Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anne Kline and Betty Lewis, partners in Classy Boutique, have capital balances of $40,000 and $60,000, and a sharing ratio of 4:6, respectively. Carol

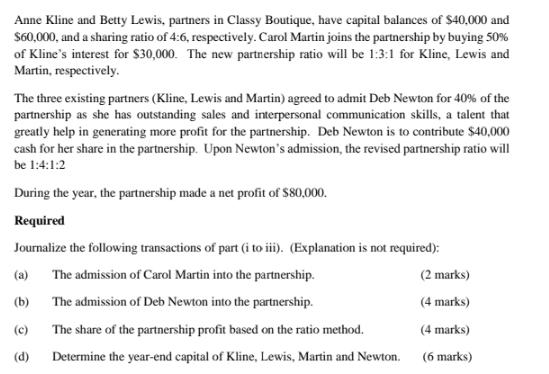

Anne Kline and Betty Lewis, partners in Classy Boutique, have capital balances of $40,000 and $60,000, and a sharing ratio of 4:6, respectively. Carol Martin joins the partnership by buying 50% of Kline's interest for $30,000. The new partnership ratio will be 1:3:1 for Kline, Lewis and Martin, respectively. The three existing partners (Kline, Lewis and Martin) agreed to admit Deb Newton for 40% of the partnership as she has outstanding sales and interpersonal communication skills, a talent that greatly help in generating more profit for the partnership. Deb Newton is to contribute $40,000 cash for her share in the partnership. Upon Newton's admission, the revised partnership ratio will be 1:4:1:2 During the year, the partnership made a net profit of $80,000. Required Journalize the following transactions of part (i to iii). (Explanation is not required): The admission of Carol Martin into the partnership. (2 marks) The admission of Deb Newton into the partnership. (4 marks) The share of the partnership profit based on the ratio method. (4 marks) Determine the year-end capital of Kline, Lewis, Martin and Newton. (6 marks) (a) (b) (c) (d)

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A Journal access for the admission of Carol Martin into the partnership Cash 30000 Anne Kline Capita...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started