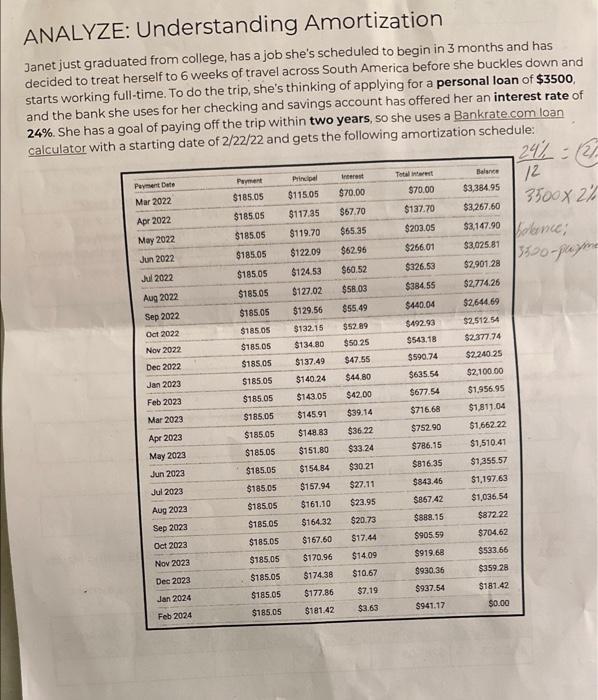

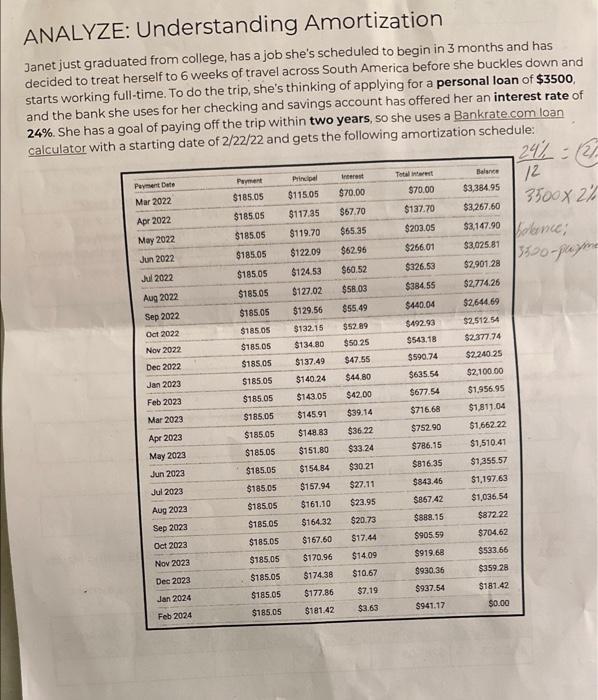

ANALYZE: Understanding Amortization Janet just graduated from college, has a job she's scheduled to begin in 3 months and has decided to treat herself to 6 weeks of travel across South America before she buckles down and starts working full-time. To do the trip, she's thinking of applying for a personal loan of $3500, and the bank she uses for her checking and savings account has offered her an interest rate of 24%. She has a goal of paying off the trip within two years, so she uses a Bankrate.com loan calculator with a starting date of 2/22/22 and gets the following amortization schedule: b. What will be the general impact on Janet's amortization schedule by making this single larger payment? Part II: Change Janet's Schedule n question 5 above, you calculated what the schedule would look like if Janet had made one 285.05 payment in March 2023. You did it by hand, but the Bankrate calculator has a feature that llows you to adjust the entire schedule. 6. Using the Bankrate.com loan calculator, enter in the original loan amount, loan term, and interest rate. 7. Then, click on "Calculate" to get the monthly loan payment of $185.05. 8. Click "Show Amortization Schedule" and scroll down to the table. Make sure that the "Start Date" of the payment in the table is 02/22/2022. 9. Click on "ADD EXTRA PAYMENTS" under the blue Calculate button. Add an extra one-time payment of $100 in March 2023 and click the blue button "APPLY EXTRA PAYMENTS." 10. Now, scroll down to March 2023 in the amortization table. You should see that there is now a one-time payment of $285.05 for that month. a. How did the extra, one-time payment of $100 affect the total interest Janet pays on the loan? b. What was the impact on the number of months it will take Janet to pay off her loan? 11. This new calculation has Janet curious - if she'd been making $285.05 payments for the entire duration of the loan: a. what would be the impact on the total interest Janet would have paid? b. What would be the impact on the number of months to pay off the loan? When using the calculator for question 7, be sure to take off the extra \$100 payment in Mar 2023; otherwise, shed be paying 5385.05 that month. 12. Reset Janet's loan back to $3500,24% interest, but pretend she decided from the start that her pay-off goal was 4 years instead of 2 . a What is Janet's new monthlv pavment? b. What's the imnact on the total interest she'll pav? c. Look at the very first payment month. How does the amount of her payment that is applied to interest compare with the amount applied to the principal balance? d. Explain how your observation in part c impacts the total amount of interest Janet will pay over the life of the loan. 13. What would be the benefit of taking a longer time to pay back your loan (ex: 4 years