Answered step by step

Verified Expert Solution

Question

1 Approved Answer

And Required B i have two Choice 1- net increase in cash 2- net decrease in cash =... Exercise 6.14 (Static) Difference between Income and

And Required B i have two Choice 1- net increase in cash

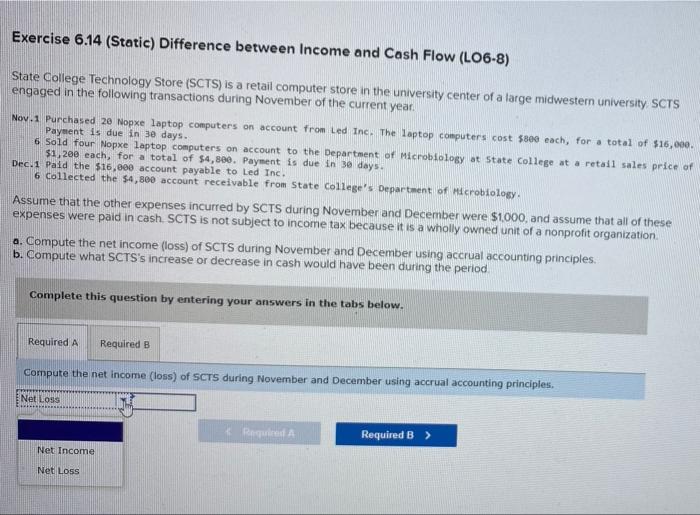

Exercise 6.14 (Static) Difference between Income and Cash Flow (LO6-8) State College Technology Store (SCTS) is a retail computer store in the university center of a large midwester university SCTS engaged in the following transactions during November of the current year. Nov.1 Purchased 20 Nopxe laptop computers on account from Led Inc. The laptop computers cost $800 each, for a total of $15,000. Payment is due in 30 days. 6 Sold four Nopxe laptop computers on account to the Department of Microbiology at State College at a retail sales price of $1,200 each, for a total of 54,880. Payment is due in 30 days. Dec. 1 Paid the $16,000 account payable to Led Inc. 6 Collected the $4,800 account receivable from State College's Department of Microbiology. Assume that the other expenses incurred by SCTS during November and December were $1.000, and assume that all of these expenses were paid in cash SCTS is not subject to income tax because it is a wholly owned unit of a nonprofit organization a. Compute the net income (loss) of SCTS during November and December using accrual accounting principles b. Compute what SCTS's increase or decrease in cash would have been during the period Complete this question by entering your answers in the tabs below. Required A Required B Compute the net income (loss) of SCTS during November and December using accrual accounting principles Net Loss Reques Required B > Net Income Net LOSS 2- net decrease in cash =...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started