Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ansell, Inc., a medical device manufacturer, uses compressed air in solenoids and pressure switches in its machines to control various mechanical movements. Over the

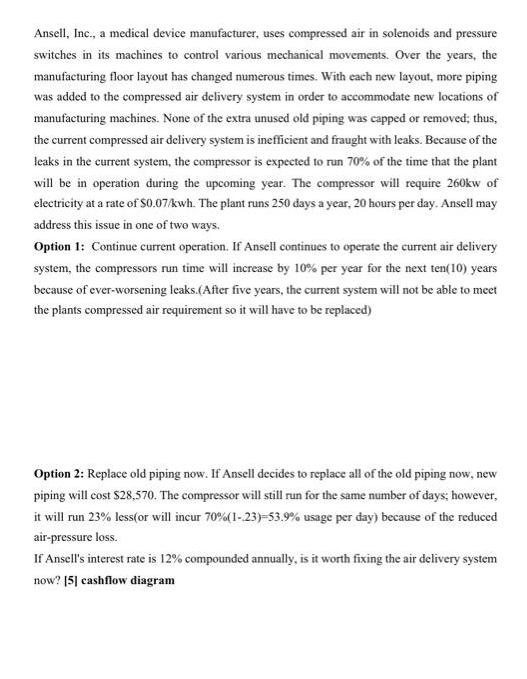

Ansell, Inc., a medical device manufacturer, uses compressed air in solenoids and pressure switches in its machines to control various mechanical movements. Over the years, the manufacturing floor layout has changed numerous times. With each new layout, more piping was added to the compressed air delivery system in order to accommodate new locations of manufacturing machines. None of the extra unused old piping was capped or removed; thus, the current compressed air delivery system is inefficient and fraught with leaks. Because of the leaks in the current system, the compressor is expected to run 70% of the time that the plant will be in operation during the upcoming year. The compressor will require 260kw of electricity at a rate of $0.07/kwh. The plant runs 250 days a year, 20 hours per day. Ansell may address this issue in one of two ways. Option 1: Continue current operation. If Ansell continues to operate the current air delivery system, the compressors run time will increase by 10% per year for the next ten(10) years because of ever-worsening leaks.(After five years, the current system will not be able to meet the plants compressed air requirement so it will have to be replaced) Option 2: Replace old piping now. If Ansell decides to replace all of the old piping now, new piping will cost $28,570. The compressor will still run for the same number of days; however, it will run 23% less (or will incur 70% (1-23) -53.9% usage per day) because of the reduced air-pressure loss. If Ansell's interest rate is 12% compounded annually, is it worth fixing the air delivery system now? [5] cashflow diagram

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To compare the two options we need to calculate the present value of the cash flows associated with ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started