Answered step by step

Verified Expert Solution

Question

1 Approved Answer

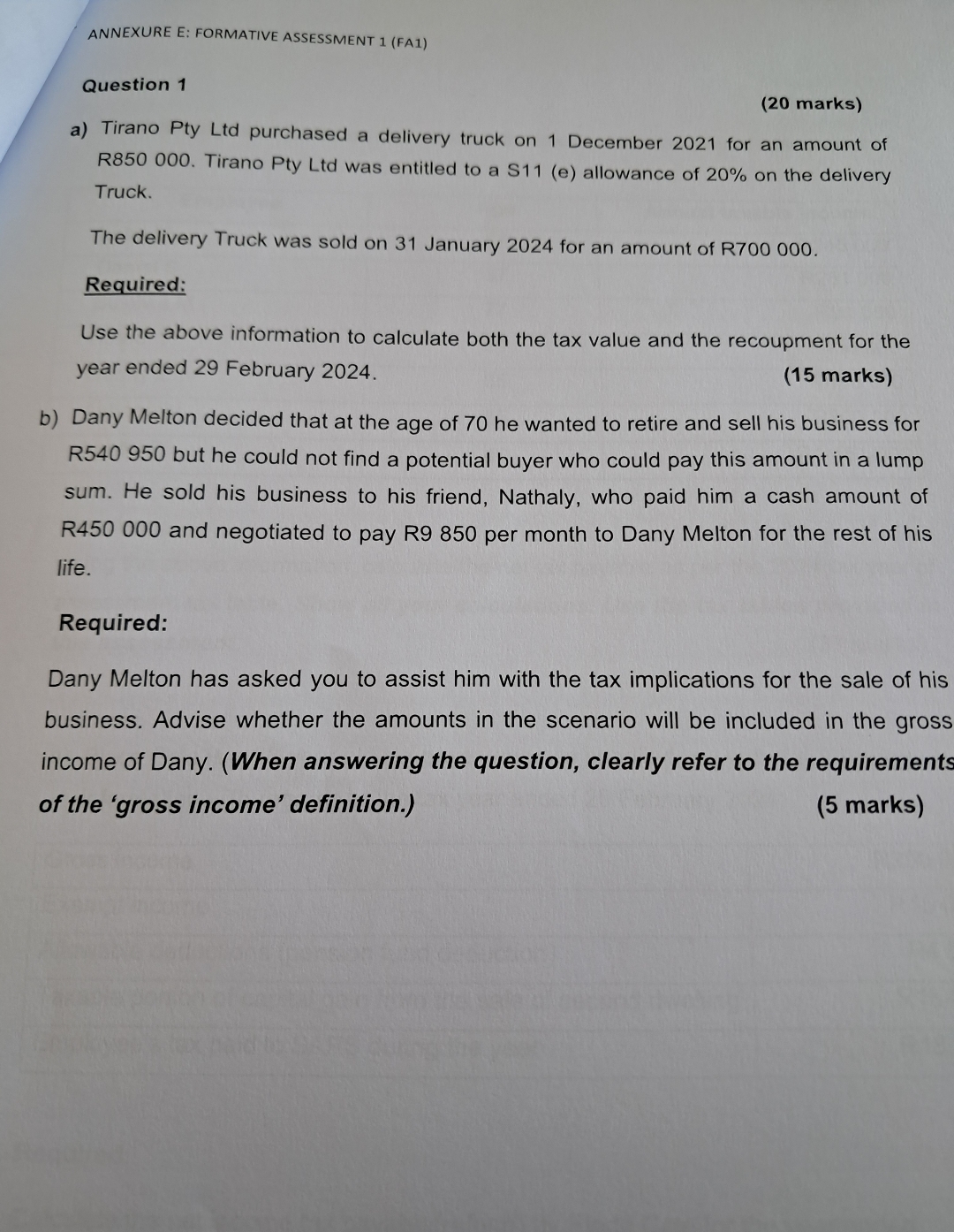

ANNEXURE E: FORMATIVE ASSESSMENT 1 ( FA 1 ) Question 1 ( 2 0 marks ) a ) Tirano Pty Ltd purchased a delivery truck

ANNEXURE E: FORMATIVE ASSESSMENT FA

Question

marks

a Tirano Pty Ltd purchased a delivery truck on December for an amount of R Tirano Pty Ltd was entitled to a Se allowance of on the delivery Truck.

The delivery Truck was sold on January for an amount of R

Required:

Use the above information to calculate both the tax value and the recoupment for the year ended February

marks

b Dany Melton decided that at the age of he wanted to retire and sell his business for R but he could not find a potential buyer who could pay this amount in a lump sum. He sold his business to his friend, Nathaly, who paid him a cash amount of R and negotiated to pay R per month to Dany Melton for the rest of his life.

Required:

Dany Melton has asked you to assist him with the tax implications for the sale of his business. Advise whether the amounts in the scenario will be included in the gross income of Dany. When answering the question, clearly refer to the requirements of the 'gross income' definition.

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started