Answered step by step

Verified Expert Solution

Question

1 Approved Answer

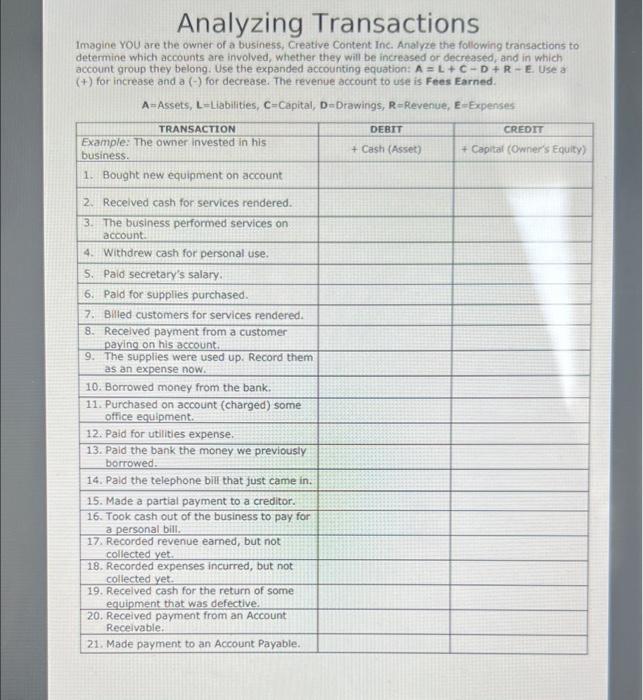

Analyzing Transactions Imagine YOU are the owner of a business, Creative Content Inc. Analyze the following transactions to determine which accounts are involved, whether they

Analyzing Transactions Imagine YOU are the owner of a business, Creative Content Inc. Analyze the following transactions to determine which accounts are involved, whether they will be increased or decreased, and in which account group they belong. Use the expanded accounting equation: A = L +C-D+R-E. Use a (+) for increase and a (-) for decrease. The revenue account to use is Fees Earned. A=Assets, L=Liabilities, C=Capital, D=Drawings, R=Revenue, E=Expenses TRANSACTION Example: The owner Invested in his business. 1 Bought new equipment on account 2. Received cash for services rendered. 3. The business performed services on account. 4. Withdrew cash for personal use. 5. Paid secretary's salary. 6. Paid for supplies purchased. 7. Billed customers for services rendered. 8. Received payment from a customer paying on his account. 9. The supplies were used up. Record them as an expense now. 10. Borrowed money from the bank. 11. Purchased on account (charged) some office equipment. 12. Paid for utilities expense. 13. Paid the bank the money we previously borrowed. 14. Paid the telephone bill that just came in. 15. Made a partial payment to a creditor. 16. Took cash out of the business to pay for a personal bill. 17. Recorded revenue earned, but not collected yet. 18. Recorded expenses incurred, but not collected yet. 19. Received cash for the return of some equipment that was defective. 20. Received payment from an Account Receivable. 21. Made payment to an Account Payable. DEBIT + Cash (Asset) CREDIT + Capital (Owner's Equity)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started