Answered step by step

Verified Expert Solution

Question

1 Approved Answer

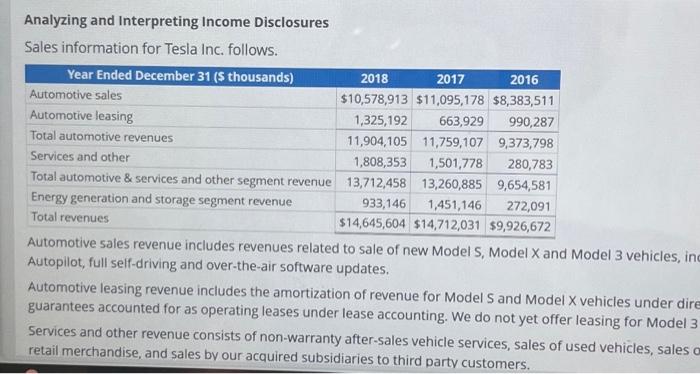

Analyzing and Interpreting Income Disclosures Sales information for Tesla Inc. follows. Year Ended December 31 ($ thousands) Automotive sales Automotive leasing Total automotive revenues Services

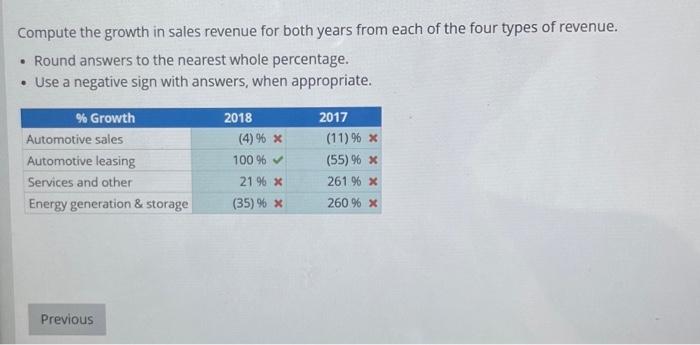

Analyzing and Interpreting Income Disclosures Sales information for Tesla Inc. follows. Year Ended December 31 ($ thousands) Automotive sales Automotive leasing Total automotive revenues Services and other Total automotive & services and other segment revenue Energy generation and storage segment revenue Total revenues 2018 2017 2016 $10,578,913 $11,095,178 $8,383,511 1,325,192 663,929 990,287 11,904,105 11,759,107 9,373,798 1,808,353 1,501,778 280,783 13,712,458 13,260,885 9,654,581 933,146 1,451,146 272,091 $14,645,604 $14,712,031 $9,926,672 Automotive sales revenue includes revenues related to sale of new Model S, Model X and Model 3 vehicles, inc Autopilot, full self-driving and over-the-air software updates. Automotive leasing revenue includes the amortization of revenue for Model S and Model X vehicles under dire guarantees accounted for as operating leases under lease accounting. We do not yet offer leasing for Model 3 Services and other revenue consists of non-warranty after-sales vehicle services, sales of used vehicles, sales a retail merchandise, and sales by our acquired subsidiaries to third party customers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started