Answered step by step

Verified Expert Solution

Question

1 Approved Answer

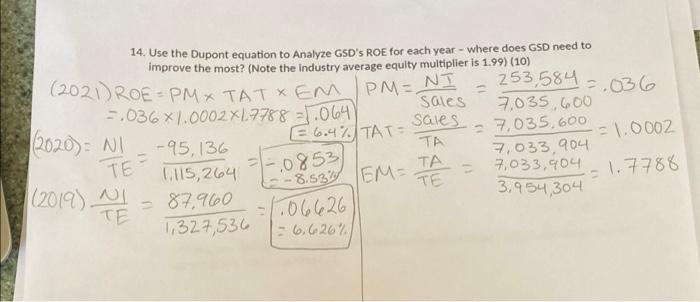

im asking you to solve #14. i started it but its not done yet (2021) roe= 6.4% 2020 roe= -17.06% 2019 roe= 13.25% 253,584 2.036

im asking you to solve #14. i started it but its not done yet

(2021) roe= 6.4%

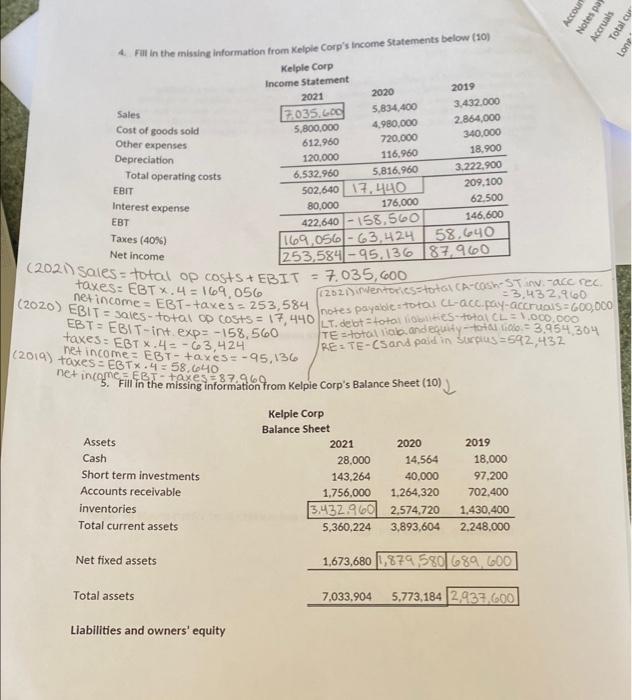

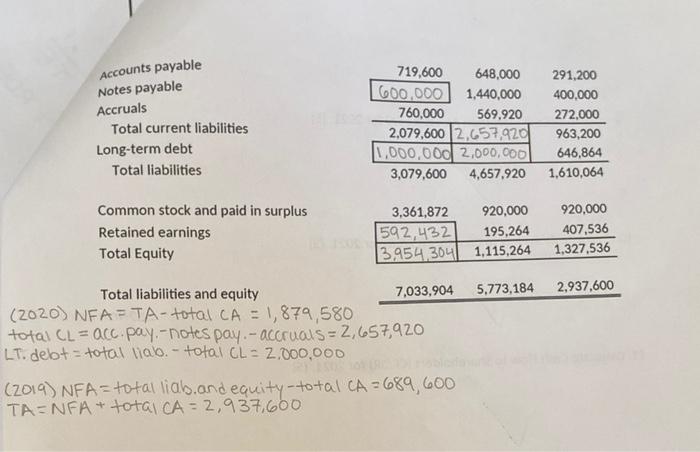

253,584 2.036 14. Use the Dupont equation to analyze GSD'S ROE for each year - where does GSD need to improve the most? (Note the industry average equity multiplier is 1.99) (10) (2021) ROE = PM * TATXEM PM= NI 2.036 1.0002X1.7788 21.064 Sales 7,035,600 sales 2020): NU E 6.4% TAT = 7,035,600 -95,136 "TA = 1.0002 7,033,904 1.115,264 -8.53 EM- 7,033,404 TE 1.7788 NI = 87,960 3,954,304 01.06626 1,327,536 -6, 626% - TA - 0853 12019) Account Total cu Notes Accruals Lone Sales Cost of goods sold Other expenses Depreciation Total operating costs EBIT Interest expense EBT Taxes (40%) Net Income (2021) Sales = total op costs +EBIT 5 taxes: EBTX.4 = 169,056 = 3,432.900 net income = EBT-taxes = 253,584 (2020) EBIT = sales - total op COSTS = 17,440 LT. debt tota Sota CL\000. DOO EBT = EBIT-int. exp= -158,560 taxes: EBTX.42-63,424 (2014) taxes = EGTX.4 = 58.640 net income = EBT - taxes=-95,136 net inca il finthe missing information Fill in the missing information from Kelpie Corp's Balance Sheet (10) Kelple Corp Balance Sheet Assets 2021 2020 2019 Cash 28,000 14.564 18.000 Short term investments 143.264 40.000 97.200 Accounts receivable 1,756,000 1,264,320 702,400 inventories 3.432.960 2,574,720 1.430,400 Total current assets 5.360.224 3,893,604 2.248.000 4 Ful in the missing information from Kelpie Corp's income Statements below (10) Kelpie Corp Income Statement 2021 2020 2019 7035.000 5,834,400 3.432.000 5,800,000 4.980.000 2.864.000 612.960 720.000 340.000 120.000 116.960 18.900 6.532.960 5.816.960 3.222.900 502,640 17.440 209.100 80,000 176,000 62.500 422.640 - 158.560 146,600 169,056 -63.424 58.640 253,584 - 95.136 87,960 7.035,600 (202) inventories to CA Cash-Stan-accrec notes payable total L-acc.pay-accus=600,000 TE = total loba and equity-tracie = 3.954 304 RE: TE-Csand paid in Sus=542,432 Net fixed assets 1.673,680 1,879,580 689. GOD Total assets 7,033,904 5.773,1842,933.600 Liabilities and owners' equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt Total liabilities 719,600 648,000 600.000 1,440,000 760,000 569.920 2,079,600 2,657,920 1,000,000 2,000,000 3,079,600 4,657,920 291,200 400,000 272,000 963,200 646,864 1,610,064 Common stock and paid in surplus Retained earnings Total Equity 3,361,872 920,000 1592, 432 195.264 3,954 304 1,115,264 920,000 407,536 1.327.536 5,773,184 2,937,600 Total liabilities and equity 7,033,904 (2020) NFA =TA-total CA = 1,879,580 total CL = acc. pay.-notes pay.- accruals = 2,657,920 LT. debt = total valo. - tota CL = 2.000.000 (2019) NFA = total liab.and equity-total CA-689,600 TA=NFA + total CA = 2,937,600 253,584 2.036 14. Use the Dupont equation to analyze GSD'S ROE for each year - where does GSD need to improve the most? (Note the industry average equity multiplier is 1.99) (10) (2021) ROE = PM * TATXEM PM= NI 2.036 1.0002X1.7788 21.064 Sales 7,035,600 sales 2020): NU E 6.4% TAT = 7,035,600 -95,136 "TA = 1.0002 7,033,904 1.115,264 -8.53 EM- 7,033,404 TE 1.7788 NI = 87,960 3,954,304 01.06626 1,327,536 -6, 626% - TA - 0853 12019) Account Total cu Notes Accruals Lone Sales Cost of goods sold Other expenses Depreciation Total operating costs EBIT Interest expense EBT Taxes (40%) Net Income (2021) Sales = total op costs +EBIT 5 taxes: EBTX.4 = 169,056 = 3,432.900 net income = EBT-taxes = 253,584 (2020) EBIT = sales - total op COSTS = 17,440 LT. debt tota Sota CL\000. DOO EBT = EBIT-int. exp= -158,560 taxes: EBTX.42-63,424 (2014) taxes = EGTX.4 = 58.640 net income = EBT - taxes=-95,136 net inca il finthe missing information Fill in the missing information from Kelpie Corp's Balance Sheet (10) Kelple Corp Balance Sheet Assets 2021 2020 2019 Cash 28,000 14.564 18.000 Short term investments 143.264 40.000 97.200 Accounts receivable 1,756,000 1,264,320 702,400 inventories 3.432.960 2,574,720 1.430,400 Total current assets 5.360.224 3,893,604 2.248.000 4 Ful in the missing information from Kelpie Corp's income Statements below (10) Kelpie Corp Income Statement 2021 2020 2019 7035.000 5,834,400 3.432.000 5,800,000 4.980.000 2.864.000 612.960 720.000 340.000 120.000 116.960 18.900 6.532.960 5.816.960 3.222.900 502,640 17.440 209.100 80,000 176,000 62.500 422.640 - 158.560 146,600 169,056 -63.424 58.640 253,584 - 95.136 87,960 7.035,600 (202) inventories to CA Cash-Stan-accrec notes payable total L-acc.pay-accus=600,000 TE = total loba and equity-tracie = 3.954 304 RE: TE-Csand paid in Sus=542,432 Net fixed assets 1.673,680 1,879,580 689. GOD Total assets 7,033,904 5.773,1842,933.600 Liabilities and owners' equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt Total liabilities 719,600 648,000 600.000 1,440,000 760,000 569.920 2,079,600 2,657,920 1,000,000 2,000,000 3,079,600 4,657,920 291,200 400,000 272,000 963,200 646,864 1,610,064 Common stock and paid in surplus Retained earnings Total Equity 3,361,872 920,000 1592, 432 195.264 3,954 304 1,115,264 920,000 407,536 1.327.536 5,773,184 2,937,600 Total liabilities and equity 7,033,904 (2020) NFA =TA-total CA = 1,879,580 total CL = acc. pay.-notes pay.- accruals = 2,657,920 LT. debt = total valo. - tota CL = 2.000.000 (2019) NFA = total liab.and equity-total CA-689,600 TA=NFA + total CA = 2,937,600 2020 roe= -17.06%

2019 roe= 13.25%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started