Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer 15.2 in full details EXERCISES LO 2 E15.1 Liquidation Basis of Accounting On March 1, 2020, Farmworth Company is entering liquidation, The book value

answer 15.2 in full details

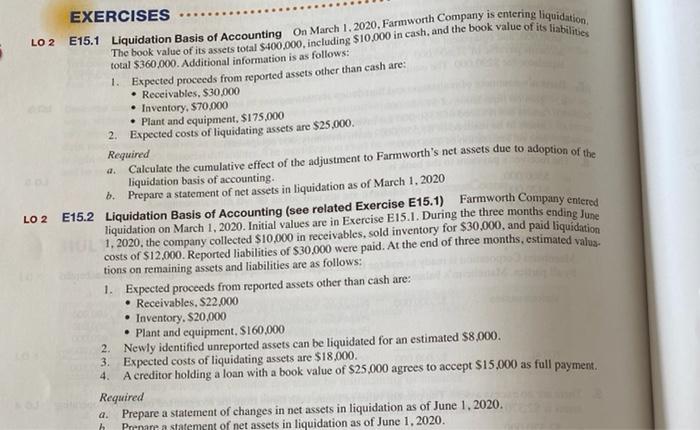

EXERCISES LO 2 E15.1 Liquidation Basis of Accounting On March 1, 2020, Farmworth Company is entering liquidation, The book value of its assets total $100.000, including $10,000 in cash, and the book value of its fiabilities total $360,000. Additional information is as follows: 1. Expected proceeds from reported assets other than cash are: Receivables, $30,000 Inventory, $70,000 Plant and equipment. $175,000 2. Expected costs of liquidating assets are $25,000 Required Calculate the cumulative effect of the adjustment to Farmworth's net assets due to adoption of the b. Prepare a statement of net assets in liquidation as of March 1, 2020 LO 2 E15.2 Liquidation Basis of Accounting (see related Exercise E15.1) Farmworth Company entered liquidation on March 1, 2020. Initial values are in Exercise E15.1. During the three months ending June 1,2020, the company collected $10,000 in receivables, sold inventory for $30,000, and paid liquidation costs of $12.000. Reported liabilities of $30,000 were paid. At the end of three months. estimated valus tions on remaining assets and liabilities are as follows: 1. Expected proceeds from reported assets other than cash are: Receivables. S22,000 Inventory, 20,000 Plant and equipment, $160,000 2. Newly identified unreported assets can be liquidated for an estimated $8,000. 3. Expected costs of liquidating assets are $18,000. 4. A creditor holding a loan with a book value of $25.000 agrees to accept $15,000 as full payment. Required a. Prepare a statement of changes in net assets in liquidation as of June 1.2020. Pronare a statement of net assets in liquidation as of June 1, 2020. h Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started