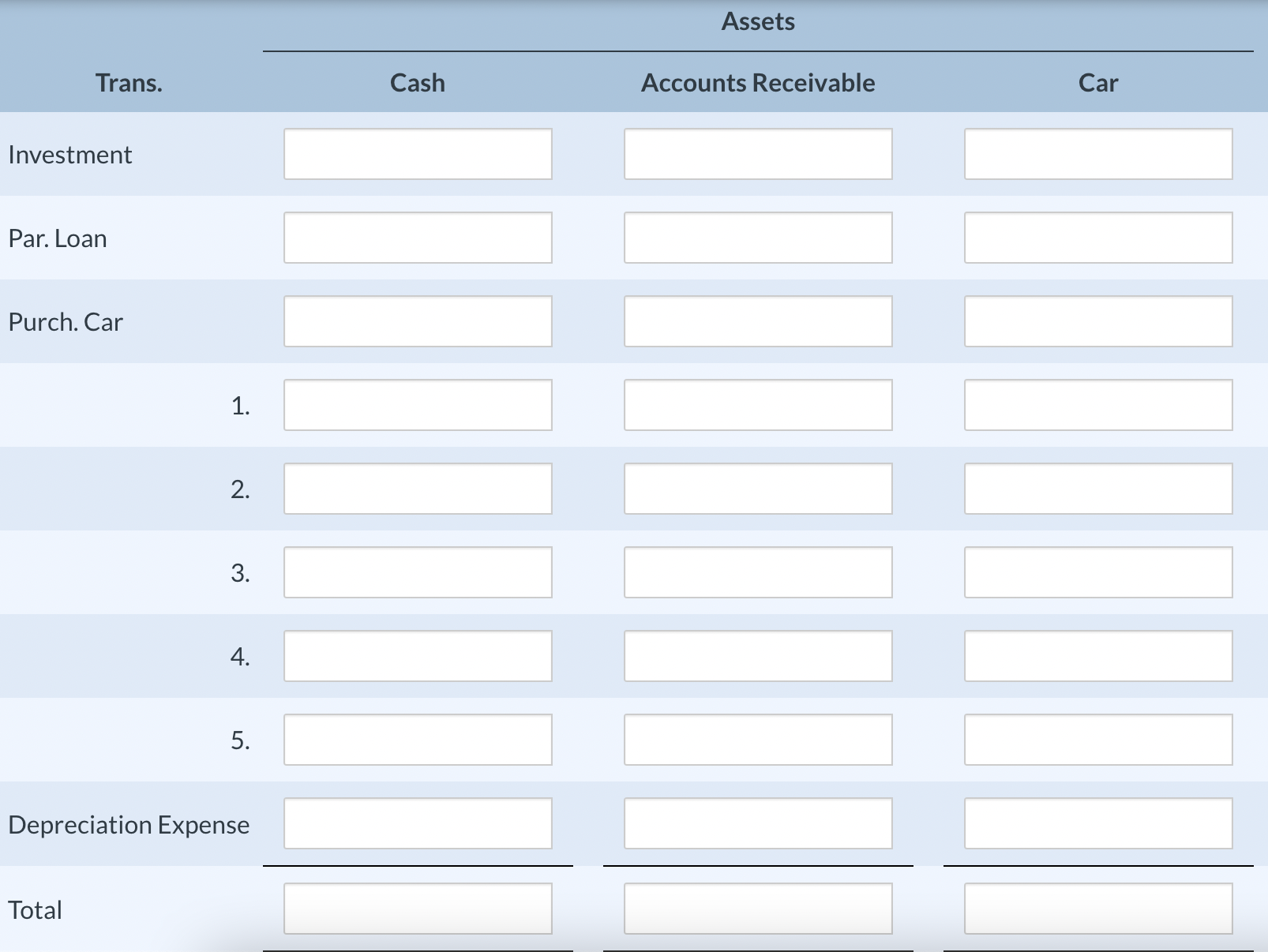

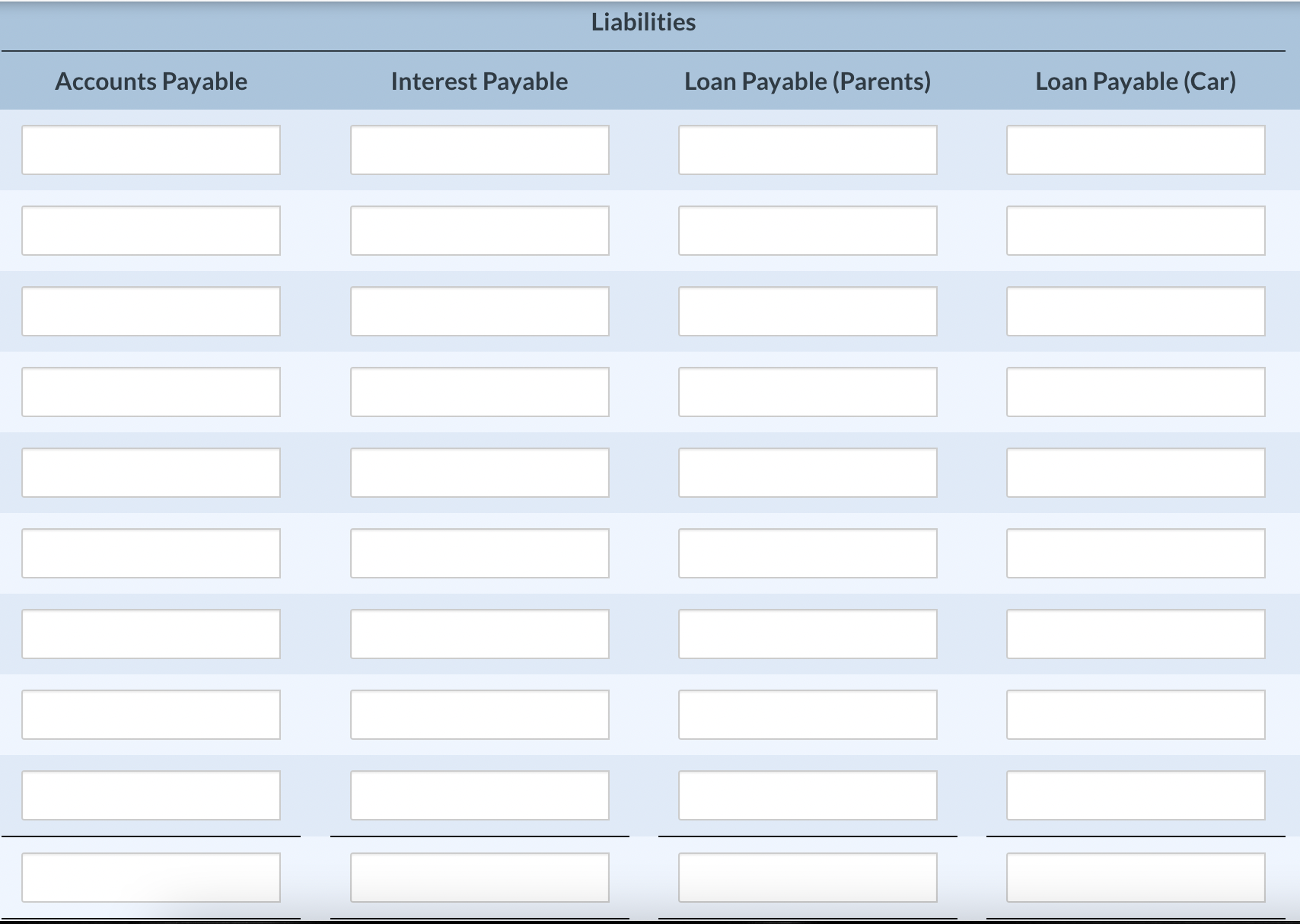

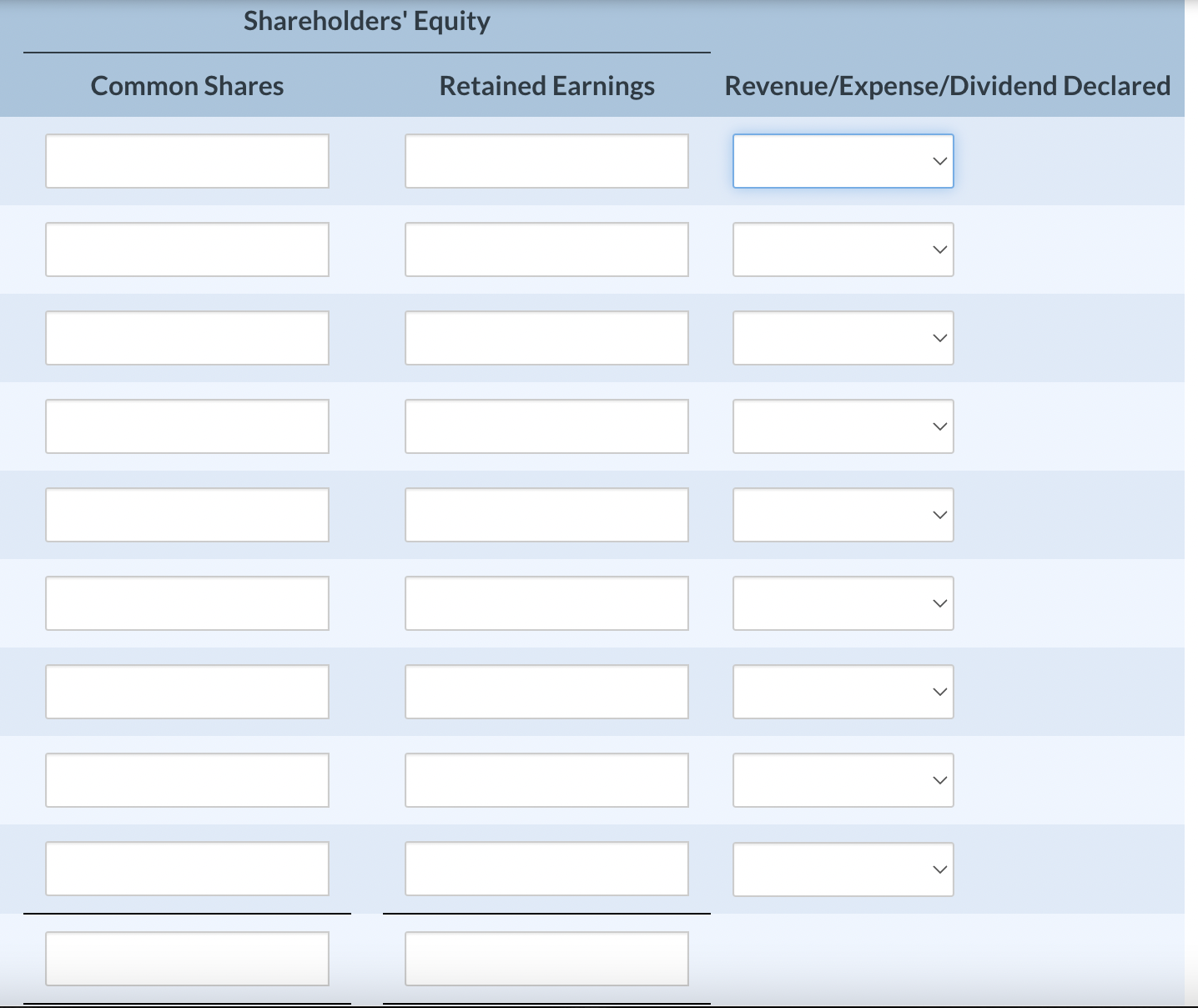

Analyze the transactions that affected the business during the summer. (Enter amounts that decrease account balance using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Indicate whether it is Revenues, Expenses or Dividends declared in the last column. In case if there is no effect then select "Not Applicable".) Liabilities Accounts Payable Interest Payable Loan Payable (Parents) Loan Payable (Car) Shareholders' Equity Common Shares Retained Earnings Revenue/Expense/Dividend Declared At the end of her first year of university, Barbara Jones decided that she should start a business to help finance her education, so she set up her own courier service. She invested savings of $2,000 in the company, which she called Ivanhoe Ltd. In addition, her parents lent the company $4,400 to help it get started. Since this was a business venture, Barbara insisted on paying interest on this loan, and her parents agreed to charge a rate of 6% per year. Barbara then negotiated the purchase of a used car for the business for $8,700. The company made a down payment of $3,500 on the car and financed the remainder of the purchase price at an interest rate of 9% per year. Due to all of the kilometres that would be put on the car while it was used in the courier business, Barbara estimated that the car could be sold at the end of the summer for $6,800. Ivanhoe began operations on May 1 and continued until August 31. Although Barbara did not keep any formal accounting records, at the end of the summer she put together the following additional information related to the business: 1. During the summer, the company made payments of $676 on the car, which included interest of $156 and principal of $520. 2. No payments (of either interest or principal) were made on the loan from her parents. 3. Barbara paid herself a salary of $1,400 per month for the four months that the business operated. 4. Payments for other operating costs (including advertising, insurance, and gas) totalled $9,400. In addition, there were unpaid bills totalling $200 at the end of August. 5. Courier charges collected from customers totalled $19,400. In addition, customers still owed $400 for services performed in the last two weeks of August. 6. After the close of business on August 31 , there was a balance of $6,549 in the company's bank account, plus a "float" of $75 in the car. Assets Trans. Cash Accounts Receivable Car Investment Par. Loan Purch. Car 1. 2. 3. 4. 5. Depreciation Expense Total Analyze the transactions that affected the business during the summer. (Enter amounts that decrease account balance using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Indicate whether it is Revenues, Expenses or Dividends declared in the last column. In case if there is no effect then select "Not Applicable".) Liabilities Accounts Payable Interest Payable Loan Payable (Parents) Loan Payable (Car) Shareholders' Equity Common Shares Retained Earnings Revenue/Expense/Dividend Declared At the end of her first year of university, Barbara Jones decided that she should start a business to help finance her education, so she set up her own courier service. She invested savings of $2,000 in the company, which she called Ivanhoe Ltd. In addition, her parents lent the company $4,400 to help it get started. Since this was a business venture, Barbara insisted on paying interest on this loan, and her parents agreed to charge a rate of 6% per year. Barbara then negotiated the purchase of a used car for the business for $8,700. The company made a down payment of $3,500 on the car and financed the remainder of the purchase price at an interest rate of 9% per year. Due to all of the kilometres that would be put on the car while it was used in the courier business, Barbara estimated that the car could be sold at the end of the summer for $6,800. Ivanhoe began operations on May 1 and continued until August 31. Although Barbara did not keep any formal accounting records, at the end of the summer she put together the following additional information related to the business: 1. During the summer, the company made payments of $676 on the car, which included interest of $156 and principal of $520. 2. No payments (of either interest or principal) were made on the loan from her parents. 3. Barbara paid herself a salary of $1,400 per month for the four months that the business operated. 4. Payments for other operating costs (including advertising, insurance, and gas) totalled $9,400. In addition, there were unpaid bills totalling $200 at the end of August. 5. Courier charges collected from customers totalled $19,400. In addition, customers still owed $400 for services performed in the last two weeks of August. 6. After the close of business on August 31 , there was a balance of $6,549 in the company's bank account, plus a "float" of $75 in the car. Assets Trans. Cash Accounts Receivable Car Investment Par. Loan Purch. Car 1. 2. 3. 4. 5. Depreciation Expense Total