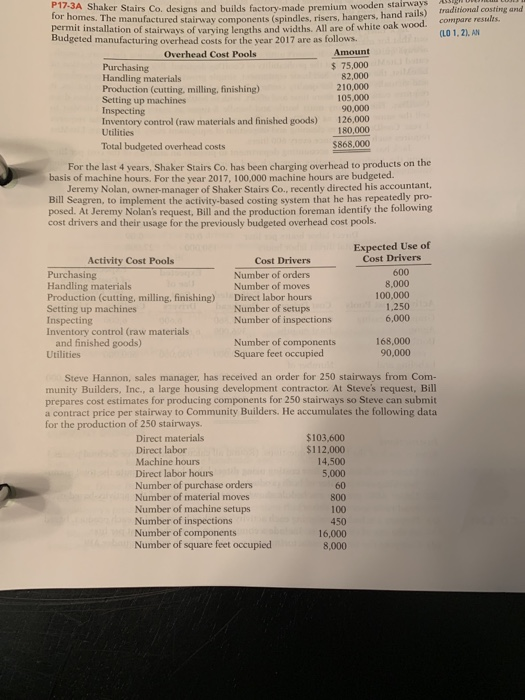

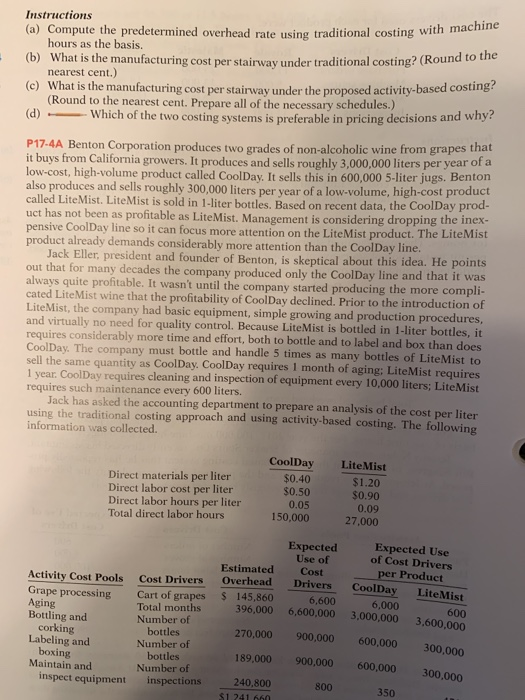

and traditional cost compare results. (LO 1,2). AN Inspecting 17.3A Shaker Stairs Co. designs and builds factory-made premium wooden stairways for homes. The manufactured stairway components (spindles, risers, hangers, hand rails) d i permit installation of stairways of varying lengths and widths. All are of white oak wood. ng lengths and widths. All are of white onk wood Budgeted manufacturing overhead costs for the year 2017 are as follows. Overhead Cost Pools Amount Purchasing $ 75,000 Handling materials 82,000 Production (cutting, milling, finishing) 210,000 Setting up machines 105.000 90,000 Inventory control (raw materials and finished goods) 126,000 Utilities 180,000 Total budgeted overhead costs $868,000 For the last 4 years, Shaker Stairs Co. has been charging overhead to products on the basis of machine hours. For the year 2017. 100.000 machine hours are budgeted. Jeremy Nolan, owner-manager of Shaker Stairs Co. recently directed his accountant, Bill Seagren, to implement the activity-based costing system that he has repeatedly pro- posed. At Jeremy Nolan's request. Bill and the production foreman identify the following cost drivers and their usage for the previously budgeted overhead cost pools. Activity Cost Pools Purchasing Handling materials Production (cutting, milling, finishing) Setting up machines Inspecting Inventory control (raw materials and finished goods) Utilities Cost Drivers Number of orders Number of moves Direct labor hours Number of setups Number of inspections Expected Use of Cost Drivers 600 8,000 100,000 1,250 6,000 Number of components Square feet occupied 168,000 90,000 Steve Hannon, sales manager, has received an order for 250 stairways from Com- munity Builders, Inc., a large housing development contractor. At Steve's request, Bill prepares cost estimates for producing components for 250 stairways so Steve can submit a contract price per stairway to Community Builders. He accumulates the following data for the production of 250 stairways. Direct materials $103.600 Direct labor $112.000 Machine hours 14,500 Direct labor hours 5,000 Number of purchase orders Number of material moves 800 Number of machine setups 100 Number of inspections 450 Number of components 16,000 Number of square feet occupied 8,000 Instructions (a) Compute the predetermined overhead rate using traditional costing with hours as the basis. (b) What is the manufacturing cost per stairway under traditional costing? (Rounce nearest cent.) (c) What is the manufacturing cost per stairway under the proposed activity-based costing (Round to the nearest cent. Prepare all of the necessary schedules.) - Which of the two costing systems is preferable in pricing decisions and why? P17-4A Benton Corporation produces two grades of non-alcoholic wine from grapes that it buys from California growers. It produces and sells roughly 3,000,000 liters per year of a low-cost, high-volume product called CoolDay. It sells this in 600,000 5-liter jugs. Benton also produces and sells roughly 300,000 liters per year of a low-volume, high-cost product called Lite Mist. Lite Mist is sold in 1-liter bottles. Based on recent data, the CoolDay prod- uct has not been as profitable as Lite Mist. Management is considering dropping the inex- pensive CoolDay line so it can focus more attention on the Lite Mist product. The Lite Mist product already demands considerably more attention than the CoolDay line. Jack Eller, president and founder of Benton, is skeptical about this idea. He points out that for many decades the company produced only the CoolDay line and that it was always quite profitable. It wasn't until the company started producing the more compli- cated Lite Mist wine that the profitability of CoolDay declined. Prior to the introduction of Lite Mist, the company had basic equipment, simple growing and production procedures. and virtually no need for quality control. Because Lite Mist is bottled in 1-liter bottles, it requires considerably more time and effort, both to bottle and to label and box than does CoolDay. The company must bottle and handle 5 times as many bottles of Lite Mist sell the same quantity as CoolDay. CoolDay requires 1 month of aging: Lite Mist requires year. CoolDay requires cleaning and inspection of equipment every 10,000 liters. Lite Mise requires such maintenance every 600 liters. Jack has asked the accounting department to prepare an analysis of the cost per using the traditional costing approach and using activity-based costing. The following information was collected Direct materials per liter Direct labor cost per liter Direct labor hours per liter Total direct labor hours CoolDayLite Mist $0.40 $1.20 $0.50 $0.90 0.05 0.09 150,000 27,000 Estimated Overhead Overhead $ 145,860 396,000 Expected Use of Cost Drivers Drivers 6 ,600 6,600,000 Expected Use of Cost Drivers per Product CoolDayLite Mist 6,000 3,000,000 3,600,000 600 Activity Cost Pools Cost Drivers Grape processing Cart of grapes Aging Total months Bottling and Number of corking bottles Labeling and Number of bottles Number of inspect equipment inspections 270,000 boxing Maintain and 900,000 900,000 800 600,000 600,000 189.000 240.800 $1 241 660 300,000 300.000 350