Answered step by step

Verified Expert Solution

Question

1 Approved Answer

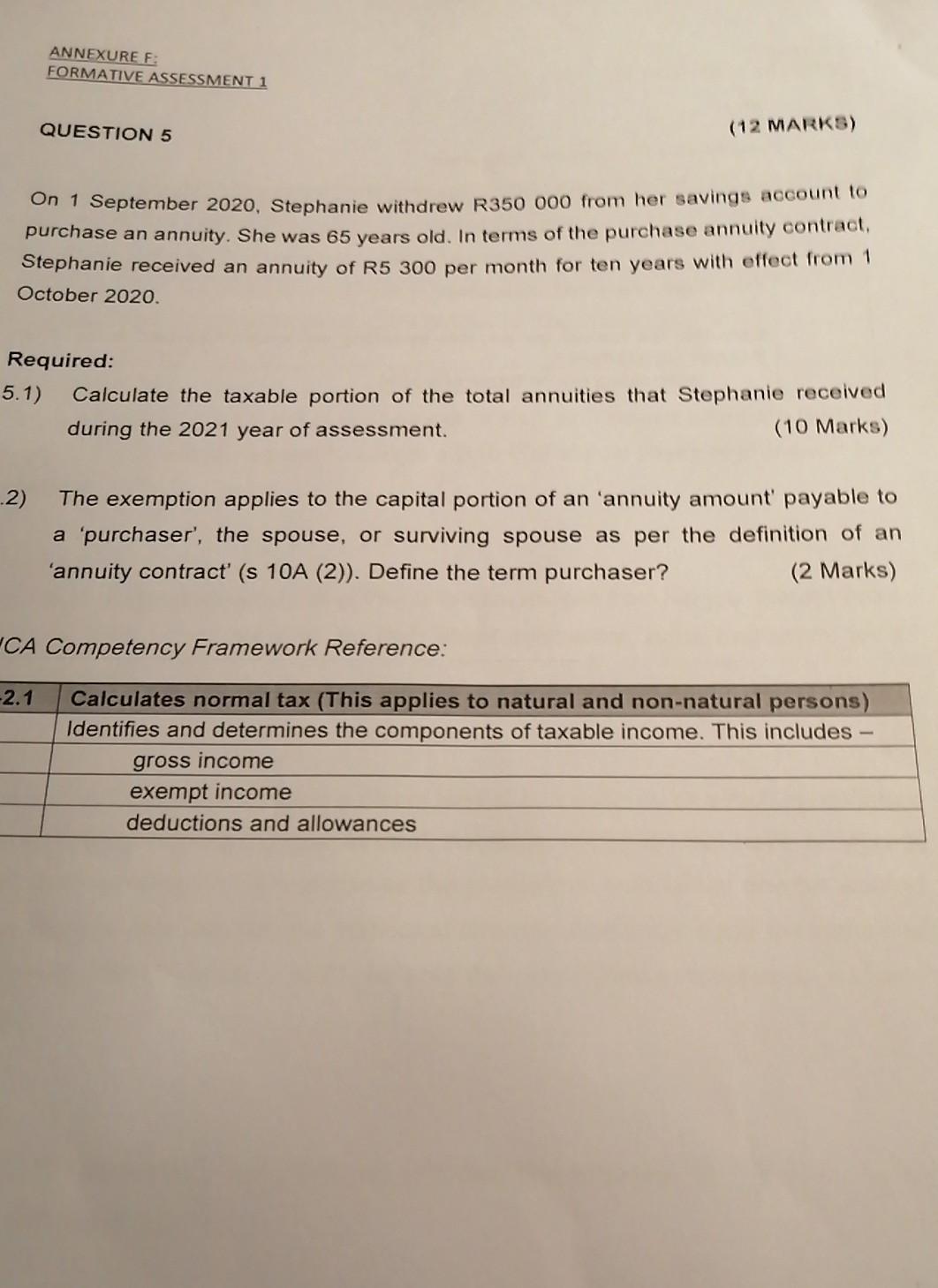

ANNEXUREF: FORMATIVE ASSESSMENT 1 QUESTION 5 (12 MARKS) On 1 September 2020, Stephanie withdrew R350 000 from her savings account to purchase an annuity. She

ANNEXUREF: FORMATIVE ASSESSMENT 1 QUESTION 5 (12 MARKS) On 1 September 2020, Stephanie withdrew R350 000 from her savings account to purchase an annuity. She was 65 years old. In terms of the purchase annuity contract, Stephanie received an annuity of R5 300 per month for ten years with effect from 1 October 2020. Required: 5.1) Calculate the taxable portion of the total annuities that Stephanie received during the 2021 year of assessment. (10 Marks) 2) The exemption applies to the capital portion of an 'annuity amount' payable to a 'purchaser', the spouse, or surviving spouse as per the definition of an 'annuity contract' (s 10A (2)). Define the term purchaser? (2 Marks) CA Competency Framework Reference: 2.1 Calculates normal tax (This applies to natural and non-natural persons) Identifies and determines the components of taxable income. This includes gross income exempt income deductions and allowances

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started