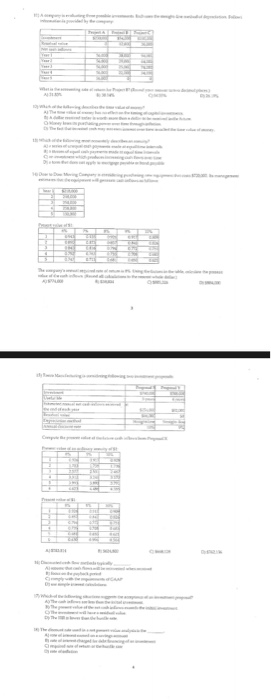

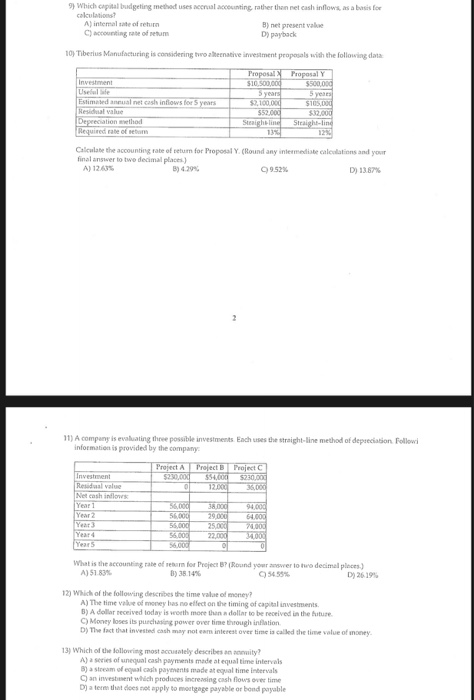

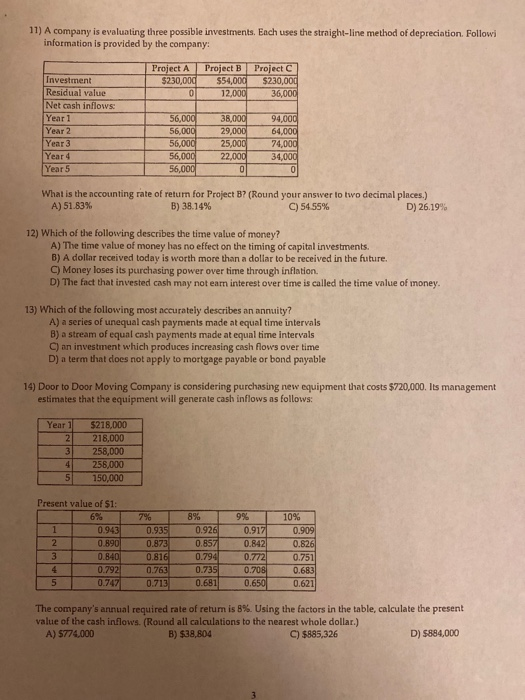

in the net shinewsb or Which capital methods calculations! Ainemalonen Com B) septe yback D 10) Tiberius Manufacturing is considering tomative s with the following E t shows sys Cathem for Proposal Yound an d you A) 12616 B) 69 D) 1357 11) A company is evaluating the possible investments Each uses the straight line method of depreciation Follow Information is provided by the company Project A 52000 Project Project C 520 53001 330d What is the c A) 51 o mfort Round B) 351476 w 54555 o decimal ) A) The y has no elect one of 5) Ad y is worth mod erived in the Monotusperinti D) The fact th a t is called the time of 13 Which most y describes ty? A) G y mdeime interval B o y madattimental an in c reduce increasing cash flows over time D) atom dat does not apply to mortgage payable or bond payable 11) A company is evaluating three possible investments. Each uses the straight-line method of depreciation Follow information is provided by the company: Project A $230,000 Project B $54,000 12.000 Project C $230,000 36.000 Investment Residual value Net cash inflows Year 1 Year 2 Year 3 Year 4 Year 5 56.000 56,000 56000 56,000 56,000 38.000 29,000 25,000 22,000 94.000 64,000 74,000 34,000 0 What is the accounting rate of return for Project B? (Round your answer to two decimal places.) A) 51.83% B) 38.14% C) 54.55% D) 26.19% 12) Which of the following describes the time value of money? A) The time value of money has no effect on the timing of capital investments B) A dollar received today is worth more than a dollar to be received in the future. C) Money loses its purchasing power over time through inflation D) The fact that invested cash may not eam interest over time is called the time value of money, 13) Which of the following most accurately describes an annuity? A) a series of unequal cash payments made at equal time intervals B) a stream of equal cash payments made at equal time intervals C) an investment which produces increasing cash flows over time D) a term that does not apply to mortgage payable or bond payable 14) Door to Door Moving Company is considering purchasing new equipment that costs $720,000. Its management estimates that the equipment will generate cash inflows as follows: Year 1 2 3 4 $218.000 218,000 258,000 256,000 150,000 0 Present value of $1: 6% 7 0.943 0.890 0.840 0.792 0.747 8 .935 0.873 0.816 0.763 0.713 % 0.926 0.857 0.794 0.735 0.681 9% 0.917 0.842 0.772 0.708 0.650 10% 0.909 0.826 0.751 0.683 0.621 The company's annual required rate of return is 8%. Using the factors in the table, calculate the present value of the cash inflows. (Round all calculations to the nearest whole dollar.) A) 5774.000 B) $38.804 C) $885,326 D) 5884,000