Question

Ann Archibald has ambition to be on the County Governing Board. Her staff has determined the breakdown of tasks needed to secure the election. The

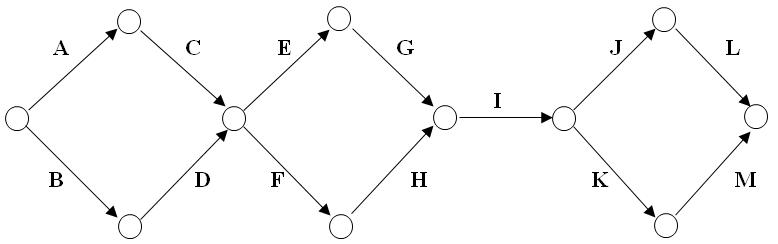

Ann Archibald has ambition to be on the County Governing Board. Her staff has determined the breakdown of tasks needed to secure the election. The following network depicts the breakdown.

Her staff also has estimated the normal and crash times and costs for tasks involved in the breakdown. The information is summarized below. The campaign starts on 4/1/2022.

Task | Time Estimates (Weeks) | Cost Estimates ($) | ||

| Normal | Crash | Normal | Crash | |

| A1 | 6 | 4 | 5,000 | 10,000 |

| B2 | 3 | 3 | 4,000 | 4,000 |

| C | 10 | 8 | 4,000 | 7,000 |

| D | 4 | 2 | 1,000 | 2,000 |

| E | 2 | 1 | 1,000 | 2,000 |

| F | 3 | 1 | 4,000 | 7,600 |

| G | 5 | 4 | 7,000 | 12,000 |

| H | 7 | 5 | 8,000 | 14,000 |

| I | 2 | 2 | 1,200 | 1,200 |

| J | 4 | 3 | 5,000 | 5,800 |

| K | 8 | 6 | 13,000 | 15,000 |

| L | 5 | 5 | 6,000 | 6,000 |

| M | 4 | 4 | 2,500 | 2,500 |

1 Task A can be crashed by 2 weeks at an additional cost of $5000 ($2,500/week).

2 Task B cannot be crashed.

Ann has to campaign for 35 weeks. Determine the total cost needed to complete the project with Ann's time constraint.

Hint: Only the tasks in CP can be crashed to shorten the project duration. Consider the tasks with more days with less cost to crash.

| Question 2 | |

| Total normal project cost: | $______________ |

Question 3

Tasks that should be crashed and additional cost:

| Task | Weeks to cut | Cost | C.P. after crash |

| Question 4 | |

| Total crashed project cost: | $_____________ |

Question 5: Your MPP file.

A B C D E F G H I J K L M

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the total cost needed to complete the project with Anns time constraint we need to iden...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started