Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ans- 23. (16,200,000) 24. 6,200,000 25. 6,200,000 Use the following information to answer questions 23 through 25. Truman Electronics manufactures a variety of household appliances.

Ans-

23. (16,200,000) 24. 6,200,000 25. 6,200,000

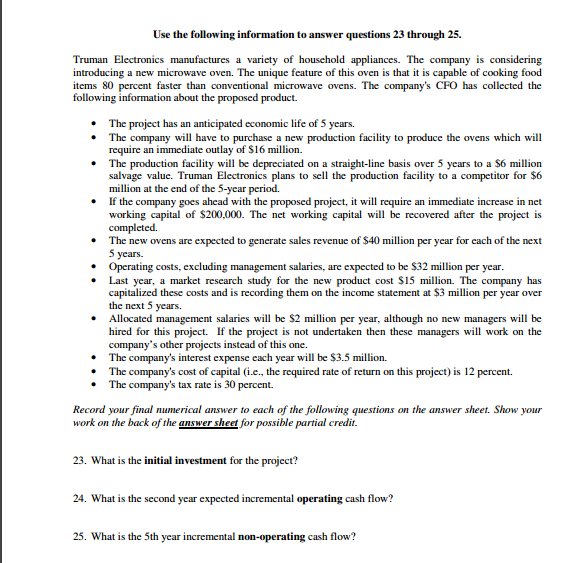

Use the following information to answer questions 23 through 25. Truman Electronics manufactures a variety of household appliances. The company is considering introducing a new microwave oven. The unique feature of this oven is that it is capable of cooking food items 80 percent faster than conventional microwave ovens. The company's CFO has collected the following information about the proposed product. Bullet The project has an anticipated economic life of 5 years. Bullet The company will have to purchase a new production facility to produce the ovens which will require an immediate outlay of dollar16 million. Bullet The production facility will be depreciated on a straight-line basis over 5 years to a dollar6 million salvage value. Truman Electronics plans to sell the production facility to a competitor for dollar6 million at the end of the 5-year period. Bullet If the company goes ahead with the proposed project, it will require an immediate increase in net working capital of dollar200.000. The net working capital will be recovered after the project is completed. Bullet The new ovens are expected to generate sales revenue of dollar40 million per year for each of the next 5 years. Bullet Operating costs, excluding management salaries, are expected to be dollar32 million per year. Bullet Last year, a market research study for the new product cost dollar15 million. The company has capitalized these costs and is recording them on the income statement at dollar3 million per year over the next 5 years. Bullet Allocated management salaries will be dollar2 million per year, although no new managers will be hired for this project. If the project is not undertaken then these managers will work on the company's other projects instead of this one. Bullet The company's interest expense each year will be dollar3.5 million. Bullet The company's cost of capital (i.e., the required rate of return on this project) is 12 percent. Bullet The company's tax rate is 30 percent. Record your final numerical answer to each of the following questions on the answer sheet. Show your work on the back of the answer sheet for possible partial credit. What is the initial investment for the project? What is the second year expected incremental operating cash flow? What is the 5th year incremental non-operating cash flowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started