answear all

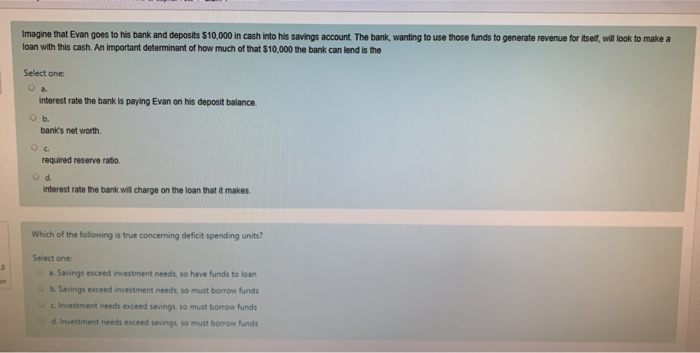

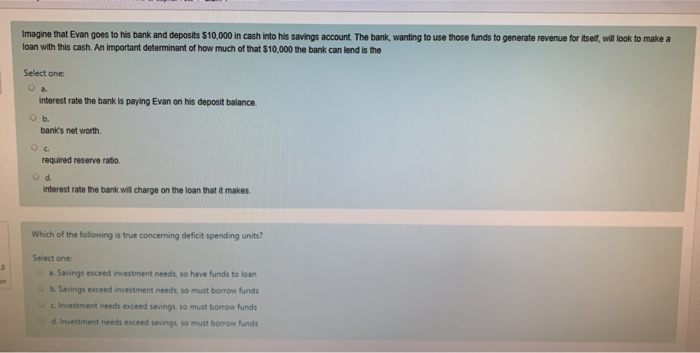

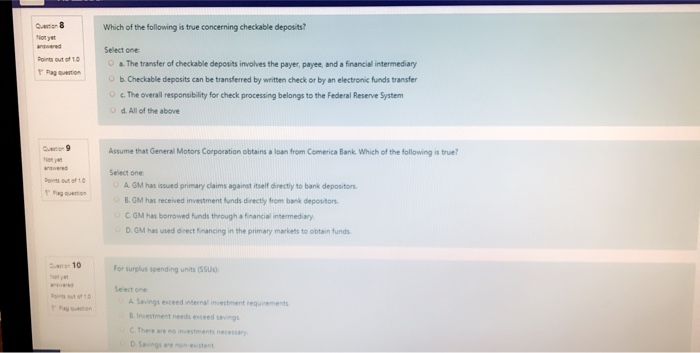

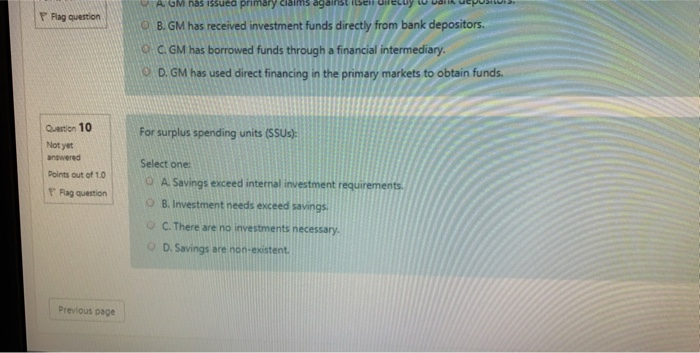

Imagine that Evan goes to his bank and deposits $10,000 in cash into his savings account. The bank, wanting to use those funds to generate revenue for itself will look to make a loan with this cash. An important determinant of how much of that $10,000 the bank can lend is the Select one Interest rate the bank is paying Evan on his deposit balance Ob. bank's net worth required reserve ratio od interest rate the bank will charge on the loan that it makes Which of the following is true concerning deficit spending units? Select one Savings exceed investment needs so have funds to loan b. Savings exceed investment needs, so must borrow funds Investment needs exceed savings, so must borrow funds d. Investment needs exceed savings, so must borrow funds Which of the following is true concerning checkable deposits? Select one The transfer of checkable deposits involves the payer, payee, and a financial intermediary b. Checkable deposits can be transferred by written check or by an electronic funds transfer c. The overall responsibility for check processing belongs to the Federal Reserve System d. All of the above Assume that General Motors Corporation obtain a loan from Comerica Bank Which of the following is true? Select one A GM has issued primary claims against itself directly to bank depositors. B. GM has received investment funds directly from bank depositors C.GM has borrowed funds through a financial intermediary D. GM has used direct francing in the primary markets to obtain funds. For surplus spending units (SSUS) Select one A Savings exceed internal investment requirements. B. Investment needs exceed savings Flag question AGM has issued primary claims against itselluleluy w walikuepusiui, O B. GM has received investment funds directly from bank depositors. O C. GM has borrowed funds through a financial intermediary. OD. GM has used direct financing in the primary markets to obtain funds. For surplus spending units (SSUS): Question 10 Not yet answered Points out of 10 P Rag question Select one: O A. Savings exceed internal investment requirements. B. Investment needs exceed savings. C. There are no investments necessary. OD. Savings are non-existent. Previous page