Answered step by step

Verified Expert Solution

Question

1 Approved Answer

and wages are to be charged to the labor cost AUDIT TEST Start of Payroll Project 12,315.64 October 9, 20- NO.1 The first payroll in

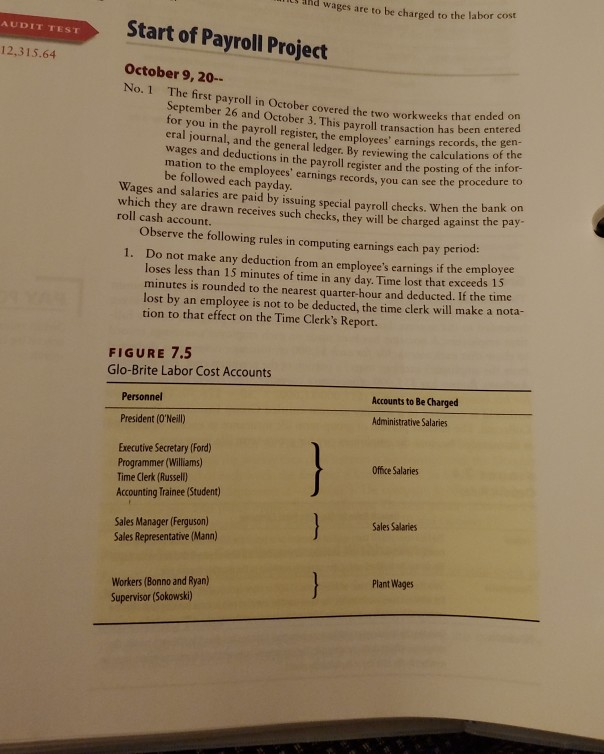

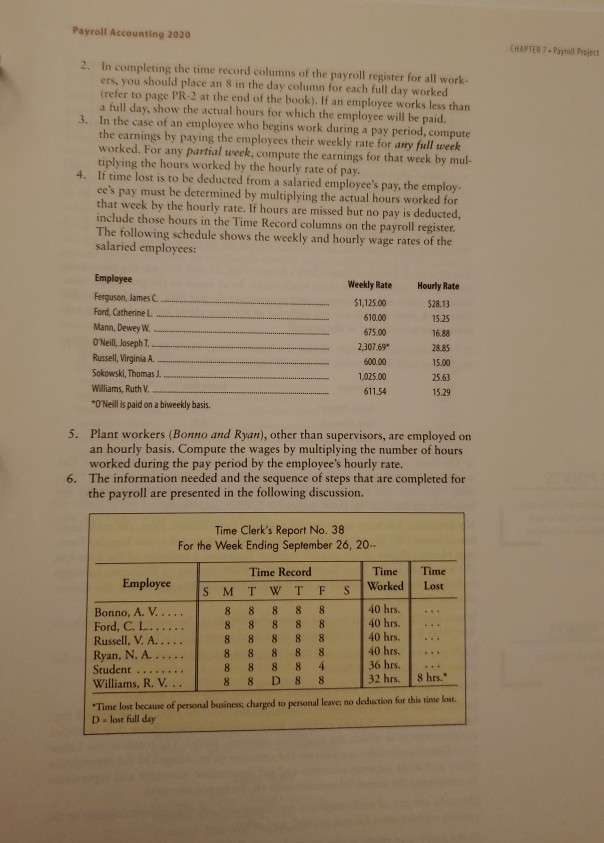

and wages are to be charged to the labor cost AUDIT TEST Start of Payroll Project 12,315.64 October 9, 20- NO.1 The first payroll in October covered the two work weeks that September 26 and October 3. This nav all transaction has been enter for you in the payroll register, the emplovees' earnings records, the cral journal, and the general ledger, By reviewing the calculations wages and deductions in the payroll register and the posting of the in mation to the employees' earnings records, you can see the procedure be followed each payday. Wages and salaries are paid by issuing special payroll checks. When the bank on which they are drawn receives such checks, they will be charged against the roll cash account. Observe the following rules in computing earnings each pay period: are drawn Paid by issui roll cash 1. Do not make any deduction from an employee's earnings if the employee loses less than 15 minutes of time in any day. Time lost that exceeds 15 minutes is rounded to the nearest quarter-hour and deducted. If the time lost by an employee is not to be deducted, the time clerk will make a nota- tion to that effect on the Time Clerk's Report. FIGURE 7.5 Glo-Brite Labor Cost Accounts Personnel President (O'Neill) Accounts to Be Charged Administrative Salaries Executive Secretary (Ford) Programmer (Williams) Time Clerk (Russell) Accounting Trainee (Student) Office Salaries Sales Manager (Ferguson) Sales Representative (Mann) Sales Salaries Workers (Bonno and Ryan) Supervisor (Sokowski) Plant Wages Payroll Accounting 2020 CHAPTER 1 - Payroll Project 2. In completing the time record columns of the payroll register for all work- ers, you should place an 8 in the day column for each full day worked (refer to page PR-2 at the end of the book). If an employee works less than a full day, show the actual hours for which the employee will be paid. 3. In the case of an employee who begins work during a pay period, compute the earnings by paying the employees their weekly rate for any full week worked. For any partial week, compute the earnings for that week by mula tiplying the hours worked by the hourly rate of pay. 4. If time lost is to be deducted from a salaried employee's pay, the employ ees pay must be determined by multiplying the actual hours worked for that week by the hourly rate. If hours are missed but no pay is deducted, include those hours in the Time Record columns on the payroll register. The following schedule shows the weekly and hourly wage rates of the salaried employees: Employee Ferguson, James Ford, Catherine L. Mann, Dewey W. O'Neill, Joseph I.. Russell, Virginia A Sokowski, Thomas I. Williams, Ruth V... "O'Neill is paid on a biweekly basis. Weekly Rate $1,125.00 610.00 675.00 2,307.69 600.00 1,025.00 611.54 Hourly Rate $28.13 15.25 16.88 28.85 15.00 25.63 15.29 5. Plant workers (Bonno and Ryan), other than supervisors, are employed on an hourly basis. Compute the wages by multiplying the number of hours worked during the pay period by the employee's hourly rate. 6. The information needed and the sequence of steps that are completed for the payroll are presented in the following discussion. Time Lost Time Clerk's Report No. 38 For the Week Ending September 26, 20- Time Record Time Employee IS M T W T F S Worked Bonno, A. V. .... 8 8 8 8 8 40 hrs. Ford, C. L....... 8 8 8 8 8 40 hrs. Russell, V. A..... 8 8 8 8 8 40 hrs. Ryan, N. A...... 8 8 8 8 8 40 hrs. Student ........ 8 8 8 8 4 36 hrs. Williams, R. V... 8 8 D8 8 32 hrs. 8 hrs. *Time lost because of personal business charged to personal leave no deduction for this time lost lost full day D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started