Question

The total number of units sold in 2019 for the three products can be found on your B_Summary worksheet (C8:C10). You need to fill out

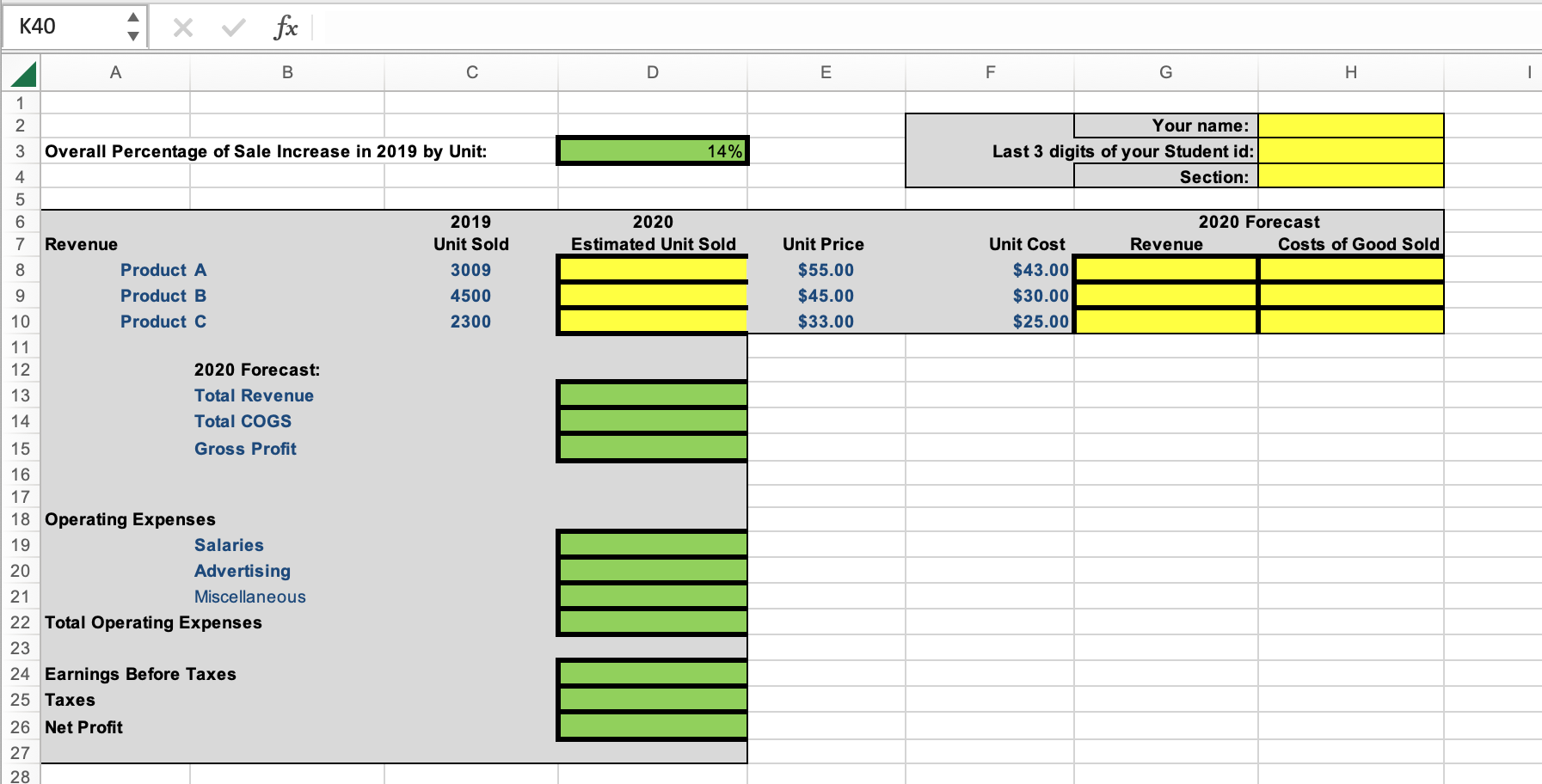

The total number of units sold in 2019 for the three products can be found on your B_Summary worksheet (C8:C10). You need to fill out all the yellow or green boxed cells according to the requirements below:

Calculate estimated number of units to be sold for all three products in 2020 (in D8:D10) as a percentage increase from the 2019 numbers. We will assume that the 2020 sales will keep the same increase rate as that of 2019, which is 14% in as specified in Cell D3. Calculate the revenues (G8:G10) and costs of goods sold (H8:H10) for each products based on 2020 data (D8:D10). Where Revenue is Units Sold * Unit Price and COGS is Units Sold * Unit Cost.

Total Revenue is the sum of the revenues for all three products for 2020 Total COGS is the sum of the COGS for all three products for 2020. Gross Profit = Total Revenue Total COGS Salaries is 12% of Total Revenue

Advertising is 4% of Total Revenue Miscellaneous expenses are 1% of Total Revenue Total Operating Expense = Salaries + Advertising + Miscellaneous Earning Before Taxes = Gross Profit Total Operating Expense Calculate Taxes based on tax rate of 25% of Earning Before Taxes Net Profit = Earnings Before Taxes - Taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started