Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Andrettl Company has a single product called a Dak. The company normally produces and sells 81,000 Daks each year at a selling price of $64

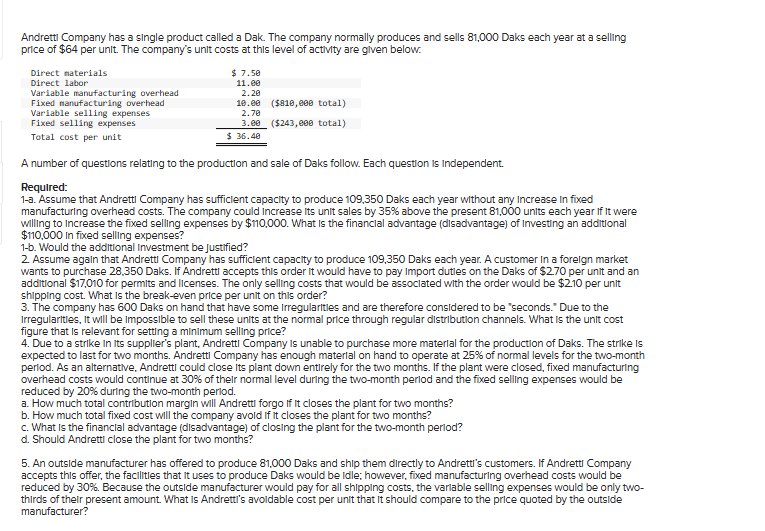

Andrettl Company has a single product called a Dak. The company normally produces and sells 81,000 Daks each year at a selling price of $64 per unit. The company's unit costs at this level of activity are given below. A number of questions relating to the production and sale of Daks follow. Each question is independent. Required: 1-a. Assume that Andrettl Company has sufficlent capacity to produce 109,350 Daks each year without any increase In fixed manufacturing overhead costs. The company could increase its unit sales by 35% above the present 81,000 units each year if it were willing to increase the fixed selling expenses by $10,000. What is the financlal advantage (dliadvantage) of Investing an additional $110,000 in fixed selling expenses? 1-b. Would the additional Investment be Justified? 2. Assume again that Andrettl Company has sufficlent capacity to produce 109,350 Daks each year. A customer In a foreign market wants to purchase 28,350 Daks. If Andrettl accepts this order It would have to pay Import dutles on the Daks of $270 per unit and an additional $17,010 for permits and licenses. The only selling costs that would be assoclated with the order would be $210 per unit shipping cost. What is the break-even price per unit on this order? 3. The company has 600 Daks on hand that have some Irregularttles and are therefore considered to be "seconds." Due to the Irregularities, it will be impossible to sell these units at the normal price through regular distribution channels. What is the unit cost figure that is relevant for setting a minimum selling price? 4. Due to a strike in its supplier's plant, Andrettl Company is unable to purchase more materlal for the production of Daks. The strike is expected to last for two months. Andrettl Company has enough materlal on hand to operate at 25% of normal levels for the two-month period. As an alternative, AndrettI could close Its plant down entirely for the two months. If the plant were closed, fixed manufacturing overhead costs would continue at 30% of their normal level during the two-month period and the fixed selling expenses would be reduced by 20% during the two-month period. a. How much total contribution margin will Andrettl forgo if it closes the plant for two months? b. How much total fixed cost will the company avoid if it closes the plant for two months? c. What is the financlal advantage (disadvantage) of closing the plant for the two-month period? d. Should Andrettl close the plant for two months? 5. An outside manufacturer has offered to produce 81,000 Daks and ship them directly to Andrettl's customers. If AndrettI Company accepts this offer, the facilitles that it uses to produce Daks would be idle; however, fixed manufacturing overhead costs would be reduced by 30%. Because the outside manufacturer would pay for all shipping costs, the varlable selling expenses would be only twothirds of their present amount. What is Andretti's avoidable cost per unit that it should compare to the price quoted by the outside manufacturer? Andrettl Company has a single product called a Dak. The company normally produces and sells 81,000 Daks each year at a selling price of $64 per unit. The company's unit costs at this level of activity are given below. A number of questions relating to the production and sale of Daks follow. Each question is independent. Required: 1-a. Assume that Andrettl Company has sufficlent capacity to produce 109,350 Daks each year without any increase In fixed manufacturing overhead costs. The company could increase its unit sales by 35% above the present 81,000 units each year if it were willing to increase the fixed selling expenses by $10,000. What is the financlal advantage (dliadvantage) of Investing an additional $110,000 in fixed selling expenses? 1-b. Would the additional Investment be Justified? 2. Assume again that Andrettl Company has sufficlent capacity to produce 109,350 Daks each year. A customer In a foreign market wants to purchase 28,350 Daks. If Andrettl accepts this order It would have to pay Import dutles on the Daks of $270 per unit and an additional $17,010 for permits and licenses. The only selling costs that would be assoclated with the order would be $210 per unit shipping cost. What is the break-even price per unit on this order? 3. The company has 600 Daks on hand that have some Irregularttles and are therefore considered to be "seconds." Due to the Irregularities, it will be impossible to sell these units at the normal price through regular distribution channels. What is the unit cost figure that is relevant for setting a minimum selling price? 4. Due to a strike in its supplier's plant, Andrettl Company is unable to purchase more materlal for the production of Daks. The strike is expected to last for two months. Andrettl Company has enough materlal on hand to operate at 25% of normal levels for the two-month period. As an alternative, AndrettI could close Its plant down entirely for the two months. If the plant were closed, fixed manufacturing overhead costs would continue at 30% of their normal level during the two-month period and the fixed selling expenses would be reduced by 20% during the two-month period. a. How much total contribution margin will Andrettl forgo if it closes the plant for two months? b. How much total fixed cost will the company avoid if it closes the plant for two months? c. What is the financlal advantage (disadvantage) of closing the plant for the two-month period? d. Should Andrettl close the plant for two months? 5. An outside manufacturer has offered to produce 81,000 Daks and ship them directly to Andrettl's customers. If AndrettI Company accepts this offer, the facilitles that it uses to produce Daks would be idle; however, fixed manufacturing overhead costs would be reduced by 30%. Because the outside manufacturer would pay for all shipping costs, the varlable selling expenses would be only twothirds of their present amount. What is Andretti's avoidable cost per unit that it should compare to the price quoted by the outside manufacturer

Andrettl Company has a single product called a Dak. The company normally produces and sells 81,000 Daks each year at a selling price of $64 per unit. The company's unit costs at this level of activity are given below. A number of questions relating to the production and sale of Daks follow. Each question is independent. Required: 1-a. Assume that Andrettl Company has sufficlent capacity to produce 109,350 Daks each year without any increase In fixed manufacturing overhead costs. The company could increase its unit sales by 35% above the present 81,000 units each year if it were willing to increase the fixed selling expenses by $10,000. What is the financlal advantage (dliadvantage) of Investing an additional $110,000 in fixed selling expenses? 1-b. Would the additional Investment be Justified? 2. Assume again that Andrettl Company has sufficlent capacity to produce 109,350 Daks each year. A customer In a foreign market wants to purchase 28,350 Daks. If Andrettl accepts this order It would have to pay Import dutles on the Daks of $270 per unit and an additional $17,010 for permits and licenses. The only selling costs that would be assoclated with the order would be $210 per unit shipping cost. What is the break-even price per unit on this order? 3. The company has 600 Daks on hand that have some Irregularttles and are therefore considered to be "seconds." Due to the Irregularities, it will be impossible to sell these units at the normal price through regular distribution channels. What is the unit cost figure that is relevant for setting a minimum selling price? 4. Due to a strike in its supplier's plant, Andrettl Company is unable to purchase more materlal for the production of Daks. The strike is expected to last for two months. Andrettl Company has enough materlal on hand to operate at 25% of normal levels for the two-month period. As an alternative, AndrettI could close Its plant down entirely for the two months. If the plant were closed, fixed manufacturing overhead costs would continue at 30% of their normal level during the two-month period and the fixed selling expenses would be reduced by 20% during the two-month period. a. How much total contribution margin will Andrettl forgo if it closes the plant for two months? b. How much total fixed cost will the company avoid if it closes the plant for two months? c. What is the financlal advantage (disadvantage) of closing the plant for the two-month period? d. Should Andrettl close the plant for two months? 5. An outside manufacturer has offered to produce 81,000 Daks and ship them directly to Andrettl's customers. If AndrettI Company accepts this offer, the facilitles that it uses to produce Daks would be idle; however, fixed manufacturing overhead costs would be reduced by 30%. Because the outside manufacturer would pay for all shipping costs, the varlable selling expenses would be only twothirds of their present amount. What is Andretti's avoidable cost per unit that it should compare to the price quoted by the outside manufacturer? Andrettl Company has a single product called a Dak. The company normally produces and sells 81,000 Daks each year at a selling price of $64 per unit. The company's unit costs at this level of activity are given below. A number of questions relating to the production and sale of Daks follow. Each question is independent. Required: 1-a. Assume that Andrettl Company has sufficlent capacity to produce 109,350 Daks each year without any increase In fixed manufacturing overhead costs. The company could increase its unit sales by 35% above the present 81,000 units each year if it were willing to increase the fixed selling expenses by $10,000. What is the financlal advantage (dliadvantage) of Investing an additional $110,000 in fixed selling expenses? 1-b. Would the additional Investment be Justified? 2. Assume again that Andrettl Company has sufficlent capacity to produce 109,350 Daks each year. A customer In a foreign market wants to purchase 28,350 Daks. If Andrettl accepts this order It would have to pay Import dutles on the Daks of $270 per unit and an additional $17,010 for permits and licenses. The only selling costs that would be assoclated with the order would be $210 per unit shipping cost. What is the break-even price per unit on this order? 3. The company has 600 Daks on hand that have some Irregularttles and are therefore considered to be "seconds." Due to the Irregularities, it will be impossible to sell these units at the normal price through regular distribution channels. What is the unit cost figure that is relevant for setting a minimum selling price? 4. Due to a strike in its supplier's plant, Andrettl Company is unable to purchase more materlal for the production of Daks. The strike is expected to last for two months. Andrettl Company has enough materlal on hand to operate at 25% of normal levels for the two-month period. As an alternative, AndrettI could close Its plant down entirely for the two months. If the plant were closed, fixed manufacturing overhead costs would continue at 30% of their normal level during the two-month period and the fixed selling expenses would be reduced by 20% during the two-month period. a. How much total contribution margin will Andrettl forgo if it closes the plant for two months? b. How much total fixed cost will the company avoid if it closes the plant for two months? c. What is the financlal advantage (disadvantage) of closing the plant for the two-month period? d. Should Andrettl close the plant for two months? 5. An outside manufacturer has offered to produce 81,000 Daks and ship them directly to Andrettl's customers. If AndrettI Company accepts this offer, the facilitles that it uses to produce Daks would be idle; however, fixed manufacturing overhead costs would be reduced by 30%. Because the outside manufacturer would pay for all shipping costs, the varlable selling expenses would be only twothirds of their present amount. What is Andretti's avoidable cost per unit that it should compare to the price quoted by the outside manufacturer Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started