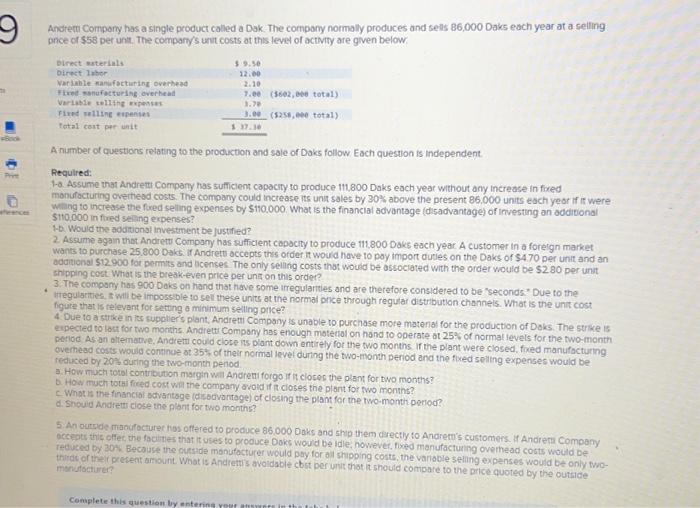

Andem Comporry has a single product called a Dak. The compary normally produces and sells 86,000 Daks each year at a selling pnce of $58 per unt. The compant's unt costs at this levet of activity are given below A number of questions rolating to the procuction and sale of Daks follow Each question is independent: Required: 1-0. Assume that Andremt Company has sumicient capacity to produce 111,800 Daks each year without any increase in fired monufocturing overthead costs. The company could increase its unit sales by 30% above the present 86,000 units each yeor if it were wang to increase the fured seling expenses by $110.000. What is the financial advantage (disadvantage) of irivesting an additiona 5110,000 in fired selang expenses? H. Would the adoditionsl investment be justified? 2. Assume again that Andretz Company has tufficlent capacty to produce 111.800 Daks each year A customer in a foreign market Wants to purchase 25.800 Daks. if Andrett accepts this order it would hove to poy import dutles on the Daks of $470 per unit and an odational $12900 for permits and acenses. The only selligg costs thvi woudd be ascociated with the order would be $280 per unet shipping cost What is the break-even price per ung on this order? 3. The compony has 900 Doks on hand that hove some iregularties and are therefore considered to be "seconds" Due to the Itregularities i wili be impossible to sel these units at the normal phice through regular distibution channels. What is the unit cost figute that is relevant for setting o minimum selling once? 4. Due to a sttike in its supplier's plant, Andremi Company is unable to purchase more matenal for the production of Doks. The strike is expected to lost for two morths. Andiett Compony has enough mote ttol on hand to operate at 25% of normal levels for the two-month period As an altematie, Andremi couid clote ins plant down entirely for the two months. If the plant were closed, fored manufacturmg ovemhead costs would continue ot 35t of their normal level during the two-thonth period and the fixed seling expenses would be reduced by 20% ouring the two-month period 3. How much totol contribution margin wil Andreni forgo if it ciosec the plant for two months? B. How much totai ficed cost whit the compary ovold if ir cioses the plont for fwo montins? C. What is the financial advantoge (disactvaritage) of closing the plant for the two-month pertoo? d. Shculd Andrett ciose the piont for two monthis? 5. An outride maourocturec hos offered to produce 86,000 Daks and ship them diectly to Anarem's customers. if Andrem Compeny. occepts thic offect the facilies that it uses to produce Doks would be idle. novever, fired manufacturing overhead costs would be redveed by 30Hk Becouse the oursde monufocturer would pty for oil shipoing costs, the variable selling expenses would be only wo. thidic of theic present amount. What is Andrettis avoidable chst per unit thot it should compare to the price quoted by the outside