Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anseers incomplete. I hope now you can see enought information to resolve it please . thank you On January 1, 2024, the general ledger of

Anseers incomplete. I hope now you can see enought information to resolve it please . thank you

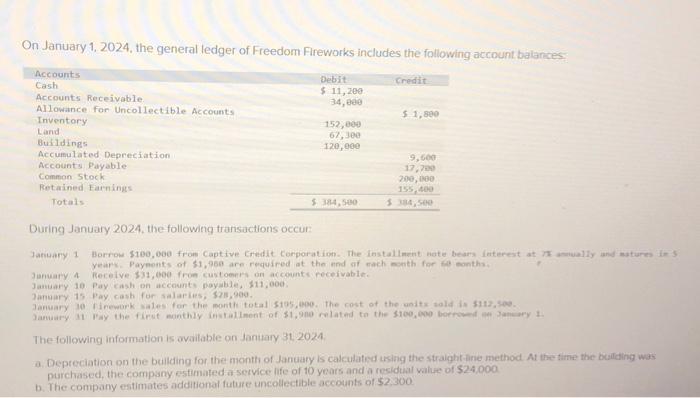

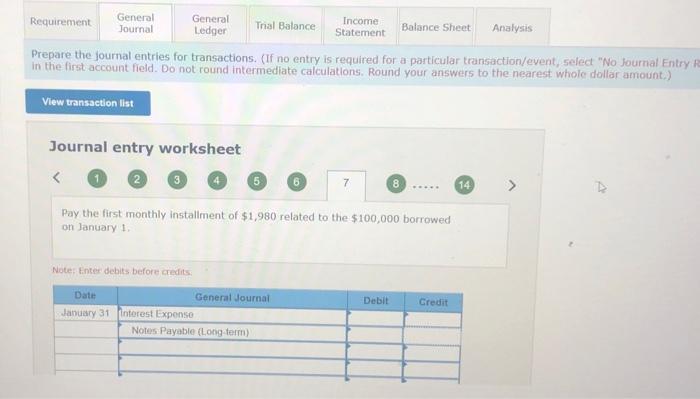

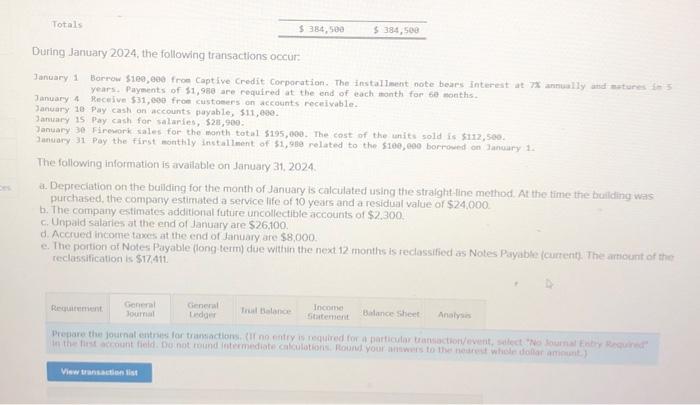

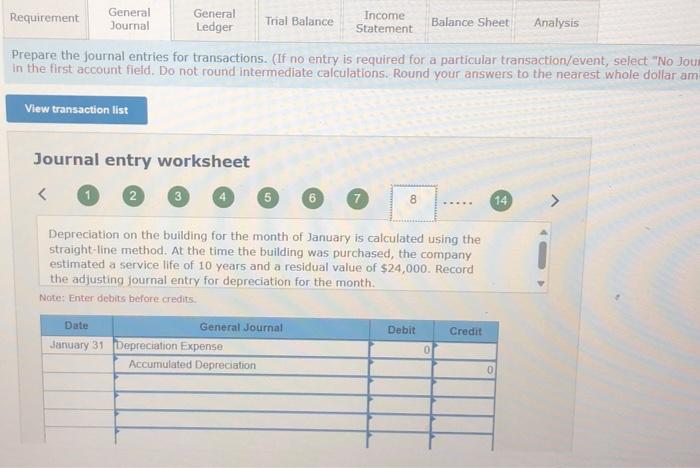

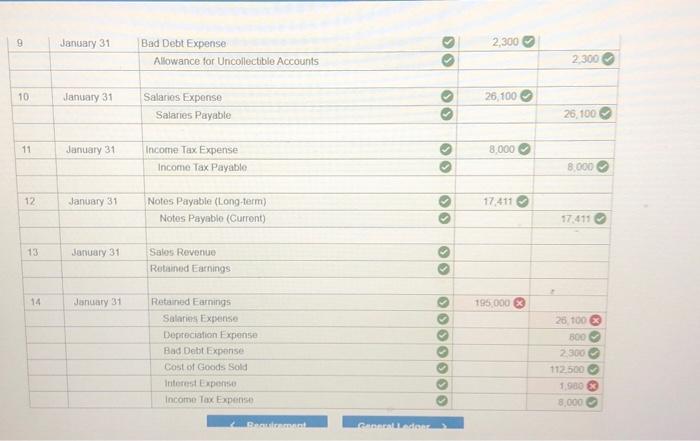

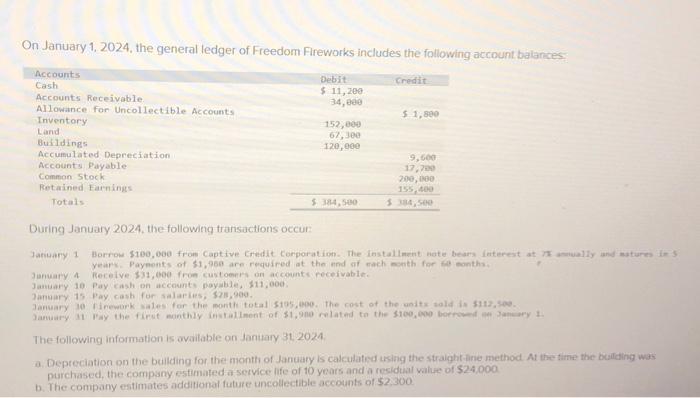

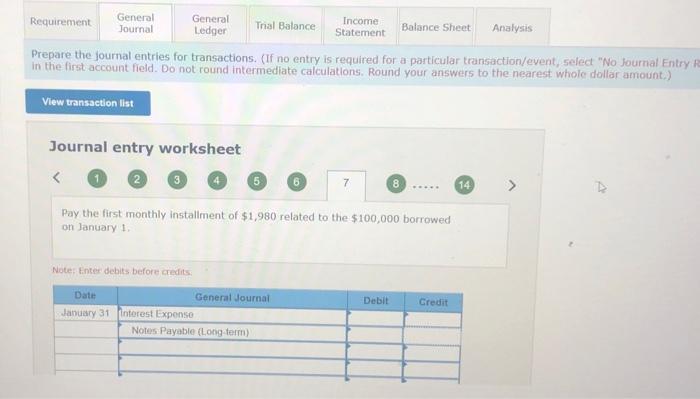

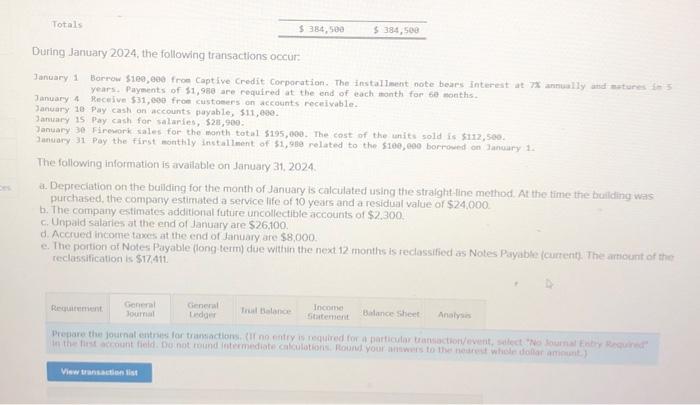

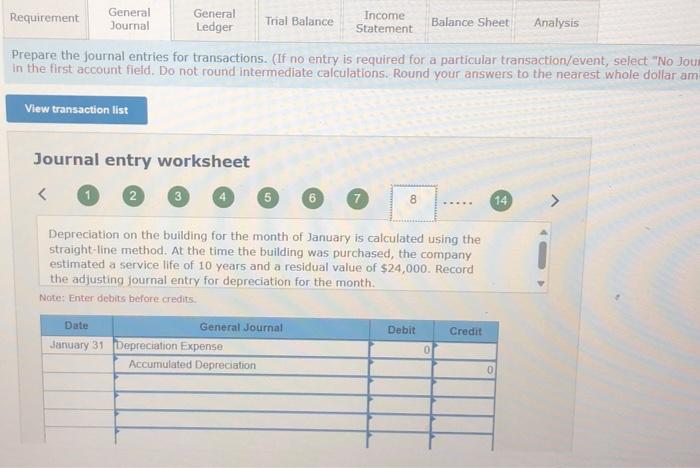

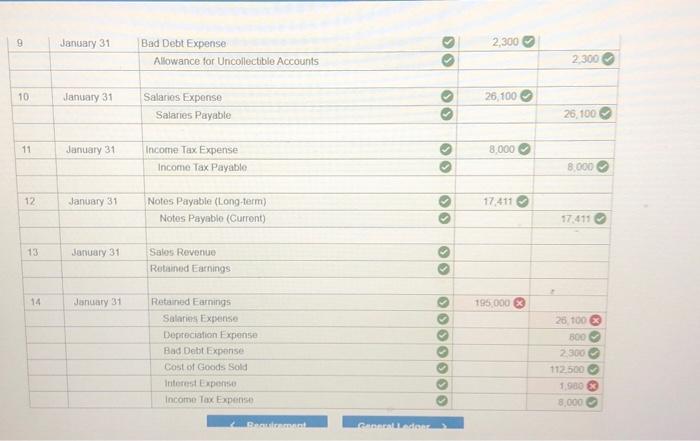

On January 1, 2024, the general ledger of Freedom Fireworks includes the following account balances: During January 2024, the following transactions occur: Jaruary 4 Recelve $31,600, fron custoents on acountsiceceivable. Jamuary 10 . Pay cash on account poyabe, $11,000. The following information is ovailable on fantary 31,2024. a Depteriation on the bullding for the month of January is cak ulated using the straight ilne method At the time the bulfing was purchased, the company estimated a service life of 10 years and a residtiat value of $24,000 b. The company estimates additional future uncollectible accounts of $2,300 \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[t]{2}{*}{9} & \multirow[t]{2}{*}{ Jansary 31} & Bad Debt Expense & \multicolumn{2}{|c|}{ (2,3000 } & \multirow{2}{*}{2,300} \\ \hline & & Allowance for Uncollectible Accounts & 0 & & \\ \hline \multirow[t]{2}{*}{10} & January 31 & Salaries Expense & 0 & 26,100 & \\ \hline & & Salanes Payable & 0 & & 26,100 \\ \hline \multirow[t]{2}{*}{11} & January 31 & Income Tax Expense & 0 & 8,000 & \\ \hline & & Income Tax Payable & 0 & & 8,0000 \\ \hline \multirow[t]{2}{*}{12} & Janisary 31 & Notes Payable (Long term) & 0 & 17,411 & \\ \hline & & Notes Payabio (Current) & & & 17.4110 \\ \hline \multirow{3}{*}{13} & January 31 & Salies Revenue & 0 & & \\ \hline & & Retained Earnings & & & \\ \hline & & & & & s \\ \hline \multirow[t]{7}{*}{14} & January 31 & Retained Earnings & 0 & 195,000 & \\ \hline & & Salaries Expense & 0 & & 26,100 \\ \hline & & Depreciation Expense & & & 8000 \\ \hline & & Bad Debt Expense & & & 23000 \\ \hline & & Cost of Goods Sold & 0 & & 1125000 \\ \hline & & Interest Expense & 0 & & 1,9000 \\ \hline & & Income Tax Expense & 0 & & 8,0000 \\ \hline \end{tabular} During January 2024 , the following transactions occur: years. Payments of $1,986 are required at the end of each month for 60 months. January 4 Receive $31, ese fron custosers on accounts receivable. lanuary 10 pay cash on accounts payahle, $11, ese. Jaruary is Pay cash for salaries, $28,900. January 30 Firemork sales for the wonth tota1 $195,000. The cost of the units sold is $112,500. January 31 Pay the first montbly installiment of $1,988 related to the $100,090 borroced on January 1. The following information is available on January 31,2024. a. Depreciation on the buliding for the month of January is calculated using the straight fline method, At the time the builing was: purchased, the company estimated a service life of to years and a residual value of $24,000 b. The company estimates additional future uncollectible accounts of $2,300. c. Unpaid salaries at the end of January are $26,100 d. Accrued income taxes at the end of Jaruary are $8,000. e. The portion of Notes Payable (fong term) due within the next 12 months is reclassified as Nates Payable (curtent. The articunt of then rectassification is $17,411. Prepare the journal entries for transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Journal entry worksheet (1.) (2.) 3 (4) (6) 8 14 Pay the first monthly instaliment of $1,980 related to the $100,000 borrowed on lanuary 1 . Note: tinter debits before credits: Prepare the journal entries for transactions. (If no entry is required for a particular transaction/event, select "No Jou in the first account field. Do not round intermediate calculations. Round your answers to the nearest whole dollar am Journal entry worksheet 1. (2.) (3. 4. (5) 6 Depreciation on the bullding for the month of January is calculated using the straight-line method. At the time the building was purchased, the company estimated a service life of 10 years and a residual value of $24,000. Record the adjusting journal entry for depreciation for the month

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started