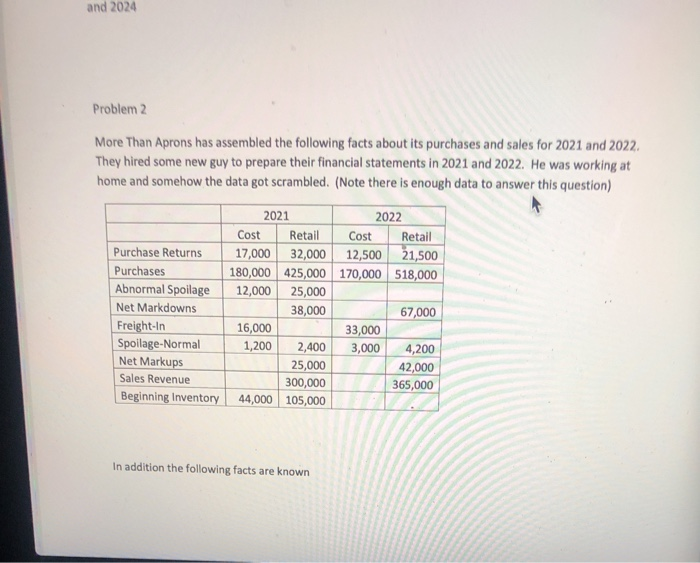

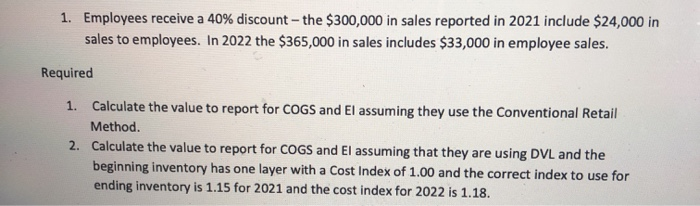

and 2024 Problem 2 More Than Aprons has assembled the following facts about its purchases and sales for 2021 and 2022 They hired some new guy to prepare their financial statements in 2021 and 2022. He was working at home and somehow the data got scrambled. (Note there is enough data to answer this question) 2022 Cost Retail 12,500 21,500 170,000 518,000 2021 Cost Retail 32,000 180,000 425,000 12,000 25,000 38,000 16,000 1,200 2,400 25,000 300,000 44,000 105,000 Purchase Returns Purchases Abnormal Spoilage Net Markdowns Freight-In Spoilage-Normal Net Markups Sales Revenue Beginning Inventory 67,000 33,000 3,000 4,200 42,000 365,000 In addition the following facts are known 1. Employees receive a 40% discount - the $300,000 in sales reported in 2021 include $24,000 in sales to employees. In 2022 the $365,000 in sales includes $33,000 in employee sales. Required 1. Calculate the value to report for COGS and El assuming they use the Conventional Retail Method. 2. Calculate the value to report for COGS and El assuming that they are using DVL and the beginning inventory has one layer with a Cost Index of 1.00 and the correct index to use for ending inventory is 1.15 for 2021 and the cost index for 2022 is 1.18. and 2024 Problem 2 More Than Aprons has assembled the following facts about its purchases and sales for 2021 and 2022 They hired some new guy to prepare their financial statements in 2021 and 2022. He was working at home and somehow the data got scrambled. (Note there is enough data to answer this question) 2022 Cost Retail 12,500 21,500 170,000 518,000 2021 Cost Retail 32,000 180,000 425,000 12,000 25,000 38,000 16,000 1,200 2,400 25,000 300,000 44,000 105,000 Purchase Returns Purchases Abnormal Spoilage Net Markdowns Freight-In Spoilage-Normal Net Markups Sales Revenue Beginning Inventory 67,000 33,000 3,000 4,200 42,000 365,000 In addition the following facts are known 1. Employees receive a 40% discount - the $300,000 in sales reported in 2021 include $24,000 in sales to employees. In 2022 the $365,000 in sales includes $33,000 in employee sales. Required 1. Calculate the value to report for COGS and El assuming they use the Conventional Retail Method. 2. Calculate the value to report for COGS and El assuming that they are using DVL and the beginning inventory has one layer with a Cost Index of 1.00 and the correct index to use for ending inventory is 1.15 for 2021 and the cost index for 2022 is 1.18