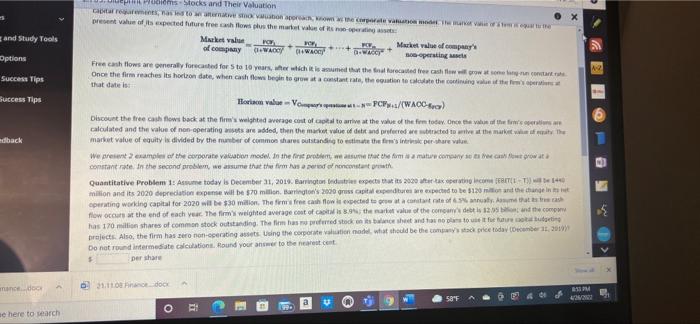

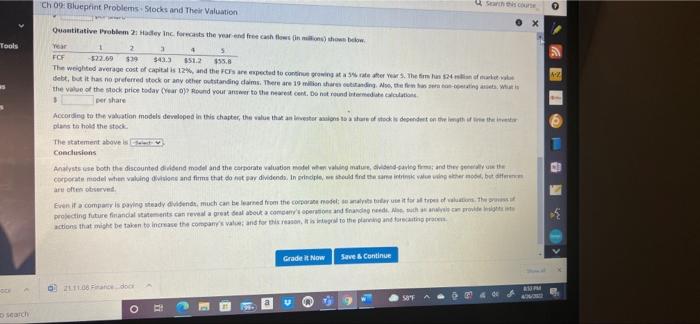

and Study Tools Options Success Tips Success Tips Eids Stocks and their Valuation Coments as to watoto wa X present of its expected to free cash flows us the market value of Make a re of company FW Market value of company's 1. WADO so-operating Free cash flows are onerally forecasted for 5 to 10 years, the which it is that the naturecated free cash wirow to content Once the firm reaches its horleon date, when cash flow begin to grow a constant rate, the equation to calculate the continuing van that date is: Horten value VampPC/(WACC) Discount the tree cash flow back at the firm's weighted average cost of capital to arrive at the value of the fem tot. Once the theme calculated and the value of non-operatings are ded, then the market value and preferred to write the market of the market value of equity is divided by the number of common shares outstanding to estimate the fines per share on we present example the corporate valuation model in the first problem, we assume te the fim de a mature como se est prowita constante. In the second problem we assume that the firms and constant Quantitative Problem: Asume today is December 31, 2018. Barrington Industries expect that its 2020 perc BTT million and its 2020 depredation expense will be $70 million Barrington's 2000 grosspures expected to be 5120 and the change corating working capital for 2020 will be $30 milion. The frecathlon ceder a contrato at master flow occurs at the end of each year. The firm welted average cost of its 3.94 the value of the comedebis 125 and the compor fe uteetins) has 170 million shares of common stock outstanding. The firm has preferred stock on its wine she was not projects. Also, the firm has zero non-operating assets. Using the corporate and what should be the price today 2010 Do not found intermediate calculation. Round your answer to the car cent edback Der har mance door 21.110 do M 58F Pof O e here to search Tools Ch 09: Blueprint Problems. Stocks and Their Valuation aan Quantitative Problem 21 Hade Inc. for the end free cash flow in the Year 5 FCF 222.69 $19 3433 351.2 55.8 The weighted average cost of capitalis 12%, and the Os are expected to contingut a rate atter er. The time is 24 debt, but it has no referred stock or any other outstanding doms. There are 19 min hartanding the finest the value of the stock price today (Year Round your to the nearestDo not round die per share According to the valuation models developed in this chapter, the value that an investors to the stock andet on the intendo plans to hold the stock The statement above sea Conclusions Analystsuse both the discounted did and model and the corporate valuation made evalung mit and there Corporate model when vahing divisions and firms that do not dividends. In principle, we should find the same with butter are often served Even if a company is paying tady dividende, much can be arred in the come model de titularet for at the projecting future financial itements can reveal a great deal outcome one and finden we can provide actions that might be taken to increase the company and for the reason, it is go to the park and forecasting proce Grade it Now Save & Continue 2011.06 a 6 of O i och