Please help. I will give you upvote if anyone can hlep me.

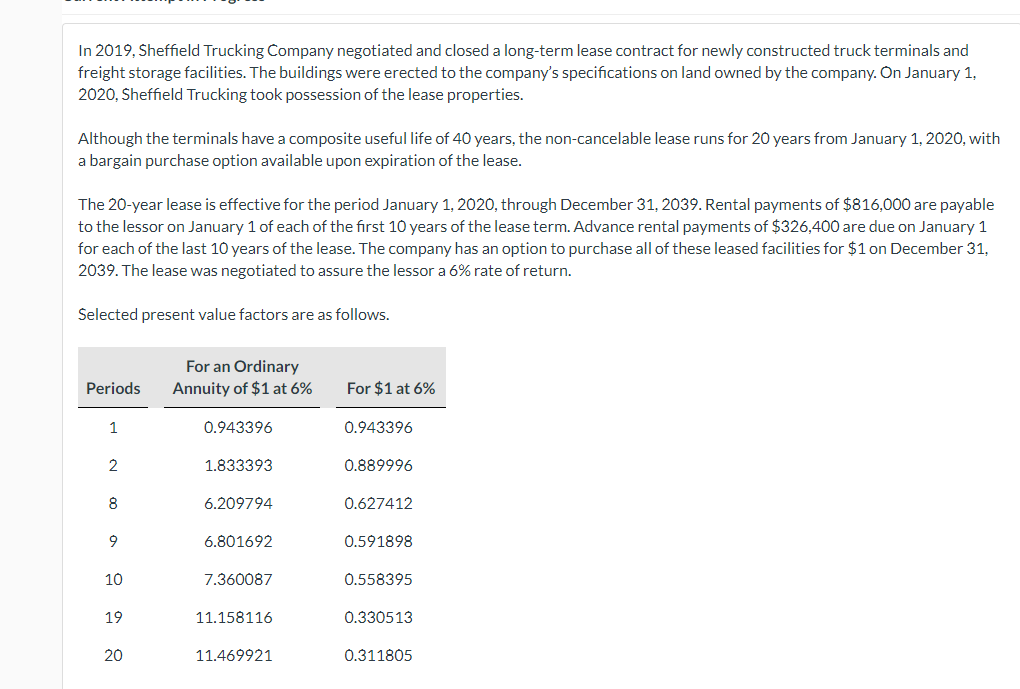

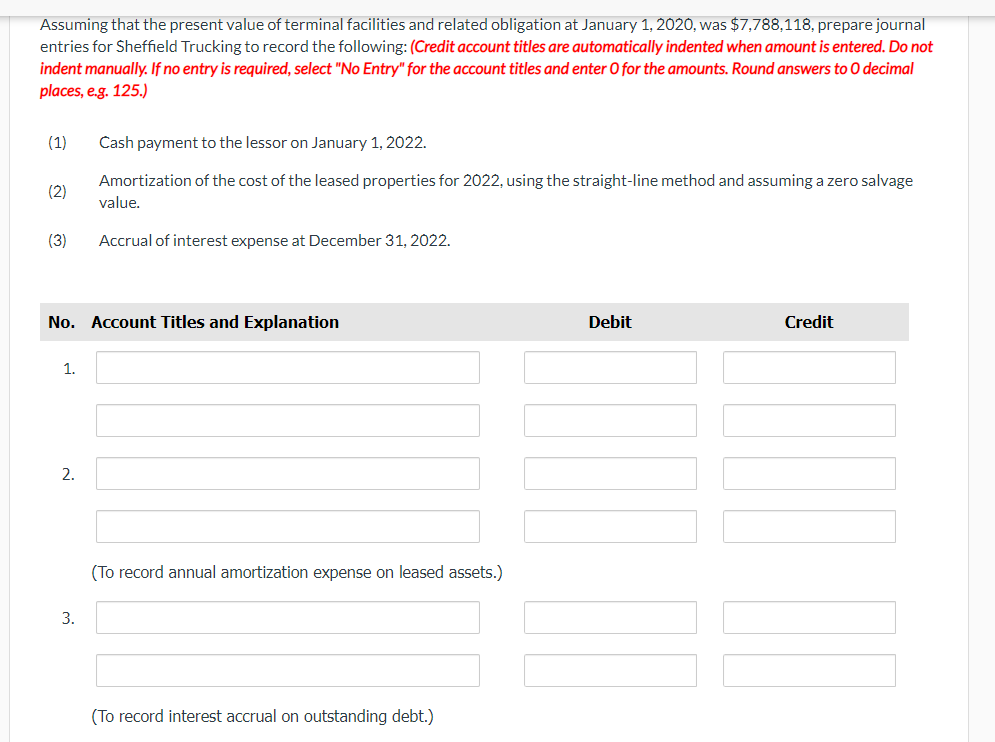

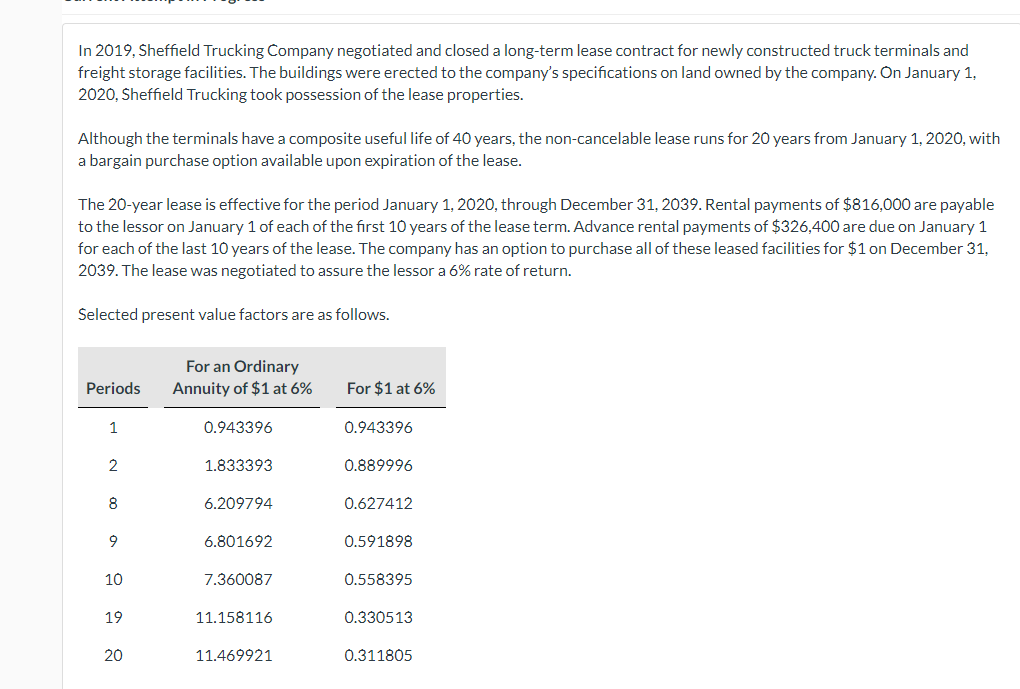

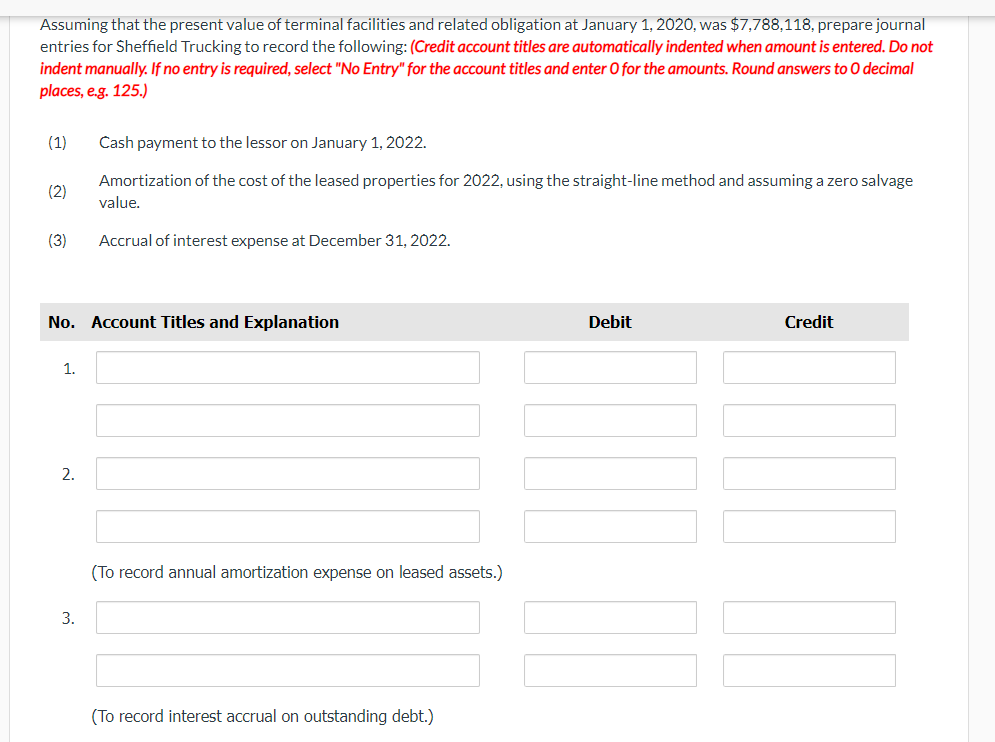

In 2019 , Sheffield Trucking Company negotiated and closed a long-term lease contract for newly constructed truck terminals and freight storage facilities. The buildings were erected to the company's specifications on land owned by the company. On January 1 , 2020 , Sheffield Trucking took possession of the lease properties. Although the terminals have a composite useful life of 40 years, the non-cancelable lease runs for 20 years from January 1,2020 , with a bargain purchase option available upon expiration of the lease. The 20-year lease is effective for the period January 1, 2020, through December 31,2039 . Rental payments of $816,000 are payable to the lessor on January 1 of each of the first 10 years of the lease term. Advance rental payments of $326,400 are due on January 1 for each of the last 10 years of the lease. The company has an option to purchase all of these leased facilities for $1 on December 31 , 2039. The lease was negotiated to assure the lessor a 6% rate of return. Selected present value factors are as follows. Assuming that the present value of terminal facilities and related obligation at January 1,2020 , was $7,788,118, prepare journal indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 125.) (1) Cash payment to the lessor on January 1,2022. (2) Amortization of the cost of the leased properties for 2022, using the straight-line method and assuming a zero salvage value. (3) Accrual of interest expense at December 31,2022. In 2019 , Sheffield Trucking Company negotiated and closed a long-term lease contract for newly constructed truck terminals and freight storage facilities. The buildings were erected to the company's specifications on land owned by the company. On January 1 , 2020 , Sheffield Trucking took possession of the lease properties. Although the terminals have a composite useful life of 40 years, the non-cancelable lease runs for 20 years from January 1,2020 , with a bargain purchase option available upon expiration of the lease. The 20-year lease is effective for the period January 1, 2020, through December 31,2039 . Rental payments of $816,000 are payable to the lessor on January 1 of each of the first 10 years of the lease term. Advance rental payments of $326,400 are due on January 1 for each of the last 10 years of the lease. The company has an option to purchase all of these leased facilities for $1 on December 31 , 2039. The lease was negotiated to assure the lessor a 6% rate of return. Selected present value factors are as follows. Assuming that the present value of terminal facilities and related obligation at January 1,2020 , was $7,788,118, prepare journal indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 125.) (1) Cash payment to the lessor on January 1,2022. (2) Amortization of the cost of the leased properties for 2022, using the straight-line method and assuming a zero salvage value. (3) Accrual of interest expense at December 31,2022