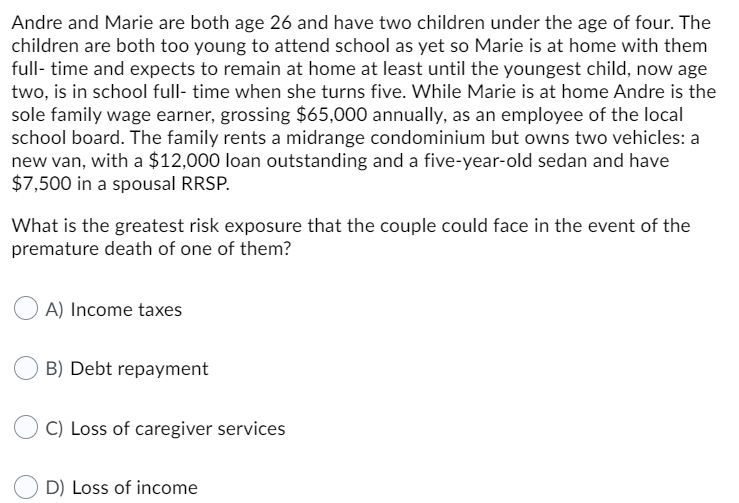

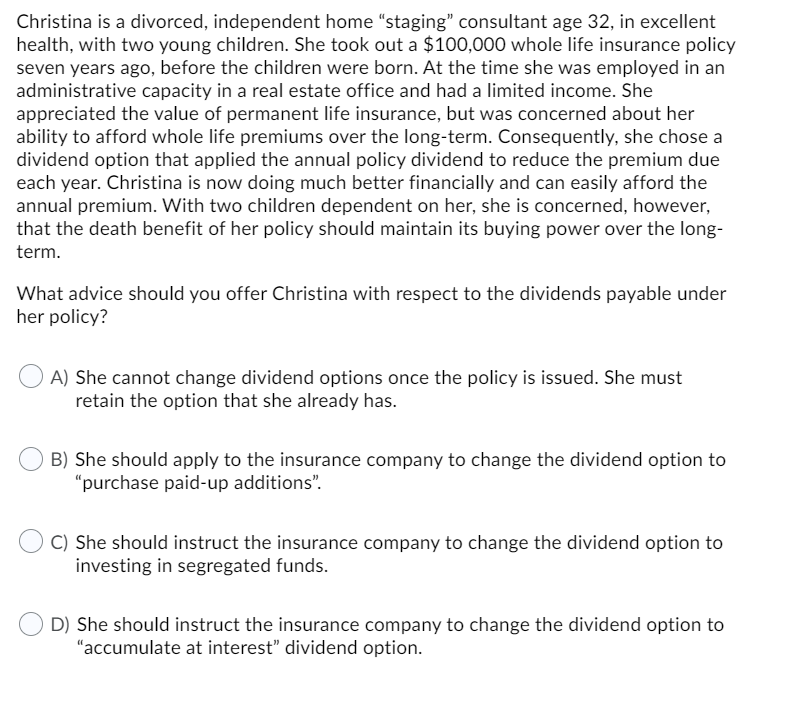

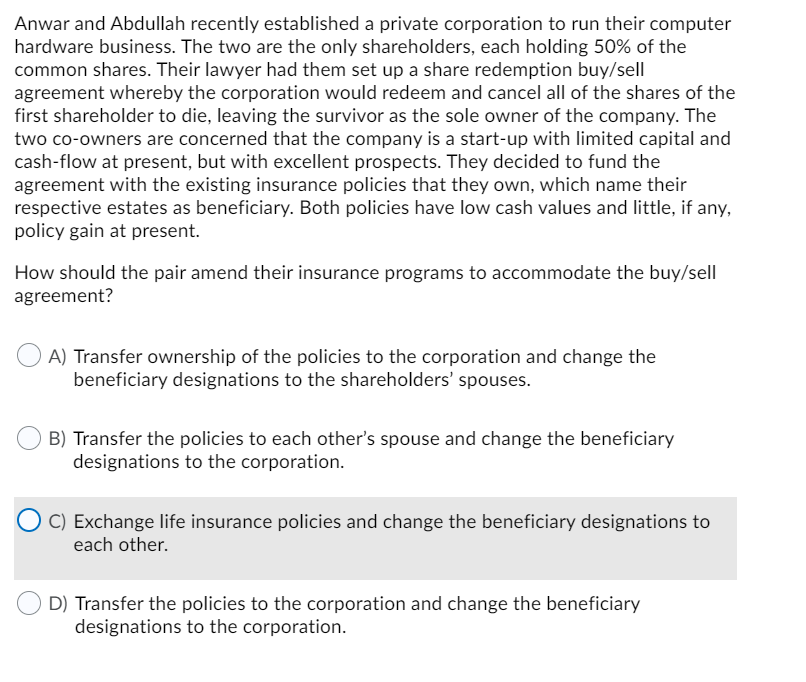

Andre and Marie are both age 26 and have two children under the age of four. The children are both too young to attend school as yet so Marie is at home with them full-time and expects to remain at home at least until the youngest child, now age two, is in school full-time when she turns five. While Marie is at home Andre is the sole family wage earner, grossing $65,000 annually, as an employee of the local school board. The family rents a midrange condominium but owns two vehicles: a new van, with a $12,000 loan outstanding and a five-year-old sedan and have $7,500 in a spousal RRSP. What is the greatest risk exposure that the couple could face in the event of the premature death of one of them? A) Income taxes B) Debt repayment C) Loss of caregiver services D) Loss of income Christina is a divorced, independent home staging" consultant age 32, in excellent health, with two young children. She took out a $100,000 whole life insurance policy seven years ago, before the children were born. At the time she was employed in an administrative capacity in a real estate office and had a limited income. She appreciated the value of permanent life insurance, but was concerned about her ability to afford whole life premiums over the long-term. Consequently, she chose a dividend option that applied the annual policy dividend to reduce the premium due each year. Christina is now doing much better financially and can easily afford the annual premium. With two children dependent on her, she is concerned, however, that the death benefit of her policy should maintain its buying power over the long- term. What advice should you offer Christina with respect to the dividends payable under her policy? A) She cannot change dividend options once the policy is issued. She must retain the option that she already has. B) She should apply to the insurance company to change the dividend option to "purchase paid-up additions". C) She should instruct the insurance company to change the dividend option to investing in segregated funds. D) She should instruct the insurance company to change the dividend option to "accumulate at interest" dividend option. Anwar and Abdullah recently established a private corporation to run their computer hardware business. The two are the only shareholders, each holding 50% of the common shares. Their lawyer had them set up a share redemption buy/sell agreement whereby the corporation would redeem and cancel all of the shares of the first shareholder to die, leaving the survivor as the sole owner of the company. The two co-owners are concerned that the company is a start-up with limited capital and cash-flow at present, but with excellent prospects. They decided to fund the agreement with the existing insurance policies that they own, which name their respective estates as beneficiary. Both policies have low cash values and little, if any, policy gain at present. How should the pair amend their insurance programs to accommodate the buy/sell agreement? A) Transfer ownership of the policies to the corporation and change the beneficiary designations to the shareholders' spouses. B) Transfer the policies to each other's spouse and change the beneficiary designations to the corporation. C) Exchange life insurance policies and change the beneficiary designations to each other. D) Transfer the policies to the corporation and change the beneficiary designations to the corporation