Answered step by step

Verified Expert Solution

Question

1 Approved Answer

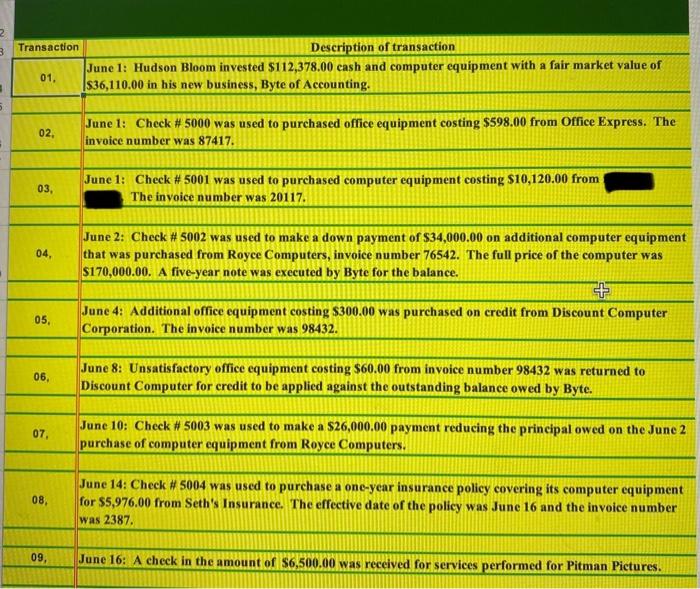

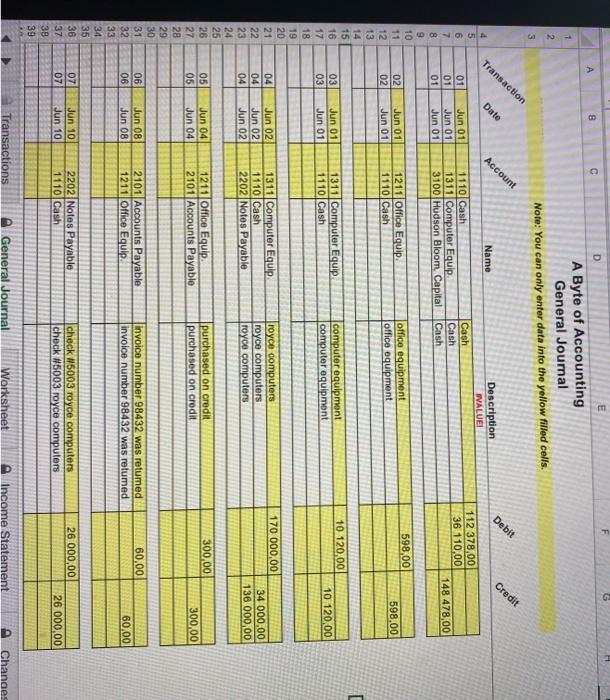

help! general journal and worksheet 3 5. Transaction 01, 02, 03, 04, 05, 06, 07. 08. 09, Description of transaction June 1: Hudson Bloom invested

help! general journal and worksheet

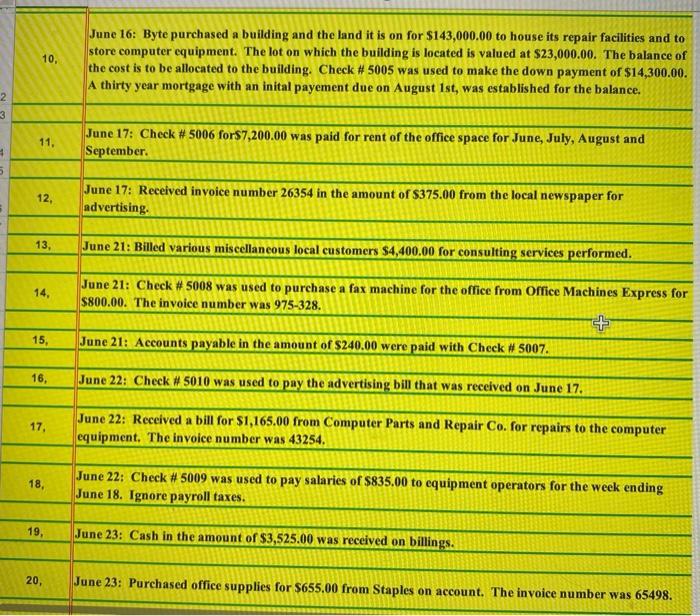

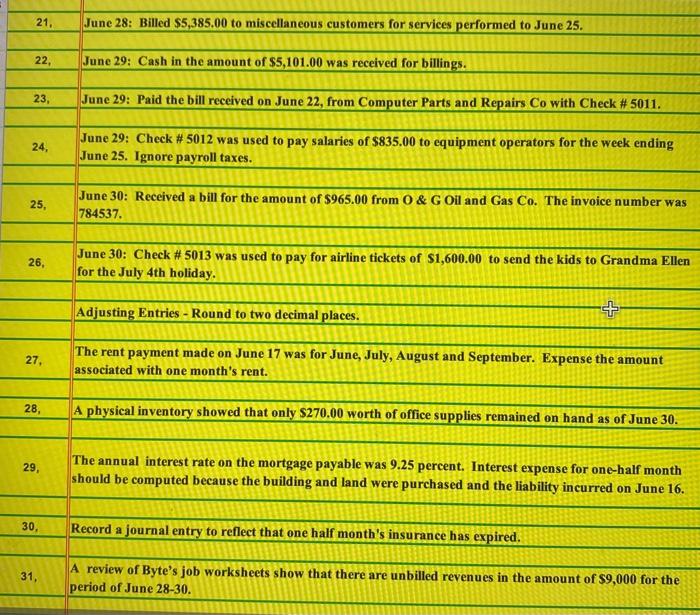

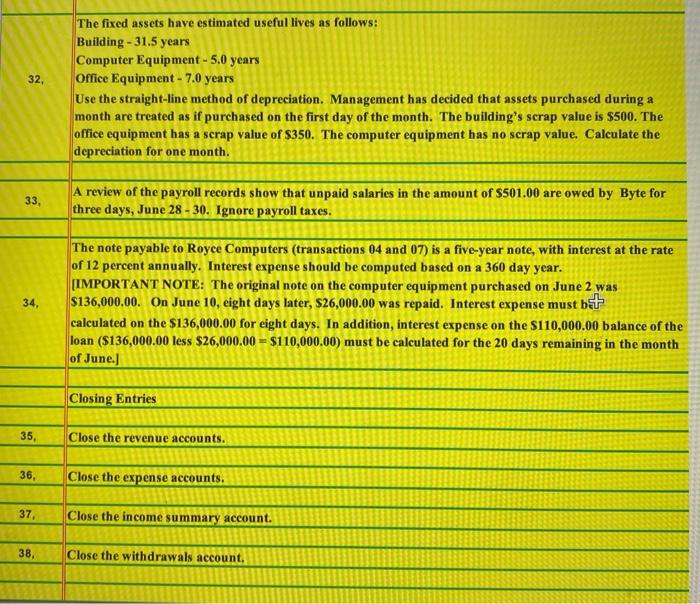

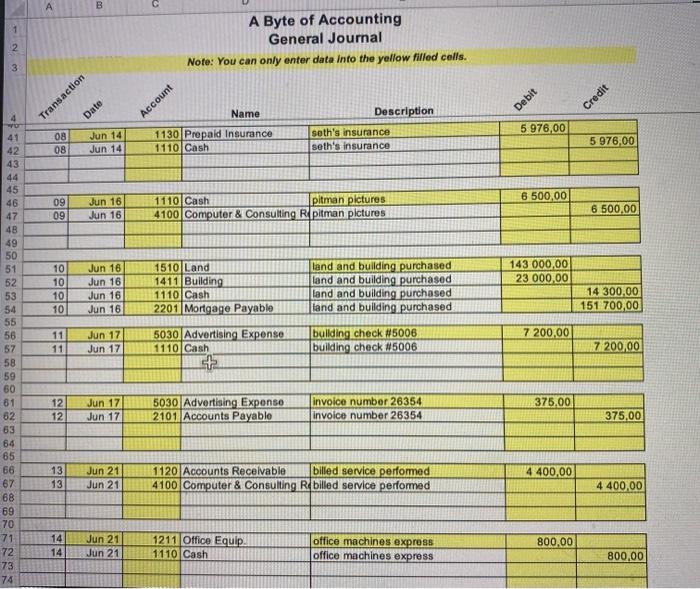

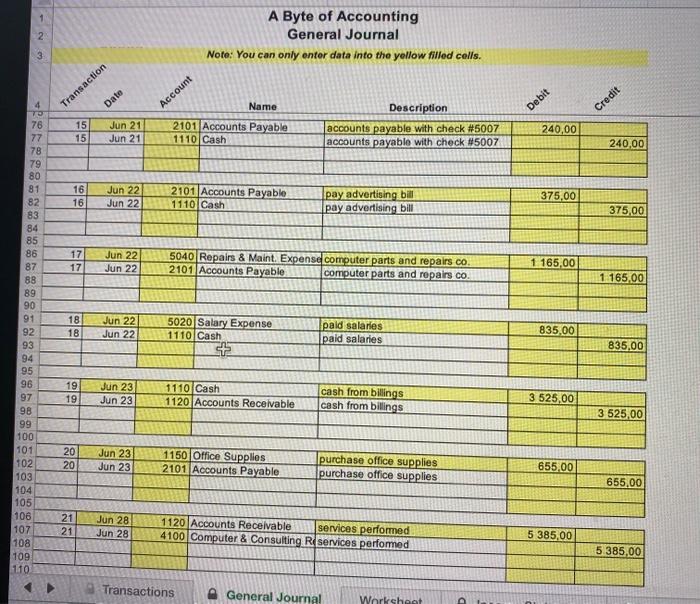

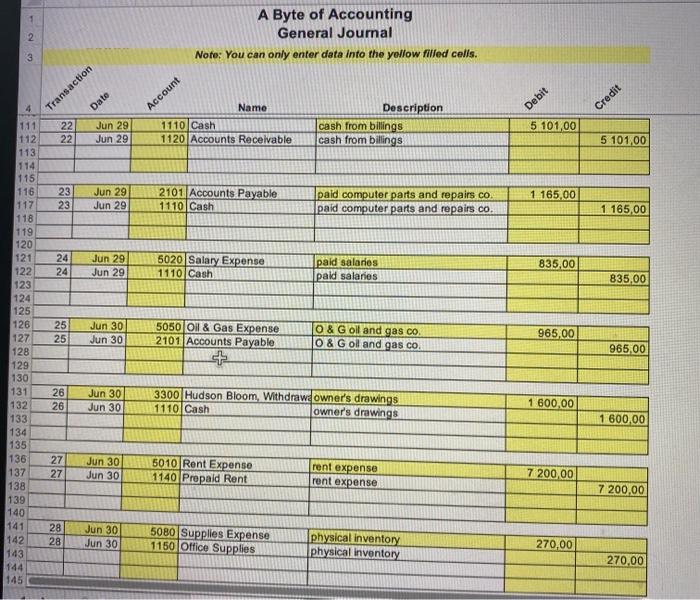

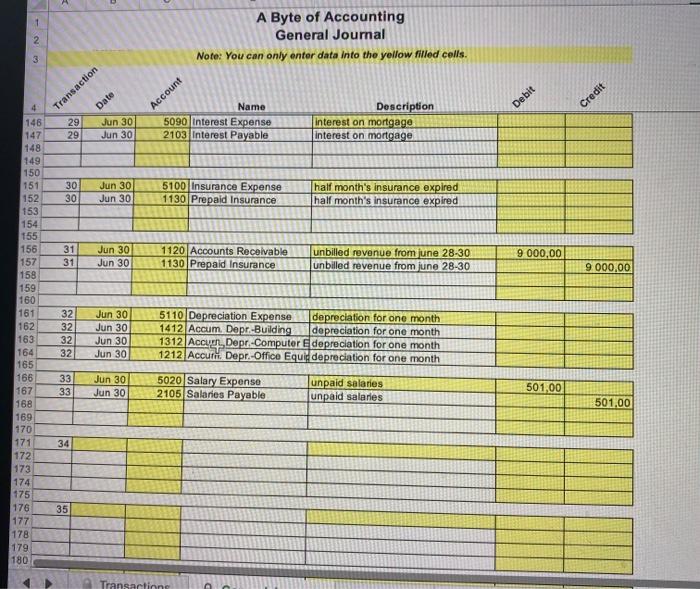

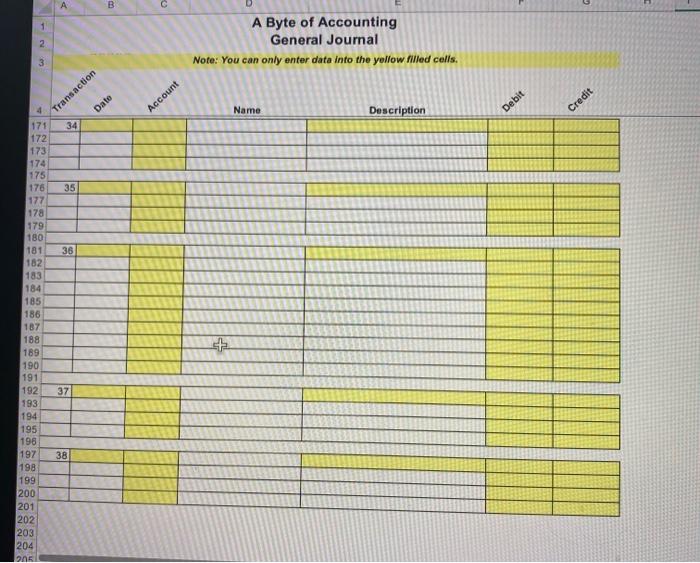

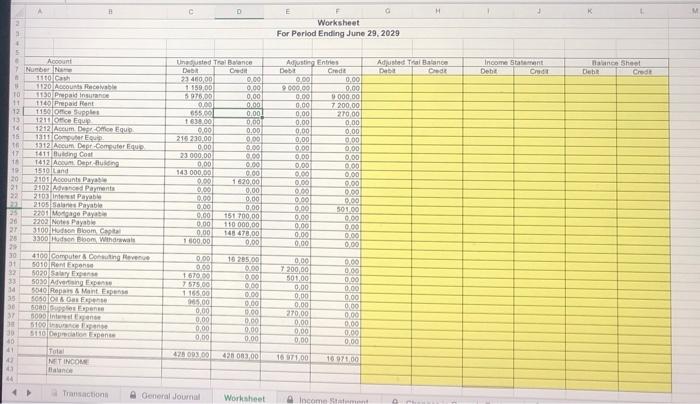

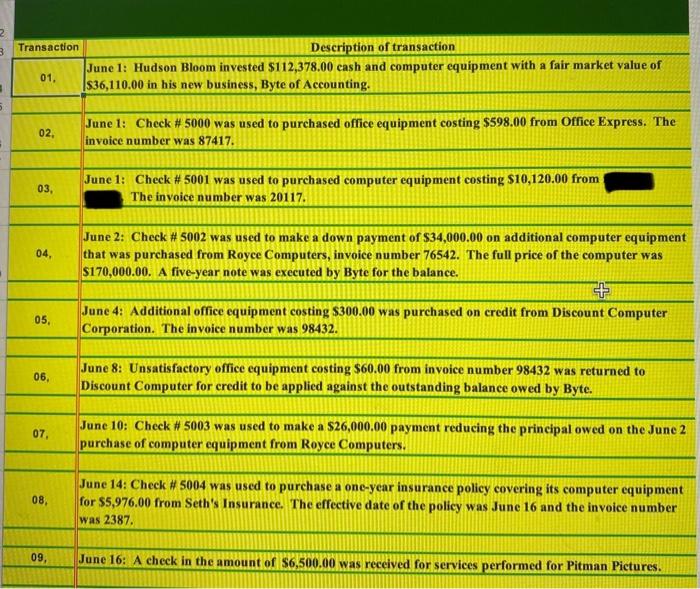

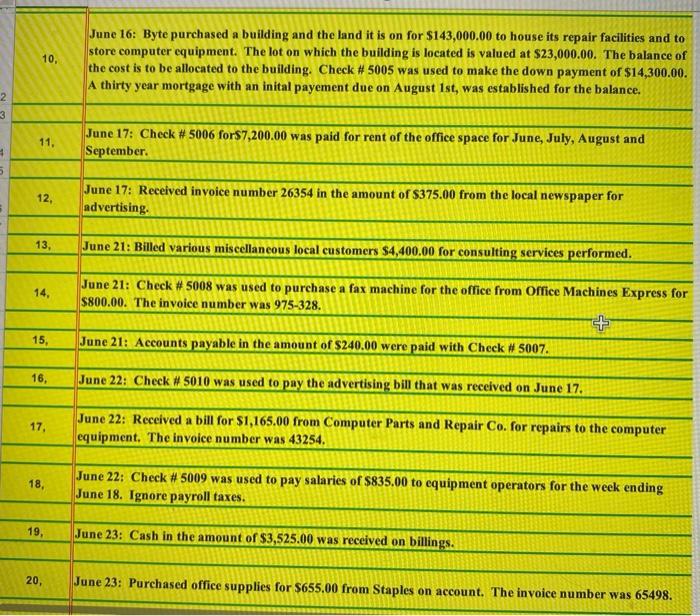

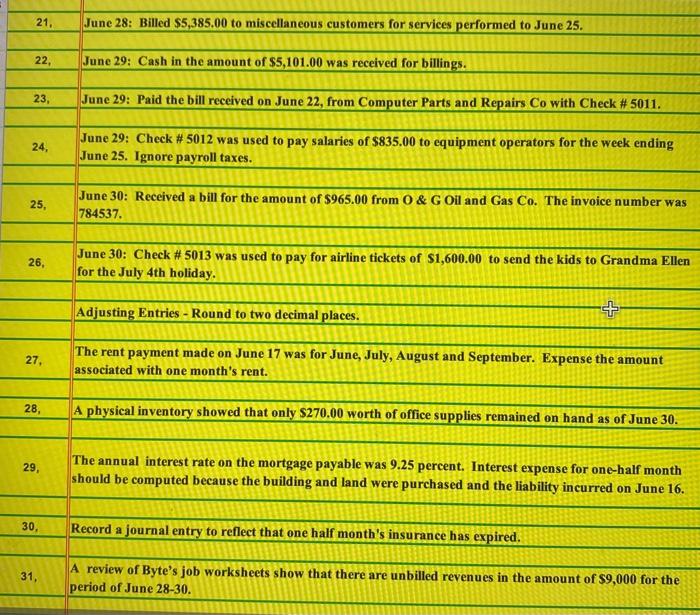

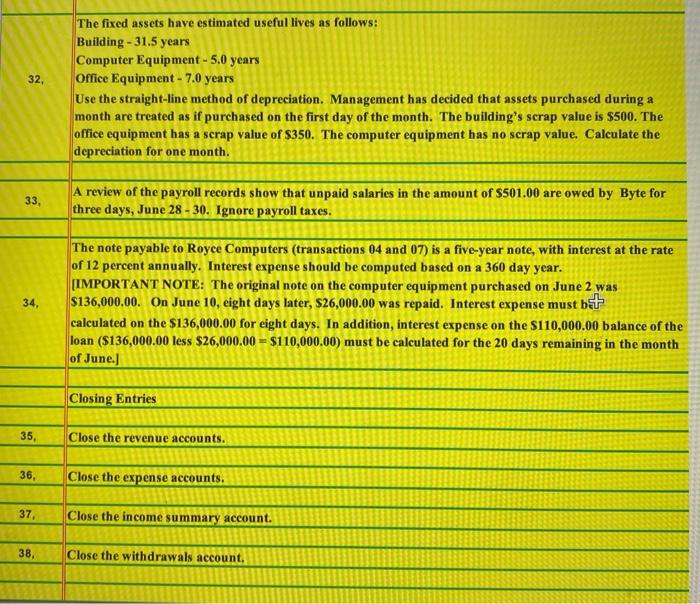

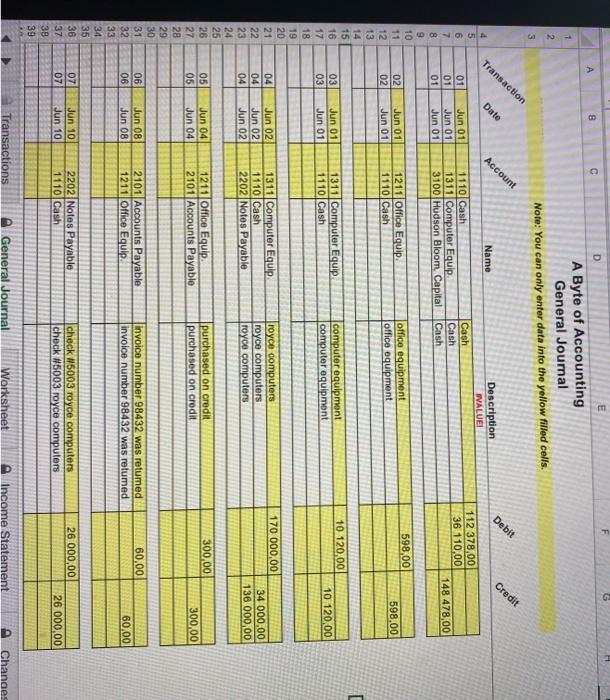

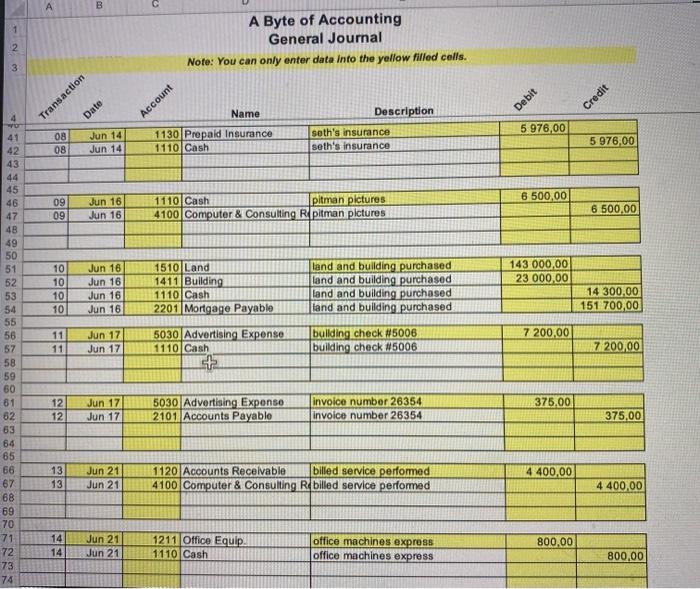

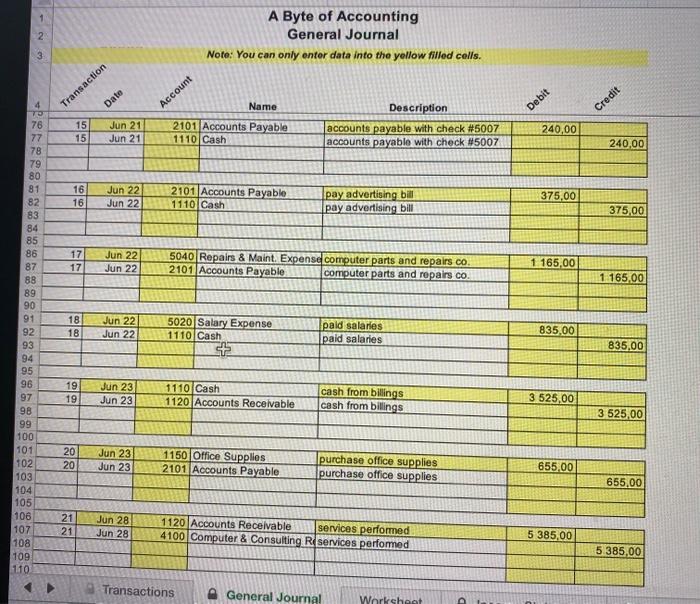

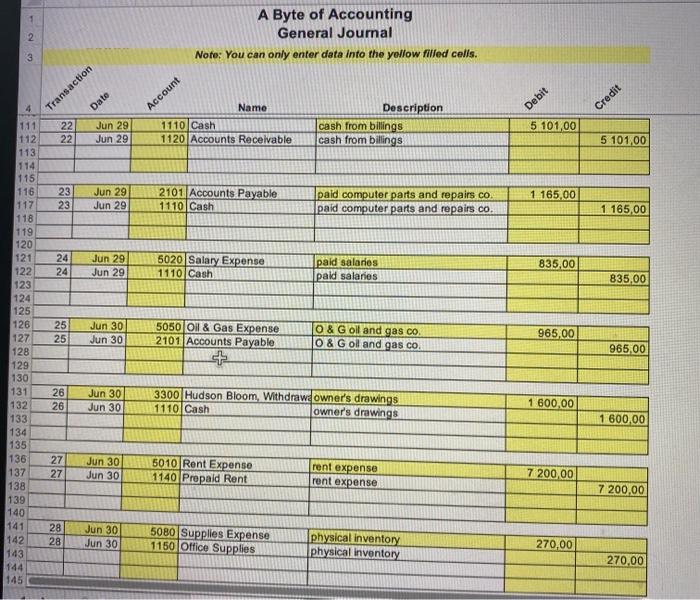

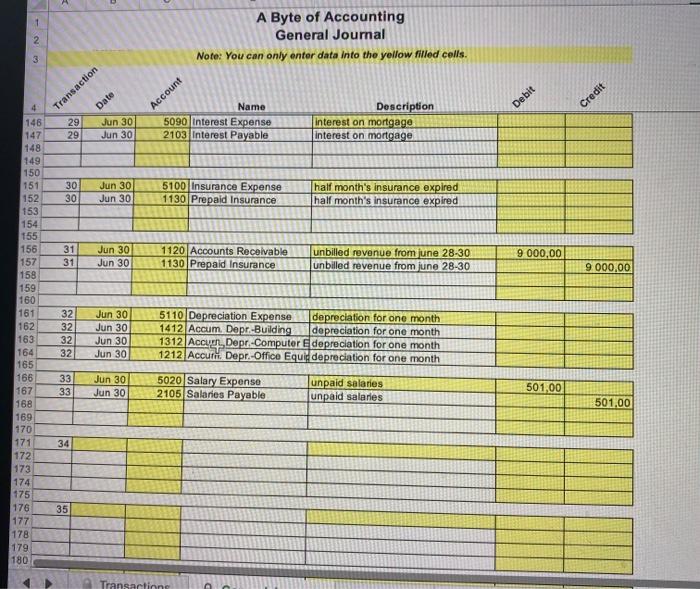

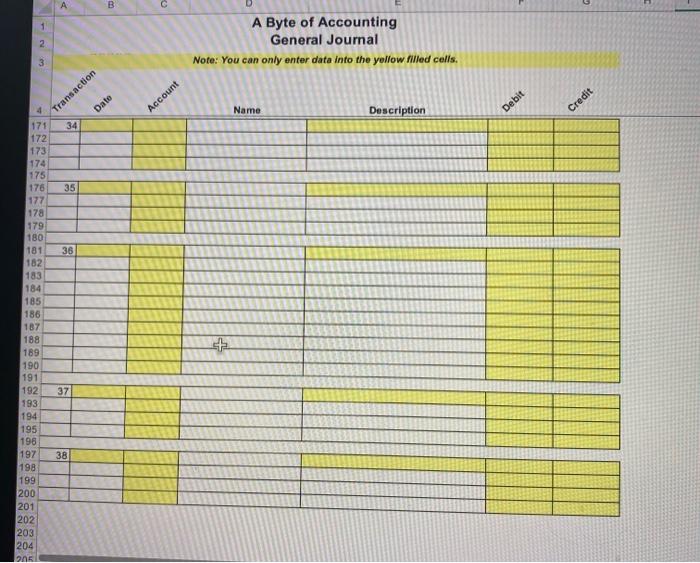

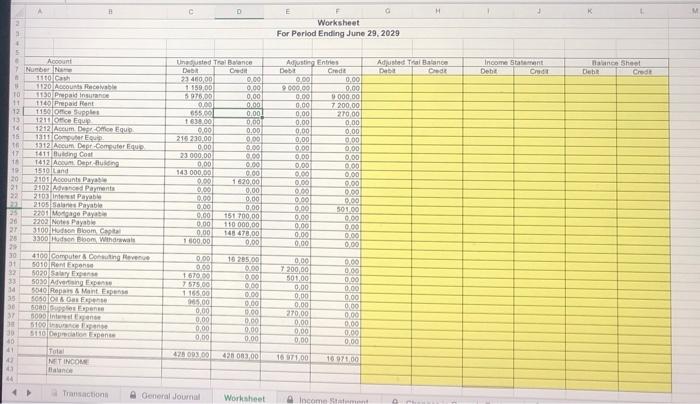

3 5. Transaction 01, 02, 03, 04, 05, 06, 07. 08. 09, Description of transaction June 1: Hudson Bloom invested $112,378.00 cash and computer equipment with a fair market value of $36,110.00 in his new business, Byte of Accounting. June 1: Check # 5000 was used to purchased office equipment costing $598.00 from Office Express. The invoice number was 87417. June 1: Check # 5001 was used to purchased computer equipment costing $10,120.00 from The invoice number was 20117. June 2: Check # 5002 was used to make a down payment of $34,000.00 on additional computer equipment that was purchased from Royce Computers, invoice number 76542. The full price of the computer was $170,000.00. A five-year note was executed by Byte for the balance. # June 4: Additional office equipment costing $300.00 was purchased on credit from Discount Computer Corporation. The invoice number was 98432. June 8: Unsatisfactory office equipment costing $60.00 from invoice number 98432 was returned to Discount Computer for credit to be applied against the outstanding balance owed by Byte. June 10: Check # 5003 was used to make a $26,000.00 payment reducing the principal owed on the June 2 purchase of computer equipment from Royce Computers. June 14: Check # 5004 was used to purchase a one-year insurance policy covering its computer equipment for $5,976.00 from Seth's Insurance. The effective date of the policy was June 16 and the invoice number was 2387. June 16: A check in the amount of $6,500.00 was received for services performed for Pitman Pictures. 2 3 4 5 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, June 16: Byte purchased a building and the land it is on for $143,000.00 to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at $23,000.00. The balance of the cost is to be allocated to the building. Check # 5005 was used to make the down payment of $14,300.00. A thirty year mortgage with an inital payement due on August 1st, was established for the balance. June 17: Check # 5006 for$7,200.00 was paid for rent of the office space for June, July, August and September. June 17: Received invoice number 26354 in the amount of $375.00 from the local newspaper for advertising. June 21: Billed various miscellaneous local customers $4,400.00 for consulting services performed. June 21: Check # 5008 was used to purchase a fax machine for the office from Office Machines Express for $800.00. The invoice number was 975-328. + June 21: Accounts payable in the amount of $240.00 were paid with Check # 5007. June 22: Check # 5010 was used to pay the advertising bill that was received on June 17. June 22: Received a bill for $1,165.00 from Computer Parts and Repair Co. for repairs to the computer equipment. The invoice number was 43254. June 22: Check # 5009 was used to pay salaries of $835.00 to equipment operators for the week ending June 18. Ignore payroll taxes. June 23: Cash in the amount of $3,525.00 was received on billings. June 23: Purchased office supplies for $655.00 from Staples on account. The invoice number was 65498. 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31, June 28: Billed $5,385.00 to miscellaneous customers for services performed to June 25. June 29: Cash in the amount of $5,101.00 was received for billings. June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co with Check # 5011. Check # 5012 was used to pay salaries of $835.00 to equipment operators for the week ending June 25. Ignore payroll taxes. June 29: June 30: Received a bill for the amount of $965.00 from O & G Oil and Gas Co. The invoice number was 784537. June 30: Check # 5013 was used to pay for airline tickets of $1,600.00 to send the kids to Grandma Ellen for the July 4th holiday. Adjusting Entries - Round to two decimal places. The rent payment made on June 17 was for June, July, August and September. Expense the amount associated with one month's rent. A physical inventory showed that only $270.00 worth of office supplies remained on hand as of June 30. The annual interest rate on the mortgage payable was 9.25 percent. Interest expense for one-half month should be computed because the building and land were purchased and the liability incurred on June 16. Record a journal entry to reflect that one half month's insurance has expired. A review of Byte's job worksheets show that there are unbilled revenues in the amount of $9,000 for the period of June 28-30. 32, 33, 34, 35, 36, 37, 38, The fixed assets have estimated useful lives as follows: Building -31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $500. The office equipment has a scrap value of $350. The computer equipment has no scrap value. Calculate the depreciation for one month. A review of the payroll records show that unpaid salaries in the amount of $501.00 are owed by Byte for three days, June 28-30. Ignore payroll taxes. The note payable to Royce Computers (transactions 04 and 07) is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $136,000.00. On June 10, eight days later, $26,000.00 was repaid. Interest expense must bet calculated on the $136,000.00 for eight days. In addition, interest expense on the $110,000.00 balance of the loan ($136,000.00 less $26,000.00 - $110,000.00) must be calculated for the 20 days remaining in the month of June.] Closing Entries Close the revenue accounts. Close the expense accounts. Close the income summary account. Close the withdrawals account. 123 456780 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 23533588 34 36 37 39 A 01 01 01 Transaction 02 02 03 03 04 04 04 8 06 06 Date 07 07 Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 Jun 01 05 Jun 04 05 Jun 04 Jun 02 Jun 02 Jun 02 Jun 08 Jun 08 Account Jun 10 Jun 10 C ANTHE 1110 Cash 1311 Computer Equip. 3100 Hudson Bloom, Capital D A Byte of Accounting General Journal Note: You can only enter data into the yellow filled cells. Name 1211 Office Equip. 1110 Cash 1311 Computer Equip. 1110 Cash 1311 Computer Equip. 1110 Cash 2202 Notes Payable 1211 Office Equip. 2101 Accounts Payable 2101 Accounts Payable 1211 Office Equip. Transactions 2202 Notes Payable 1110 Cash Cash Cash Cash office equipment office equipment E Description #VALUE! computer equipment computer equipment royce computers royce computers royce computers purchased on credit purchased on credit invoice number 98432 was retumed invoice number 98432 was retumed General Journal check #5003 royce computers check #5003 royce computers Worksheet F Debit 112 378,00 36 110,00 598,00 10 120,00 170 000,00 300,00 60,00 26 000,00 Credit 148 478,00 598,00 10 120,00 34 000,00 136 000,00 Income Statement 300,00 60,00 26 000,00 Changes 1 2 3 4 wor 41 42 43 44 45 s 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 A 09 09 10 10 10 10 08 Jun 14 08 Jun 14 11 11 12 12 13 13 Transaction 14 14 B Date Jun 16 Jun 16 Jun 16 Jun 16 Jun 16 Jun 16 Jun 17 Jun 17 Jun 17 Jun 17 Jun 21 Jun 21 Jun 21 Jun 21 A Byte of Accounting General Journal Note: You can only enter data into the yellow filled cells. Name. 1130 Prepaid Insurance 1110 Cash Account 1510 Land 1411 Building 1110 Cash 2201 Mortgage Payable 1110 Cash pitman pictures 4100 Computer & Consulting Repitman pictures 5030 Advertising Expense 1110 Cash 5030 Advertising Expense 2101 Accounts Payable Description seth's insurance seth's insurance 1211 Office Equip. 1110 Cash land and building purchased land and building purchased land and building purchased land and building purchased building check #5006 building check #5006 invoice number 26354 invoice number 26354 1120 Accounts Receivable billed service performed 4100 Computer & Consulting Rebilled service performed office machines express office machines express Debit 5 976,00 6 500,00 143 000,00 23 000,00 7 200,00 375,00 4 400,00 800,00 Credit 5 976,00 6 500,00 14 300,00 151 700,00 7 200,00 375,00 4 400,00 800,00 PRERRO533338 70 76 4 77 78 79 80 81 1 82 84 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 109 110 101 102 103 104 105 106 107 108 Transaction 199 15 Jun 21 15 Jun 21 16 Jun 22 16 Jun 22 Date 17 Jun 22 17 Jun 22 18 18 21 21 19 19 20 20 Jun 22 Jun 22 Jun 23 Jun 23 Jun 23 Jun 23 Jun 28 Jun 28 Account Name 2101 Accounts Payable 1110 Cash A Byte of Accounting General Journal Note: You can only enter data into the yellow filled cells. 2101 Accounts Payable 1110 Cash 5040 Repairs & Maint. Expense 2101 Accounts Payable 5020 Salary Expense 1110 Cash 1110 Cash 1120 Accounts Receivable 1150 Office Supplies 2101 Accounts Payable Transactions Description accounts payable with check # 5007 accounts payable with check #5007 pay advertising bill pay advertising bill computer parts and repairs co. computer parts and repairs co. paid salaries paid salaries cash from billings cash from billings General Journal purchase office supplies purchase office supplies 1120 Accounts Receivable services performed 4100 Computer & Consulting Reservices performed Worksheet Debit 240,00 375,00 1 165,00 835,00 3 525,00 655,00 5 385,00 Credit 240,00 375,00 1 165,00 835,00 3 525,00 655,00 5 385,00 1 2 3 114 115 111 22 Jun 29 112 22 Jun 29 113 116 117 118 119 120 121 122 123 124 125 126 132 133 144 145 Transaction 134 135 136 137 138 139 140 141 142 143 Date 23 Jun 29 23 Jun 29 127 128 129 130 131 26 Jun 30 24 Jun 29 24 Jun 29 25 Jun 30 25 Jun 30 123 26 Jun 30 27 Jun 30 27 Jun 30 28 28 Jun 30 Jun 30 Account A Byte of Accounting General Journal Note: You can only enter data into the yellow filled cells. Name 1110 Cash 1120 Accounts Receivable 2101 Accounts Payable 1110 Cash 5020 Salary Expense 1110 Cash 5050 Oil & Gas Expense 2101 Accounts Payable 5010 Rent Expense 1140 Prepaid Rent 5080 Supplies Expense 1150 Office Supplies cash from billings cash from billings Description paid computer parts and repairs.co. paid computer parts and repairs co. paid salaries paid salaries 3300 Hudson Bloom, Withdraw owner's drawings 1110 Cash owner's drawings O & G oil and gas co. O & Goll and gas co. rent expense rent expense physical inventory physical inventory Debit 5 101,00 1 165,00 835,00 965,00 1 600,00 7 200,00 270,00 Credit 5 101,00 1 165,00 835,00 965,00 1 600,00 7 200,00 270,00 123 4 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 Transaction 29 Jun 30 29 Jun 30 30 Jun 30 30 Jun 30 Date 31 Jun 30 31 Jun 30 32 32 32 32 33 33 34 35 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Account Name 5090 Interest Expense 2103 Interest Payable A Byte of Accounting General Journal Note: You can only enter data into the yellow filled cells. 5100 Insurance Expense 1130 Prepaid Insurance 1120 Accounts Receivable 1130 Prepaid Insurance 5020 Salary Expense 2105 Salaries Payable Transactions Description interest on mortgage interest on mortgage half month's insurance expired half month's insurance expired 5110 Depreciation Expense 1412 Accum. Depr.-Building depreciation for one month depreciation for one month 1312 Accurn Depr.-Computer Edepreciation for one month 1212 Accur. Depr.-Office Equip depreciation for one month unbilled revenue from june 28-30 unbilled revenue from june 28-30 unpaid salaries unpaid salaries Debit 9 000,00 501,00 Credit 9 000,00 501,00 1 2 3 4 171 34 172 173 174 175 179 180 176 35 177 178 181 182 183 456 184 185 186 187 188 189 190 191 192 193 194 198 199 200 201 202 A 203 204 2051 Transaction 195 196 197 38 36 37 B Date Account A Byte of Accounting General Journal Note: You can only enter data into the yellow filled cells. + Name Description Debit Credit 2 3 4 10 11 12 13 14 15 16 17 18 19. (20 21 22 22 25 26 27 28 29 30 31 32 33 34 35 30 37 38 30 40 41 43 43 44 A Account Number Name 1110 Cash 1120 Accounts Receivable 1130 Prepaid Insurance 1140 Prepaid Rent 1150 Office Supples 1211 Office Equip 1212 Accum Deger Office Equip B 1311 Computer Equip 1312 Accum Depr-Computer Equip 1411 Bulding Cost 1412 Acoum Depr-Bulding 1510 Land 2101 Accounts Payable 2102 Advanced Payments 2103 Interest Payable 2105 Salanes Payable 2201 Mongage Paya 2202 Notes Payable 3100 Hudson Bloom, Capital 3300 Hudson Bloom Withdrawals 4100 Computer & Consulting Revenue 5010 Rent Expense 5020 Salary Expense 5030 Advertising Expense 5040 Repairs & Maint Expense 5050 O&Gas Expense 5080 Supplies Expense 5000 Interest Expense 5100 insurance Expense $110 Depreciation Expense Total NET INCOME Balance Transactions C Unadusted Tral Balance Debit Credi 23 460,00 1.159.00 5.976.00 0.00 655.00 1638.00 215 0.00 230,00 0,00 23 000,00 0,00 143 000,00 0.00 0,00 0.00 0,00 0.00 0.00 0.00 1 600,00 0,00 0.00 1.670.00 7 575.00 1.165.00 945,00 0,00 0,00 0,00 0,00 428 093.00 D General Journal 0,00 0,00 0,00 0.00 0,00 0,00 0.00 0,00 0.00 0.00 0.00 0.00 1620.00 0,00 0.00 0,00 151.700,00 110 000,00 148 478,00 0,00 10 205.00 0.00 0.00 0,00 0.00 0,00 0,00 0,00 0.00 0.00 428 083,00 Worksheet. E Worksheet For Period Ending June 29, 2029 Adjusting Entries Debit 0.00 9.000.00 0.00 0.00 0,00 0.00 0,00 0,00 0.00 0.00 0,00 0.00 0,00 0,00 0.00 0.00 0,00 0,00 0.00 0,00 0,00 7200,00 501,00 0,00 0,00 0.00 270,00 0,00 0,00 0,00 16.971.00 Credit 0,00 0.00 9000.00 7200,00 270.00 0,00 0.00 0,00 0,00 0,00 0.00 0,00 0.00 0.00 0,00 501.00 0.00 0,00 0.00 0,00 0.00 0.00 0,00 0,00 0,00 0.00 0.00 0,00 0.00 0,00 16 971,00 G Income Statement H Adjusted Tral Balance Debit Crede 9 rum Income Statement Debit Credit L Balance Sheet Cred Debit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started