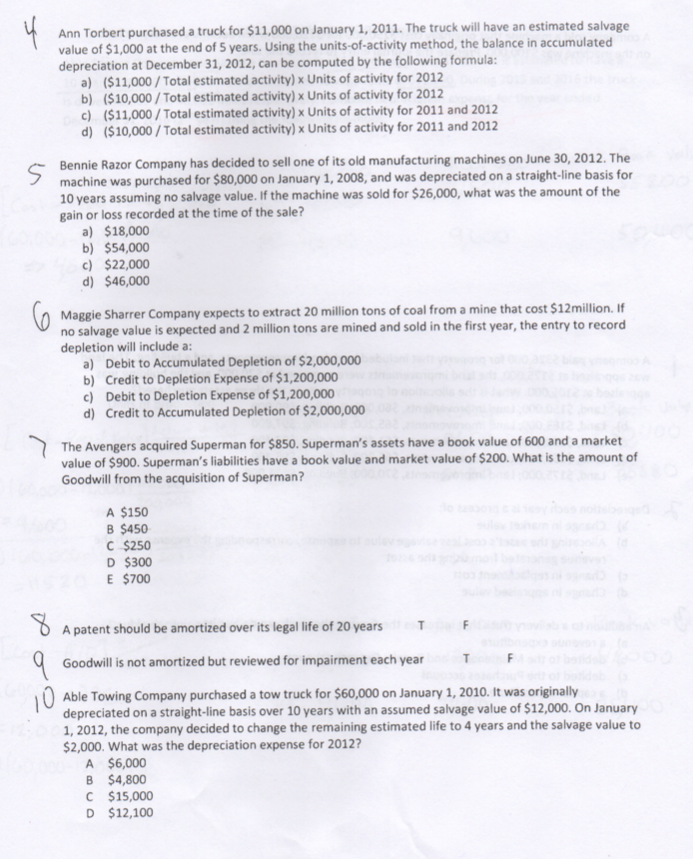

Ann Torbert purchased a truck for $11,000 on January 1, 2011. The truck will have an estimated salvage value of $1,000 at the end of 5 years. Using the units-of-activity method, the balance in accumulated depreciation at December 31, 2012, can be computed by the following formula: a) ($11,000/Total estimated activity) x Units of activity for 2012 b) ($10,000/Total estimated activity) x Units of activity for 2012 c) ($11,000/Total estimated activity) x Units of activity for 2011 and 2012 d) ($10,000/Total estimated activity) x Units of activity for 2011 and 2012 Bennie Razor Company has decided to sell one of its old manufacturing machines on June 30, 2012. The machine was purchased for $80,000 on January 1, 2008, and was depreciated on a straight-line basis for 10 years assuming no salvage value. If the machine was sold for $26,000, what was the amount of the gain or loss recorded at the time of the sale? a) $18,000 b) $54,000 c) $22,000 d) $46,000 Maggie Sharrer Company expects to extract 20 million tons of coal from a mine that cost $12miliion. If no salvage value is expected and 2 million tons are mined and sold in the first year, the entry to record depletion will include a: a) Debit to Accumulated Depletion of $2,000,000 b) Credit to Depletion Expense of $1, 200,000 c) Debit to Depletion Expense of $1, 200,000 d) Credit to Accumulated Depletion of $2,000,000 The Avengers acquired Superman for $850. Superman's assets have a book value of 600 and a market value of $900. Superman's liabilities have a book value and market value of $200. What is the amount of Goodwill from the acquisition of Superman? A $150 B $450 C $250 D $300 E $700 A patent should be amortized over its legal life of 20 years Goodwill is not amortized but reviewed for impairment each year Able Towing Company purchased a tow truck for $60,000 on January 1, 2010. It was originally depreciated on a straight-line basis over 10 years with an assumed salvage value of $12,000. On January 1, 2012, the company decided to change the remaining estimated life to 4 years and the salvage value to $2,000. What was the depreciation expense for 2012? A $6,000 B $4, 800 C $15,000 D $12, 100