Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyzing and Interpreting Inventories and Its Related Ratios and Disclosures Inventories Effective December 3 0 , 2 0 0 7 ( beginning of 4 th

Analyzing and Interpreting Inventories and Its Related Ratios and Disclosures Inventories

Effective December beginning of th quarter of Fiscal Year the Company changed its inventory valuation method from the lower of cost determined under the FIFO method, or market to the

lower of cost determined under the LIFO method, or market. In the high inflation environment that the Company was experiencing, the Company believed that the LIFO inventory method was preferable over

the FIFO method because it better compares the cost of current production to current revenue. The effect of LIFO was to increase continuing net earnings by $ million in and to reduce net earnings by

$ million in compared to what would have been reported using the FIFO inventory method. The increase in earnings per share was $ $ diluted in ; and a reduction in earnings per share

of $ $ diluted in There were LIFO liquidations of $ million in and $ million in Most of this LIFO liquidation in is reported as Discontinued Operations since it related to the

Modesto fruit. The inventories by category and the impact of using the LIFO method are shown in the following table:

In prior financial statements, Cicero has stated that it "manages the Company for cash, not reported earnings" and that the "decision to switch to LIFO has turned out to be a very prudent one of the last five

years."

a Compute the ratio of inventories to total current assets for and c What inventory costing method does the Company use? What effect has the use of this method relative to FIFO or LIFO had on its reported income for and Was the result an increase or

decrease? Explain.

d Cicero claims that it manages its company for cash flow. Does its inventory reporting help the Company to do so How much in taxes has the Company saved, assuming a tax rate, by the inventory

approach it adopted?

The company's use of has led to a of its taxes as indicated by the million amount in the

The Company's cash savings from its inventory reporting method is $ million.

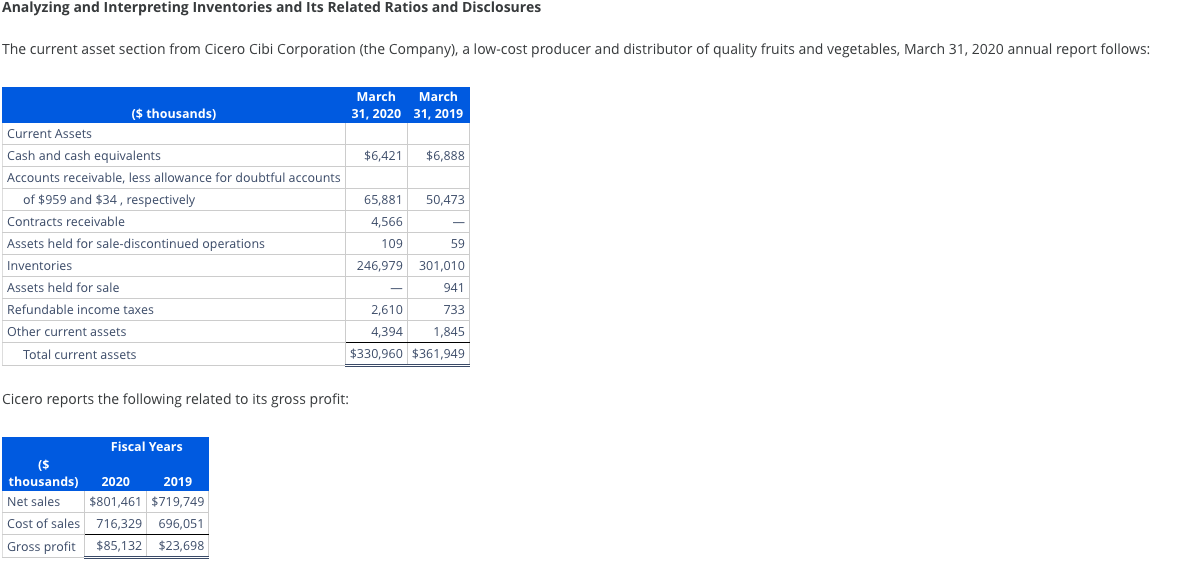

The current asset section from Cicero Cibi Corporation the Company a lowcost producer and distributor of quality fruits and vegetables, March annual report follows:

Cicero reports the following related to its gross profit:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started