Answered step by step

Verified Expert Solution

Question

1 Approved Answer

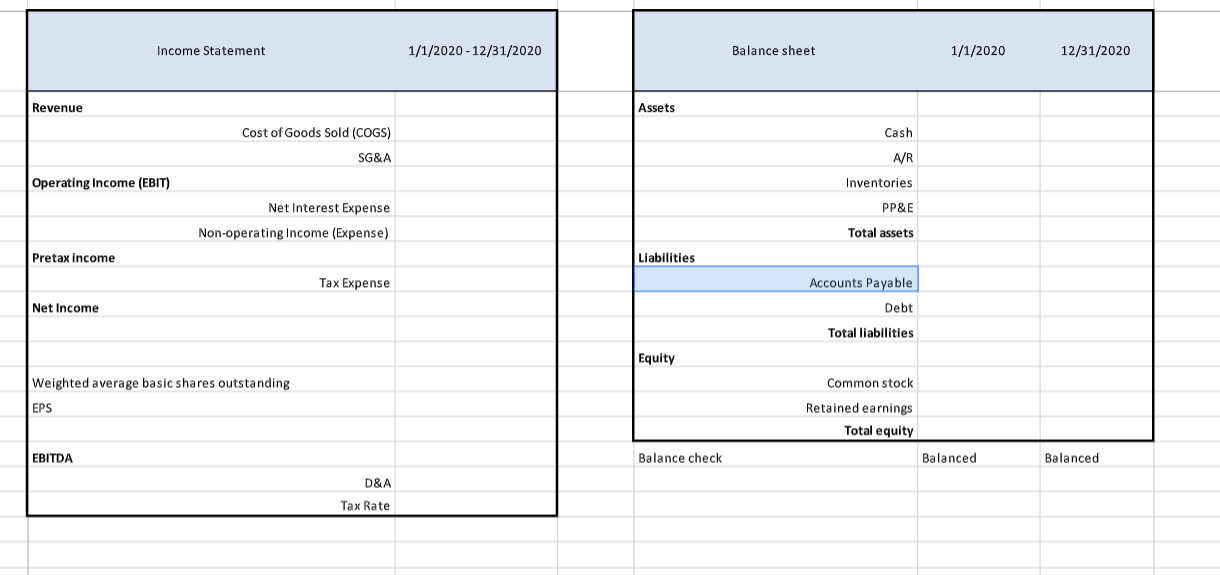

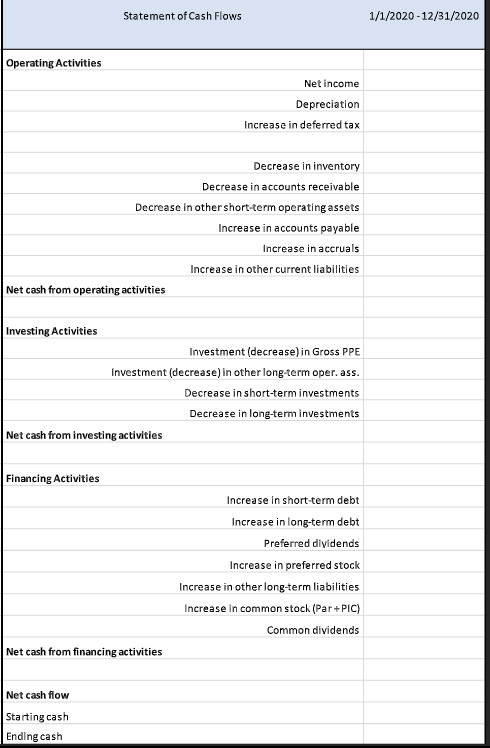

Please show how these actions affect the statement sheets below. Please enter answers in format provided below. 7 March 1, 2020 In order to operate

Please show how these actions affect the statement sheets below. Please enter answers in format provided below.

| 7 | March 1, 2020 | In order to operate your mold business, you will need to have an inventory of special chemicals to treat and prevent mold. You estimate that for each completed project, $800 worth of chemical is used. However, because you have to buy the chemical in bulk from your supplier, you buy a starting inventory of $70,000 on credit. |

| 8 | April 1, 2020 | During a project, one of your specialists accidentally sprayed a client's cat, Mr. Fluffykins, with the mold chemical. Mr. Fluffykins developed a horrible rash and started foaming at the mouth, and because Mr. Fluffykins is an extremely valuable part of the family, the client paid $1,500 in veterinary services. The client sued you and because you did not have liability insurance, you hired a lawyer and ended up settling with the client for $5,000. |

| 9 | June 30, 2020 | To help support your business growth, you hire a Salesperson for $12,000 per year paid (monthly payments starting now) + 15% of the value of completed projects that are sold. |

| 10 | June 30, 2020 | On June 30, 2020, you find an investor who invests $200,000 and you issue them 1000 shares. |

| 11 | December 15, 2020 | With your future in mind, you purchase a warehouse building to serve as an office/equipment storage facility for $100,000. |

| 12 | December 20, 2020 | You pay your chemical supplier back 50% of what the credit they extended to you. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started