Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Annual depreciation expense on a building purchased a few years ago (using the straight-line method) is $5,800. The cost of the building was $116,000. The

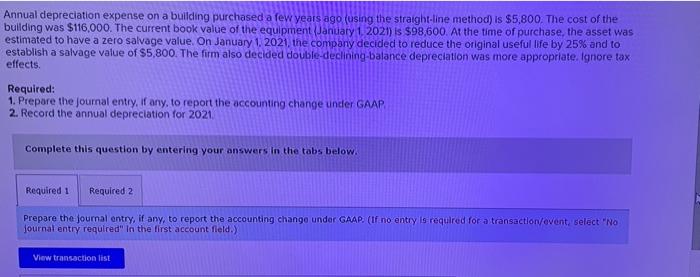

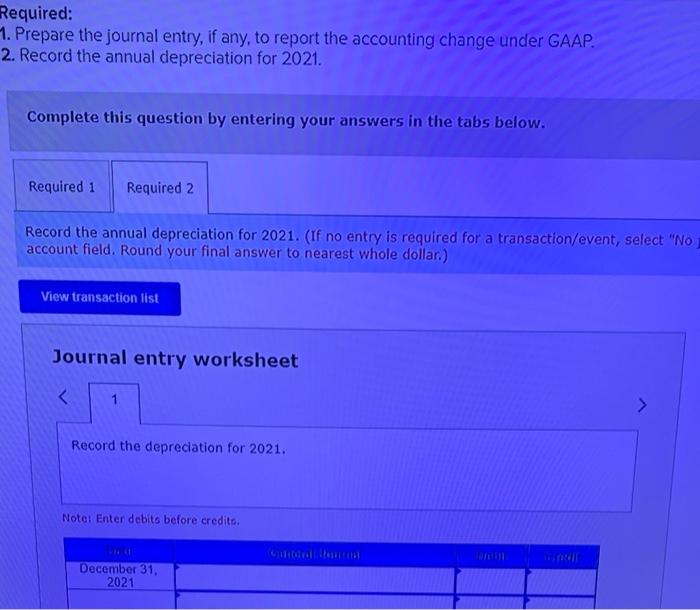

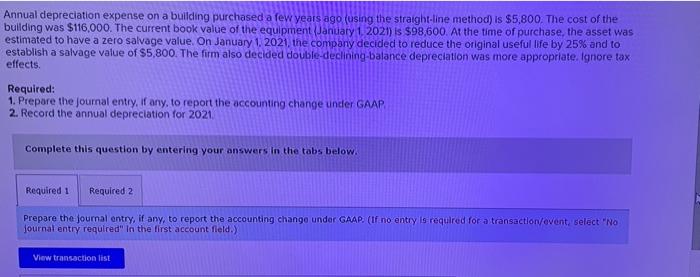

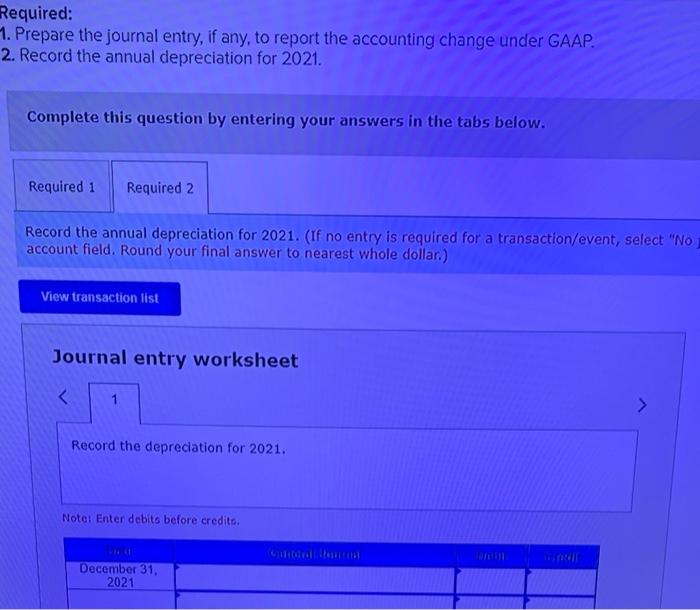

Annual depreciation expense on a building purchased a few years ago (using the straight-line method) is $5,800. The cost of the building was $116,000. The current book value of the equipment January 1 2021) is $98,600. At the time of purchase, the asset was estimated to have a zero salvage value. On January 1, 2021, the company decided to reduce the original useful life by 25% and to establish a salvage value of $5,800. The firm also decided double-declining-balance depreciation was more appropriate. Ignore tax effects. Required: 1. Prepare the journal entry, if any, to report the accounting change under GAAP 2. Record the annual depreciation for 2021 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry, if any, to report the accounting change under GAAP (If no entry is required for a transaction/event, select "No Journal entry required in the first account field.) View transaction list Required: 1. Prepare the journal entry, if any, to report the accounting change under GAAP. 2. Record the annual depreciation for 2021. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Record the annual depreciation for 2021. (If no entry is required for a transaction/event, select "No account field. Round your final answer to nearest whole dollar.) View transaction list Journal entry worksheet 1 Record the depreciation for 2021. Note: Enter debits before credito December 31, 2021

Annual depreciation expense on a building purchased a few years ago (using the straight-line method) is $5,800. The cost of the building was $116,000. The current book value of the equipment January 1 2021) is $98,600. At the time of purchase, the asset was estimated to have a zero salvage value. On January 1, 2021, the company decided to reduce the original useful life by 25% and to establish a salvage value of $5,800. The firm also decided double-declining-balance depreciation was more appropriate. Ignore tax effects. Required: 1. Prepare the journal entry, if any, to report the accounting change under GAAP 2. Record the annual depreciation for 2021 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry, if any, to report the accounting change under GAAP (If no entry is required for a transaction/event, select "No Journal entry required in the first account field.) View transaction list Required: 1. Prepare the journal entry, if any, to report the accounting change under GAAP. 2. Record the annual depreciation for 2021. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Record the annual depreciation for 2021. (If no entry is required for a transaction/event, select "No account field. Round your final answer to nearest whole dollar.) View transaction list Journal entry worksheet 1 Record the depreciation for 2021. Note: Enter debits before credito December 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started