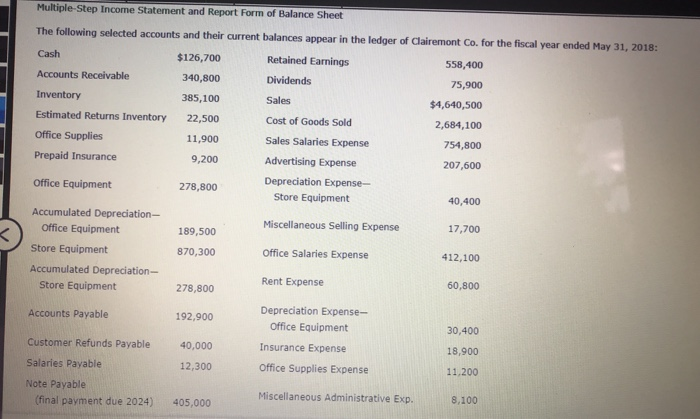

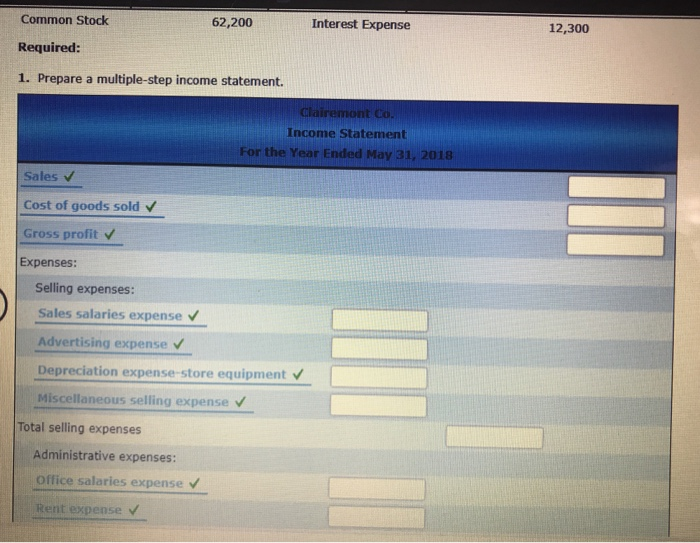

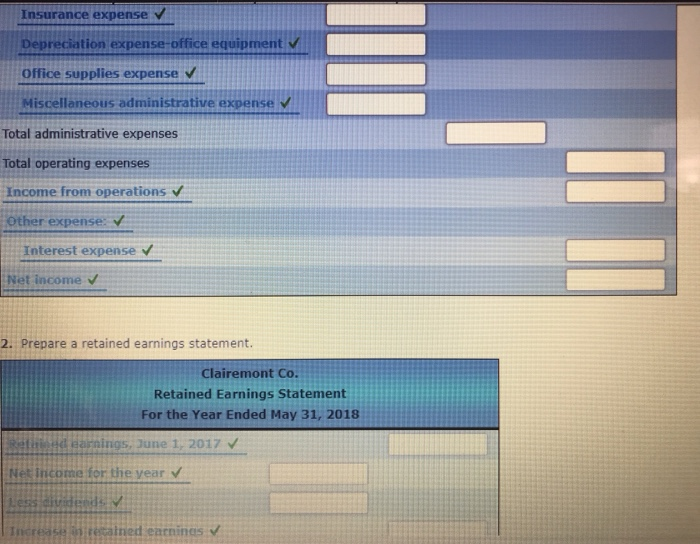

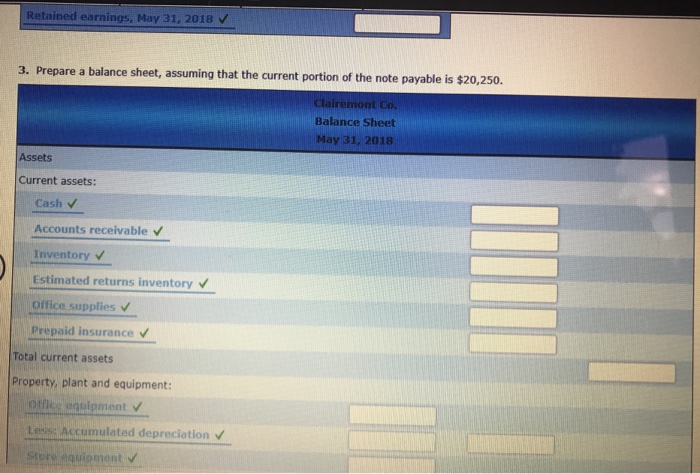

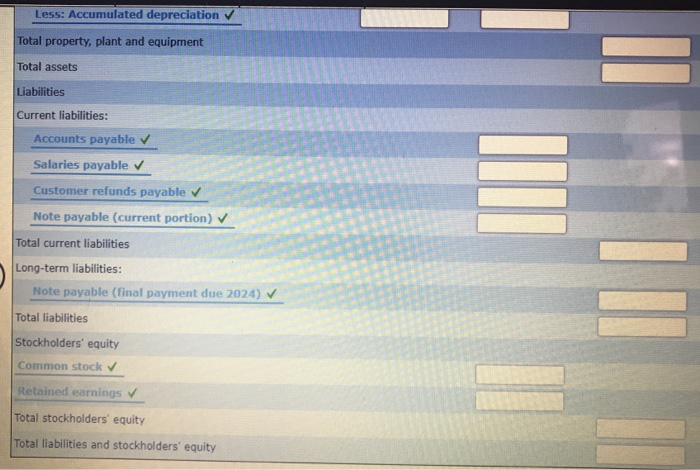

Multiple-Step Income Statement and Report Form of Balance Sheet The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2018: Cash $126,700 Retained Earnings 558,400 Accounts Receivable 340,800 Dividends 75,900 Inventory 385,100 Sales $4,640,500 Estimated Returns Inventory 22,500 Cost of Goods Sold 2,684,100 Office Supplies 11,900 Sales Salaries Expense 754,800 Prepaid Insurance 9,200 Advertising Expense 207,600 Office Equipment Depreciation Expense- 278,800 Store Equipment 40,400 Accumulated Depreciation- Miscellaneous Selling Expense Office Equipment 17,700 189,500 Store Equipment 870,300 Office Salaries Expense 412,100 Accumulated Depreciation- Store Equipment Rent Expense 60,800 278,800 Depreciation Expense- Accounts Payable 192,900 Office Equipment 30,400 Customer Refunds Payable 40,000 Insurance Expense 18,900 Salaries Payable 12,300 Office Supplies Expense 11,200 Note Payable (final payment due 2024) Miscellaneous Administrative Exp. 405,000 8,100 Common Stock 62,200 Interest Expense 12,300 Required: 1. Prepare a multiple-step income statement. Clairemont Co. Income Statement For the Year Ended May 31, 2018 Sales Cost of goods sold Gross profit Expenses: Selling expenses: Sales salaries expense Advertising expense v Depreciation expense store equipment Miscellaneous selling expense Total selling expenses Administrative expenses: office salaries expense Rent expense Insurance expense Depreciation expense-office equipment Office supplies expense v Miscellaneous administrative expense Total administrative expenses Total operating expenses Income from operations Other expense: Interest expense Net income 2. Prepare a retained earnings statement. Clairemont Co. Retained Earnings Statement For the Year Ended May 31, 2018 ed earnings, June 1, 2017 Net Income for the year Less dividends increase in retained earnings Retained earnings, May 31, 2018 3. Prepare a balance sheet, assuming that the current portion of the note payable is $20,250. Clairemont Co. Balance Sheet May 31, 2018 Assets Current assets: Cash Accounts receivable Inventory Estimated returns inventory Office supplies Prepaid insurance Total current assets Property, plant and equipment: Olee equipment L: Accumulated depreciation Storment Less: Accumulated depreciation Total property, plant and equipment Total assets Liabilities Current liabilities: Accounts payable Salaries payable Customer refunds payable Note payable (current portion) Total current liabilities Long-term liabilities: Note payable (final payment due 2024) Total liabilities Stockholders' equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity