Question

Anson CPA Limited has been engaged to act as the independent auditor of Green Limited (the company) for the year ended 30 June 2020. The

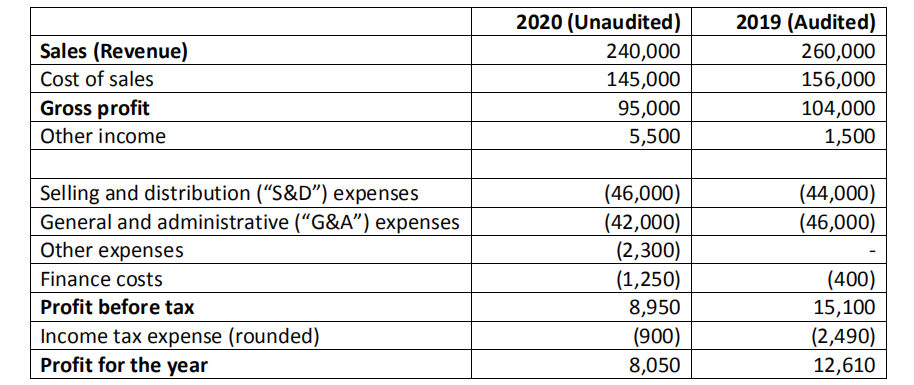

Anson CPA Limited has been engaged to act as the independent auditor of Green Limited (the

company) for the year ended 30 June 2020. The company is engaged in the selling of household

articles for daily use in Hong Kong. The company has been able to maintain a stable market share

over the past four years ended 30 June 2019 owing to the premium quality of the goods it is selling.

You have been assigned as the engagement manager on the audit of the financial statements of

Green Limited for the year ended 30 June 2020. Bob Chan, the engagement partner, has recently

been provided by the company with a set of its unaudited management accounts as of and for the

year ended 30 June 2020. Bob would like you to discuss with him the potential audit risks that the

audit team should pay attention to, based on the key financial data (expressed in thousands of HKD)

as set out in the unaudited management accounts. In this connection, Bob would like to deal with 6 | P a g e

the income statement related issues, if any, before moving on to those related to the statement of

financial position. The following is the unaudited income statement for the year ended 30 June

2020 together with the audited results for the previous year.

Other pieces of information which are relevant and applicable to Green Limited are as follows:

(i) The significant slowdown of economic activities of Hong Kong during the year ended

30 June 2020 as compared with those activities in 2019 resulted in a general market

contraction for the year ended 30 June 2020 of approximately 15% in respect of the

market in which the company was operating, mainly attributed to much weaker demand.

(ii) Despite keen competition and weaker demand, the company was able to maintain the

selling prices of its products during the year ended 30 June 2020.

(iii) Inflation for the year under review was around 2%.

(iv) Tax rate for incorporated companies operating in Hong Kong was 16.5% for both years.

(v) There was no significant change in interest rate during the year.

(vi) There were no significant changes in the head count for both years. Green Limiteds

remuneration policy is to make salary adjustment based on inflation currently in place

plus a discretionary bonus which is based on the companys performance. The company

advised that in view of the good results achieved an amount of HK$ 4 million (allocated

as to 50% for S&D and 50% for G&A staff) was provided for in respect of the year

ended 30 June 2019 while no bonus would be recommended for the current year due to

the poorer overall results achieved.

(vii) Anson CPA Limited expressed a true and fair view opinion on Green Limited s

financial statements for the year ended 30 June 2019.

Required:

(a)

When analyzing the income statement, you noted that some performance indicators were a

bit out of line with your expectation. Identify five areas where you think Bob should

discuss with management of Green Limited so as to understand more about the companys

performance for the year ended 30 June 2020.

(b)

For each of the issues identified by you in (a) above, what do you think would be the

related potential audit risks that your team need to focus on?

Sales (Revenue) Cost of sales Gross profit Other income 2020 (Unaudited) 240,000 145,000 95,000 5,500 2019 (Audited) 260,000 156,000 104,000 1,500 (44,000) (46,000) Selling and distribution (S&D) expenses General and administrative ("G&A) expenses Other expenses Finance costs Profit before tax Income tax expense (rounded) Profit for the year (46,000) (42,000) (2,300) (1,250) 8,950 (900) 8,050 (400) 15,100 (2,490) 12,610 Sales (Revenue) Cost of sales Gross profit Other income 2020 (Unaudited) 240,000 145,000 95,000 5,500 2019 (Audited) 260,000 156,000 104,000 1,500 (44,000) (46,000) Selling and distribution (S&D) expenses General and administrative ("G&A) expenses Other expenses Finance costs Profit before tax Income tax expense (rounded) Profit for the year (46,000) (42,000) (2,300) (1,250) 8,950 (900) 8,050 (400) 15,100 (2,490) 12,610Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started