Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Portland Company sells much of its merchandise on credit with terms of n/30. Customers sometimes ask for an extension of credit beyond 30 days,

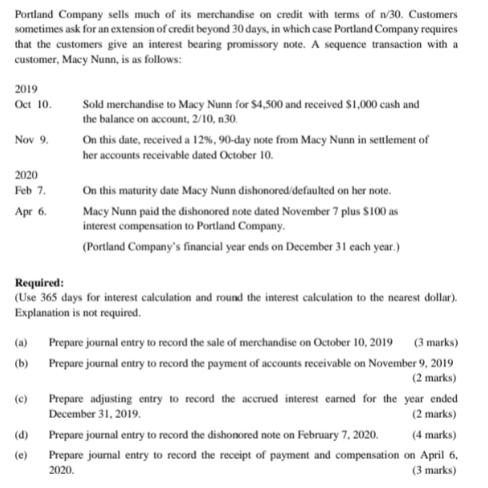

Portland Company sells much of its merchandise on credit with terms of n/30. Customers sometimes ask for an extension of credit beyond 30 days, in which case Portland Company requires that the customers give an interest bearing promissory note. A sequence transaction with a customer, Macy Nunn, is as follows: 2019 Oct 10. Nov 9. 2020 Feb 7. Apr 6. (a) (b) (c) Sold merchandise to Macy Nunn for $4,500 and received $1,000 cash and the balance on account, 2/10,n30. Required: (Use 365 days for interest calculation and round the interest calculation to the nearest dollar). Explanation is not required. (d) (e) On this date, received a 12%, 90-day note from Macy Nunn in settlement of her accounts receivable dated October 10. On this maturity date Macy Nunn dishonored/defaulted on her note. Macy Nunn paid the dishonored note dated November 7 plus $100 as interest compensation to Portland Company. (Portland Company's financial year ends on December 31 each year.) Prepare journal entry to record the sale of merchandise on October 10, 2019 (3 marks) Prepare journal entry to record the payment of accounts receivable on November 9, 2019 (2 marks) Prepare adjusting entry to record the accrued interest earned for the year ended December 31, 2019. (2 marks) (4 marks) on April 6, (3 marks) Prepare journal entry to record the dishonored note on February 7, 2020. Prepare journal entry to record the receipt of payment and compensation 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Problem Portland company sells much of its merchandise on credit with terms of n30 Customers sometim...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started