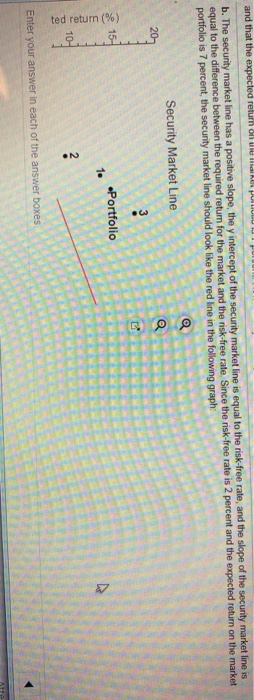

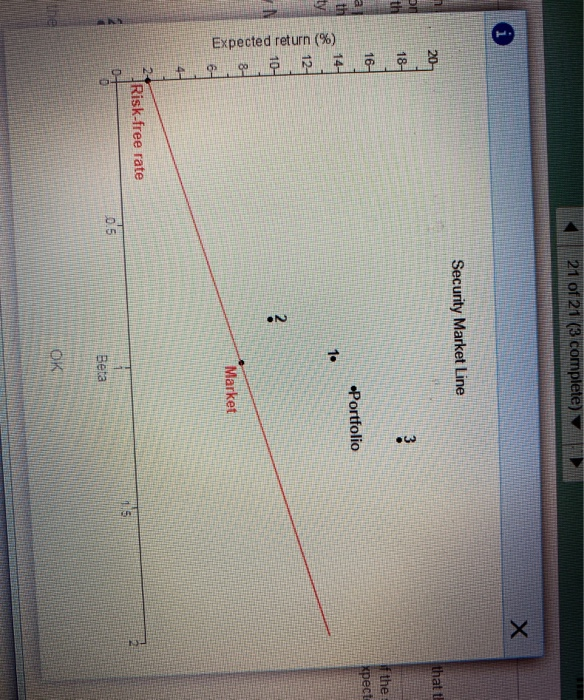

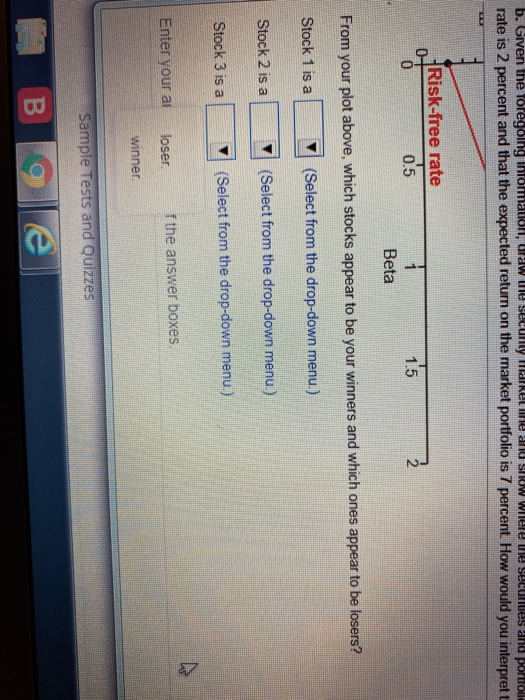

and that the expected return of a hot pic w porn b. The security market line has a positive slope, the y intercept of the security market line is equal to the risk-free rate, and the slope of the security market line is equal to the difference between the required return for the market and the risk-free rate. Since the risk-free rate is 2 percent and the expected return on the market portfolio is 7 percent, the security market line should look like the red line in the following graph Security Market Line 9S 7 ted return (%) Enter your answer in each of the answer boxes 21 of 21 (3 complete) Security Market Line that t AU fthe xpect Portfolio Expected return (%) Market Risk-free rate Beta OK b. Given the foregoing information, Uraw ule secully make me and show Wilele ne secures and porcol rate is 2 percent and that the expected return on the market portfolio is 7 percent. How would you interprett Risk-free rate 0.5 = 1. 5 2 Beta From your plot above, which stocks appear to be your winners and which ones appear to be losers? Stock 1 is a (Select from the drop-down menu.) Stock 2 is a (Select from the drop-down menu.) Stock 3 is a (Select from the drop-down menu.) Enter your ai loser. f the answer boxes. winner. Sample Tests and Quizzes B le and that the expected return of a hot pic w porn b. The security market line has a positive slope, the y intercept of the security market line is equal to the risk-free rate, and the slope of the security market line is equal to the difference between the required return for the market and the risk-free rate. Since the risk-free rate is 2 percent and the expected return on the market portfolio is 7 percent, the security market line should look like the red line in the following graph Security Market Line 9S 7 ted return (%) Enter your answer in each of the answer boxes 21 of 21 (3 complete) Security Market Line that t AU fthe xpect Portfolio Expected return (%) Market Risk-free rate Beta OK b. Given the foregoing information, Uraw ule secully make me and show Wilele ne secures and porcol rate is 2 percent and that the expected return on the market portfolio is 7 percent. How would you interprett Risk-free rate 0.5 = 1. 5 2 Beta From your plot above, which stocks appear to be your winners and which ones appear to be losers? Stock 1 is a (Select from the drop-down menu.) Stock 2 is a (Select from the drop-down menu.) Stock 3 is a (Select from the drop-down menu.) Enter your ai loser. f the answer boxes. winner. Sample Tests and Quizzes B le