Answered step by step

Verified Expert Solution

Question

1 Approved Answer

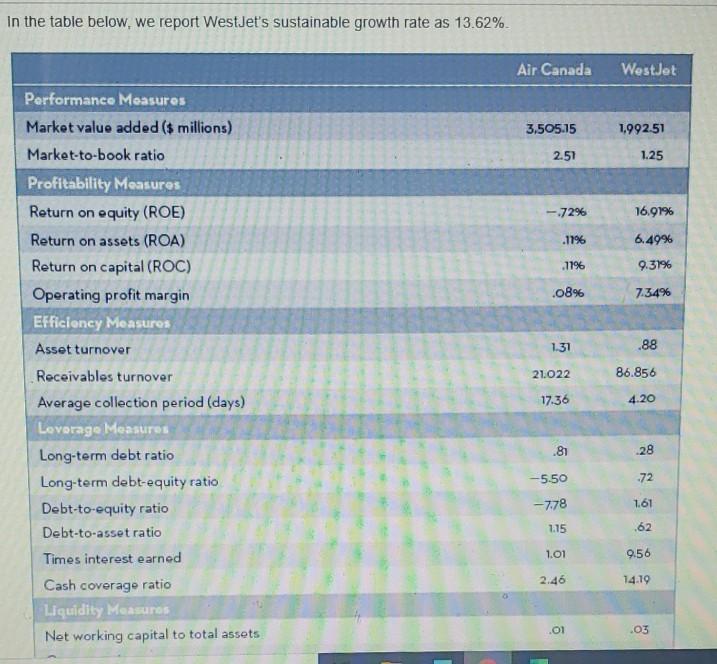

ans A and B? In the table below, we report WestJet's sustainable growth rate as 13.62% Air Canada WestJet 3.505.15 1,992.51 2.51 1.25 - 72%

ans A and B?

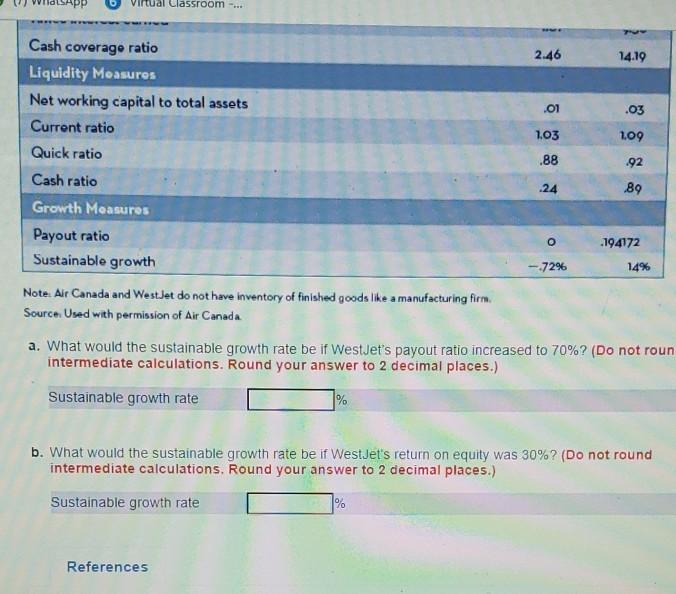

In the table below, we report WestJet's sustainable growth rate as 13.62% Air Canada WestJet 3.505.15 1,992.51 2.51 1.25 - 72% 16,91% .11% 6.49% 9.31% .11% .08% 7.34% 1.31 .88 Performance Measures Market value added ($ millions) Market-to-book ratio Profitability Measures Return on equity (ROE) Return on assets (ROA) Return on capital (ROC) Operating profit margin Efficiency Measures Asset turnover Receivables turnover Average collection period (days) Loverage Measures Long-term debt ratio Long-term debt-equity ratio Debt-to-equity ratio Debt-to-asset ratio Times interest earned Cash coverage ratio Liquidity Measures Net working capital to total assets 21.022 86.856 17.36 4.20 .81 28 -5.50 .72 -7.78 1.61 1.15 .62 1.01 9.56 2.46 14.19 .01 .03 Virtual Classroom -... 2.46 14.19 .01 .03 1.03 1.09 Cash coverage ratio Liquidity Measures Net working capital to total assets Current ratio Quick ratio Cash ratio Growth Measures Payout ratio Sustainable growth .88 92 .24 89 O .194172 - 72% 14% Note: Air Canada and WestJet do not have inventory of finished goods like a manufacturing firm. Source Used with permission of Air Canada a. What would the sustainable growth rate be if WestJet's payout ratio increased to 70%? (Do not roun intermediate calculations. Round your answer to 2 decimal places.) Sustainable growth rate % b. What would the sustainable growth rate be if WestJet's return on equity was 30%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Sustainable growth rate % ReferencesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started