Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Andy's Bookstore operates as a sole proprietorship under the ownership of Mr. Andy. Below are the financial transactions of Andy's Bookstore for the year 2022,

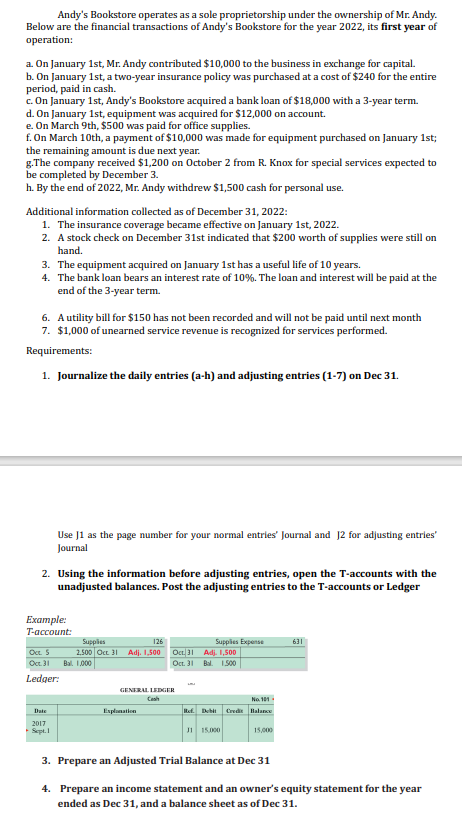

Andy's Bookstore operates as a sole proprietorship under the ownership of Mr. Andy. Below are the financial transactions of Andy's Bookstore for the year 2022, its first year of operation: a. On January 1st, Mr. Andy contributed $10,000 to the business in exchange for capital. b. On January 1st, a two-year insurance policy was purchased at a cost of $240 for the entire period, paid in cash. c. On January 1st, Andy's Bookstore acquired a bank loan of $18,000 with a 3-year term. d. On January 1st, equipment was acquired for $12,000 on account. e. On March 9th, \$500 was paid for office supplies. f. On March 10th, a payment of $10,000 was made for equipment purchased on January 1st; the remaining amount is due next year. g.The company received $1,200 on October 2 from R. Knox for special services expected to be completed by December 3. h. By the end of 2022, Mr. Andy withdrew \$1,500 cash for personal use. Additional information collected as of December 31, 2022: 1. The insurance coverage became effective on January 1st, 2022. 2. A stock check on December 31 st indicated that $200 worth of supplies were still on hand. 3. The equipment acquired on January 1 st has a useful life of 10 years. 4. The bank loan bears an interest rate of 10%. The loan and interest will be paid at the end of the 3-year term. 6. A utility bill for $150 has not been recorded and will not be paid until next month 7. $1,000 of unearned service revenue is recognized for services performed. Requirements: 1. Journalize the daily entries (a-h) and adjusting entries (1-7) on Dec 31. Use J1 as the page number for your normal entries' Journal and J2 for adjusting entries' Journal 2. Using the information before adjusting entries, open the T-accounts with the unadjusted balances. Post the adjusting entries to the T-accounts or Ledger Example: T-account: Ledger: restean 1 ERatev 3. Prepare an Adjusted Trial Balance at Dec 31 4. Prepare an income statement and an owner's equity statement for the year ended as Dec 31, and a balance sheet as of Dec 31

Andy's Bookstore operates as a sole proprietorship under the ownership of Mr. Andy. Below are the financial transactions of Andy's Bookstore for the year 2022, its first year of operation: a. On January 1st, Mr. Andy contributed $10,000 to the business in exchange for capital. b. On January 1st, a two-year insurance policy was purchased at a cost of $240 for the entire period, paid in cash. c. On January 1st, Andy's Bookstore acquired a bank loan of $18,000 with a 3-year term. d. On January 1st, equipment was acquired for $12,000 on account. e. On March 9th, \$500 was paid for office supplies. f. On March 10th, a payment of $10,000 was made for equipment purchased on January 1st; the remaining amount is due next year. g.The company received $1,200 on October 2 from R. Knox for special services expected to be completed by December 3. h. By the end of 2022, Mr. Andy withdrew \$1,500 cash for personal use. Additional information collected as of December 31, 2022: 1. The insurance coverage became effective on January 1st, 2022. 2. A stock check on December 31 st indicated that $200 worth of supplies were still on hand. 3. The equipment acquired on January 1 st has a useful life of 10 years. 4. The bank loan bears an interest rate of 10%. The loan and interest will be paid at the end of the 3-year term. 6. A utility bill for $150 has not been recorded and will not be paid until next month 7. $1,000 of unearned service revenue is recognized for services performed. Requirements: 1. Journalize the daily entries (a-h) and adjusting entries (1-7) on Dec 31. Use J1 as the page number for your normal entries' Journal and J2 for adjusting entries' Journal 2. Using the information before adjusting entries, open the T-accounts with the unadjusted balances. Post the adjusting entries to the T-accounts or Ledger Example: T-account: Ledger: restean 1 ERatev 3. Prepare an Adjusted Trial Balance at Dec 31 4. Prepare an income statement and an owner's equity statement for the year ended as Dec 31, and a balance sheet as of Dec 31 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started