Answered step by step

Verified Expert Solution

Question

1 Approved Answer

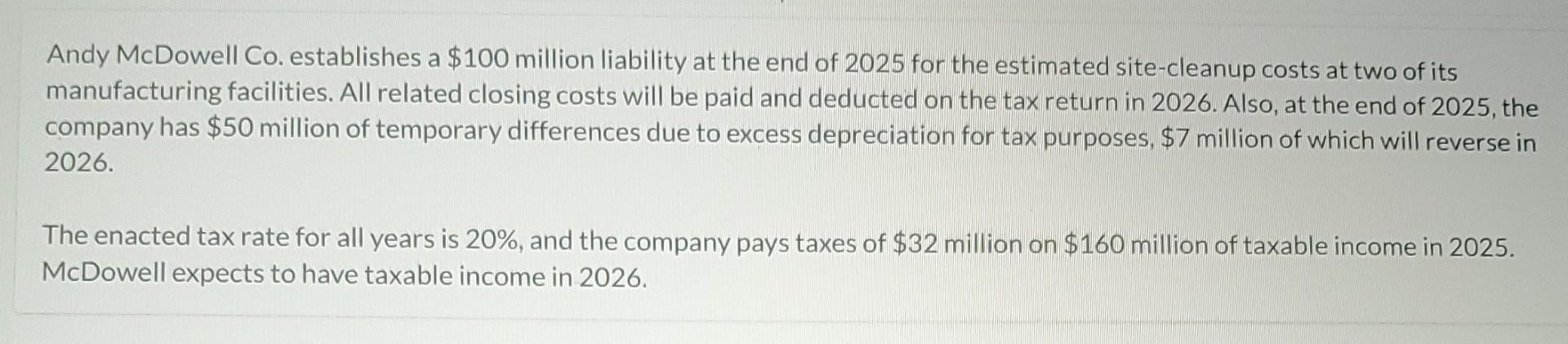

Andy McDowell Co. establishes a $100 million liability at the end of 2025 for the estimated site-cleanup costs at two of its manufacturing facilities. All

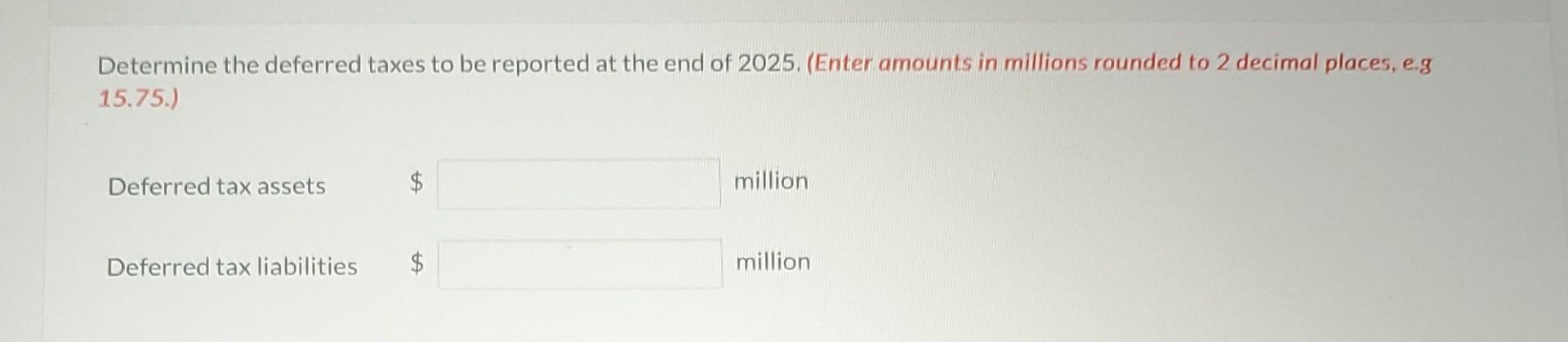

Andy McDowell Co. establishes a $100 million liability at the end of 2025 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2026 . Also, at the end of 2025 , the company has $50 million of temporary differences due to excess depreciation for tax purposes, $7 million of which will reverse in 2026. The enacted tax rate for all years is 20%, and the company pays taxes of $32 million on $160 million of taxable income in 2025 . McDowell expects to have taxable income in 2026. Determine the deferred taxes to be reported at the end of 2025. (Enter amounts in millions rounded to 2 decimal places, e.g 15.75.) Deferred tax assets million Deferred tax liabilities million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started