Question

Andrea Zowkewych, CPA was asked by Jeff Scott to review the accounting records and prepare the financial statements for his antique shop for the month

Andrea Zowkewych, CPA was asked by Jeff Scott to review the accounting records and prepare the financial statements for his antique shop for the month ended January 31. Andrea reviewed the records and found three errors:

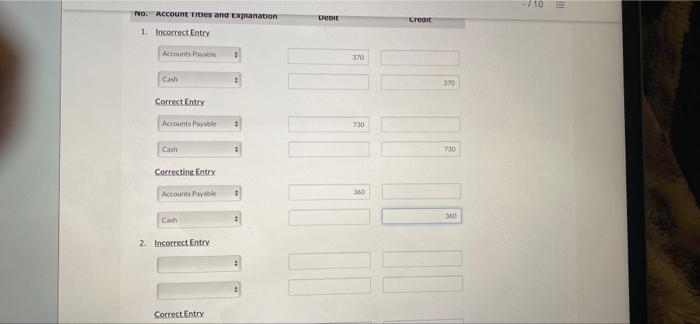

1. Cash paid on accounts payable for $730 was recorded as a debit to Accounts Payable $370 and a credit to cash $370.

2. The purchase of supplies on account for $610 was debited to Equipment $610 and credited to Accounts Payable $630.

3. Jeff withdrew cash for $3,600 and the bookkeeper debited Accounts Receivable for $300 and credited cash $360.

Prepare an analysis of each error showing the

a) Incorrect entry

b) Correct entry

c) Correcting entry

-/10 NO. ACCount Tities and Explanation Credit 1. Incorrect Etry Accounts Payable 370 Cash 370 Correct Entry Accounts Payable 730 Cash 730 Correcting Entry Accounts Payable 360 360 Cash 2. Incorrect Entry Correct Entry

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

No Account Titles and Explanations Debit Credit 1 Incorrect Entry Accounts Payable 370 Cash 370 Cor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started