Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P. Smith Ltd has an accounting year ending on December 31 each year and applies the straight- line method at a rate of 10

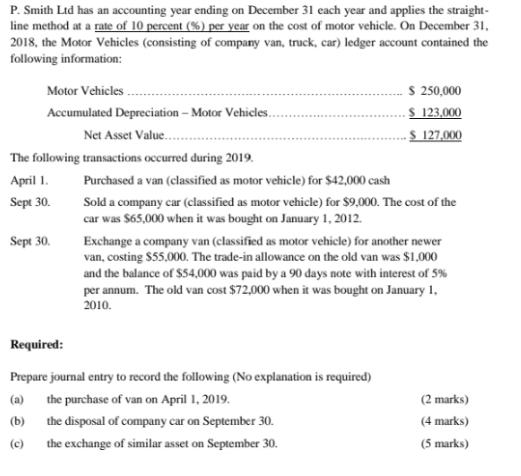

P. Smith Ltd has an accounting year ending on December 31 each year and applies the straight- line method at a rate of 10 percent (%) per year on the cost of motor vehicle. On December 31, 2018, the Motor Vehicles (consisting of company van, truck, car) ledger account contained the following information: Motor Vehicles.. Accumulated Depreciation - Motor Vehicles.. Net Asset Value...... The following transactions occurred during 2019. April 1. Sept 30. Sept 30. Purchased a van (classified as motor vehicle) for $42,000 cash Sold a company car (classified as motor vehicle) for $9,000. The cost of the car was $65,000 when it was bought on January 1, 2012. $ 250,000 $ 123,000 $ 127,000 Exchange a company van (classified as motor vehicle) for another newer van, costing $55,000. The trade-in allowance on the old van was $1,000 and the balance of $54,000 was paid by a 90 days note with interest of 5% per annum. The old van cost $72,000 when it was bought on January 1, 2010. Required: Prepare journal entry to record the following (No explanation is required) the purchase of van on April 1, 2019. (a) (b) (c) the disposal of company car on September 30. the exchange of similar asset on September 30. (2 marks) (4 marks) (5 marks)

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Journal In the Books of P smith Ltd For the year ended 31 st March 2020 a Purchase of Van on 1 April ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started